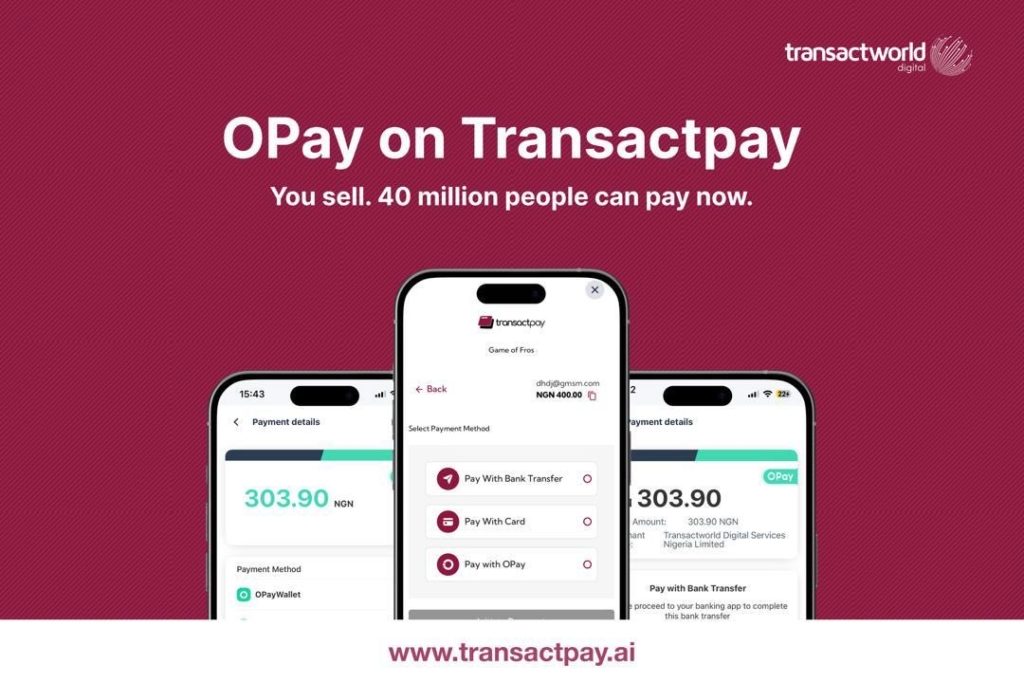

Transactworld Digital, the CBN-licensed fintech behind Transactpay, has announced a new integration with OPay that gives Nigerian businesses direct access to over 40 million active mobile wallet users, including more than 10 million who transact daily.

With this integration, businesses using Transactpay can now receive payments directly from customers using Nigeria’s largest mobile money platform — without any additional setup or third-party redirects.

Key business benefits include:

Access to 40 million+ customers with verified wallets10M+ daily payment opportunities now open to Transactpay merchantsReal-time settlement and in-app transaction flowNo website or app required to get started“Our goal is simple: make it easier for Nigerian businesses to get paid — by people already paying daily,” said Ernest Obi, Co-founder and CEO of Transactworld Digital.

This move positions Transactpay as a growth enabler for SMEs, retail merchants, and service providers looking to scale without spending aggressively on customer acquisition.

Transactworld’s merchant base spans sectors like logistics, hospitality, beauty, food, and digital services. With this expansion, many of those merchants can now tap directly into the spending power of Nigeria’s mobile-first consumers.

About Transactworld Digital

Transactworld Digital Services Ltd. is a Nigerian financial technology company licensed by the Central Bank of Nigeria as a Payment Solution Service Provider. Its flagship product, Transactpay, empowers businesses of all sizes to accept local and international payments via bank transfer, card, QR, and now — directly from OPay mobile wallets.

Learn more: https://www.transactpay.ai/