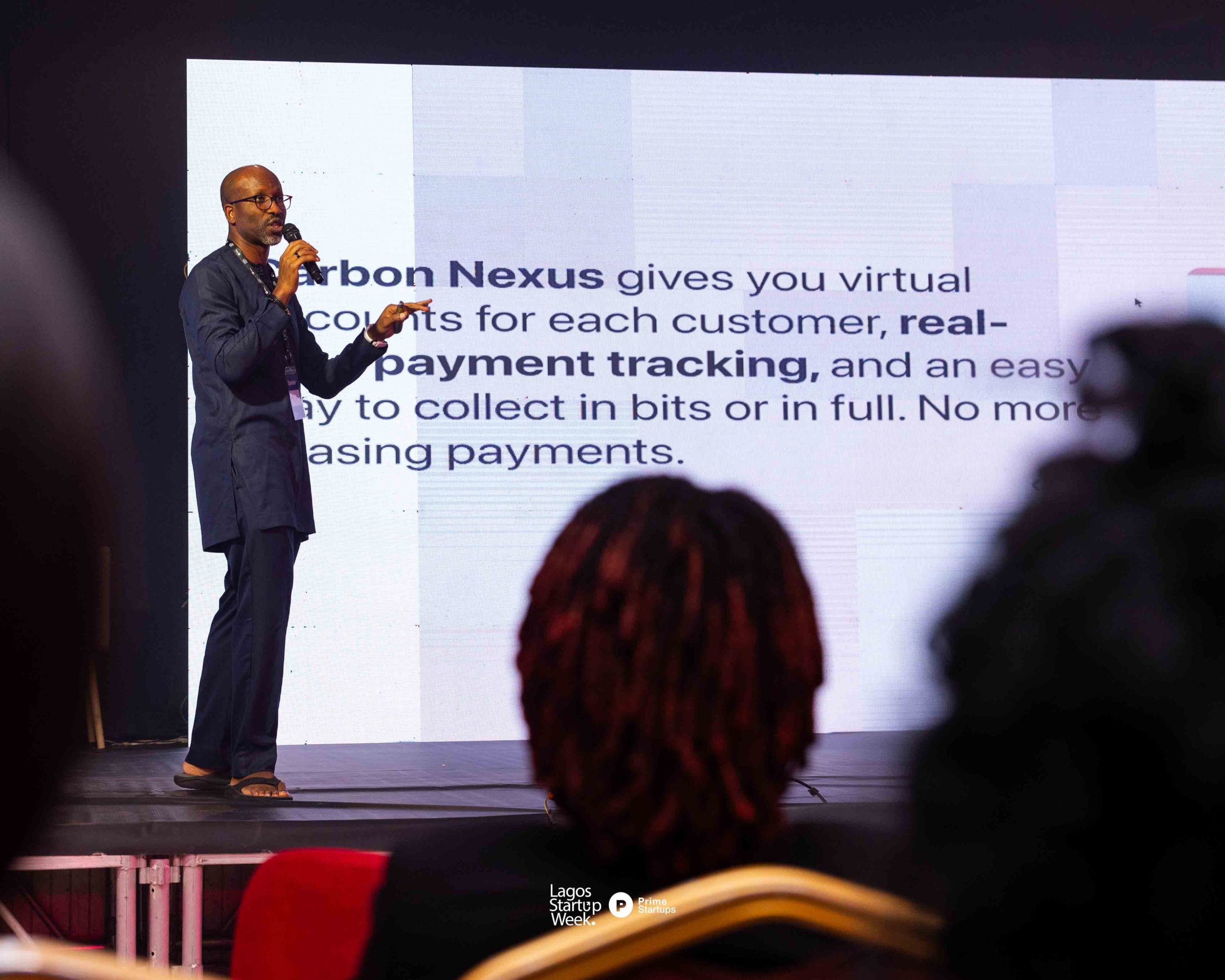

For Nigerian businesses, collecting money can sometimes feel harder than earning it. Whether it’s staggered payments, missed alerts, or messy reconciliation, staying on top of what’s coming in, and from whom is a daily battle.

That’s why Carbon, Nigeria’s leading digital bank, officially launched Carbon Nexus at Lagos Startup Week 2025, a new payment infrastructure product designed to bring clarity, control, and calm to the chaos of collections.

“Too many business owners are still refreshing bank apps and updating spreadsheets just to keep track of who’s paid,” said Ngozi Dozie, CEO and co-founder of Carbon. “With Carbon Nexus, we’re giving them a smarter, simpler way to manage money coming in. No more guesswork, no more stress.”

Nexus for builders

The first version of Nexus is built for platforms, tech companies, and product teams that want to embed collections into their workflows. Available via direct API, it gives businesses the ability to:

- Instantly generate static or dynamic sub-accounts (NUBANs)

- Track payments in real time — even when they come in bits

- Get webhook notifications the moment a payment hits

- Build custom flows without needing to touch core banking rails

If you’re building a fintech product, running a billing system, or managing customer balances, Nexus gives you bank-grade infrastructure — minus the friction.

Coming soon: Nexus for merchants

Later this year, Carbon will launch a low-code version of Nexus inside the Carbon Business app, designed for non-technical users who still need serious payment tools.

Merchants will be able to spin up virtual accounts in seconds using a conversational AI interface powered by Carbon’s Merchant Command Platform (MCP). Just tell it what you need and the system does the rest.

- “Create an account for Gbemi’s next payment”

- “Track all rent payments for Block B”

- “Notify me when Obinna pays via POS”

Once the virtual account is active, the system monitors it in real time and sends updates via SMS, email, or webhook, whatever works for your team.

“Whether you’re a dev or a distributor, a product manager or a property manager — Nexus meets you where you are,” Dozie added. “It’s smart, flexible, and built for how Nigerian businesses actually operate.”

Why this matters

Carbon Nexus is more than a product. It’s a step toward making payments infrastructure accessible, whether you have a dev team or a day job. It’s about giving businesses the same superpowers big banks and startups use — but without the complexity or cost.

The mission?

- Take the pain out of payment collection

- Put real-time visibility at your fingertips

- Cut out reconciliation stress

- Automate the back-and-forth

- And help businesses, big or smal, grow with confidence

Ready to build?

The API-based version of Carbon Nexus is now available for integration. The low-code, merchant-focused rollout begins in Q3 2025 inside the Carbon Business app.

To learn more or request access, email sme@getcsrbon.co

About Carbon

Carbon is a fully licensed digital bank helping individuals and businesses grow with smarter money tools. From instant loans to payments and now embedded financial infrastructure, Carbon is building the systems that power everyday ambition — with less hassle and more sense.