Picture this. You just got a notification from Piggyvest: ‘Corporate debt notes are in’.

You try to fund your wallet to make a quick investment, but you can’t. You immediately experience a delay in payment. The delay isn’t your bank’s fault, it’s not Piggyvest’s either. It’s a temporary, unpredictable downtime in the third-party payment rail connecting the two systems. Over the past two years, Piggyvest has refined and rebuilt its payment rails to ensure payment flows are not only secure but instant.

It has achieved this by internalising its payment rails, leading to faster and smoother transaction flows.

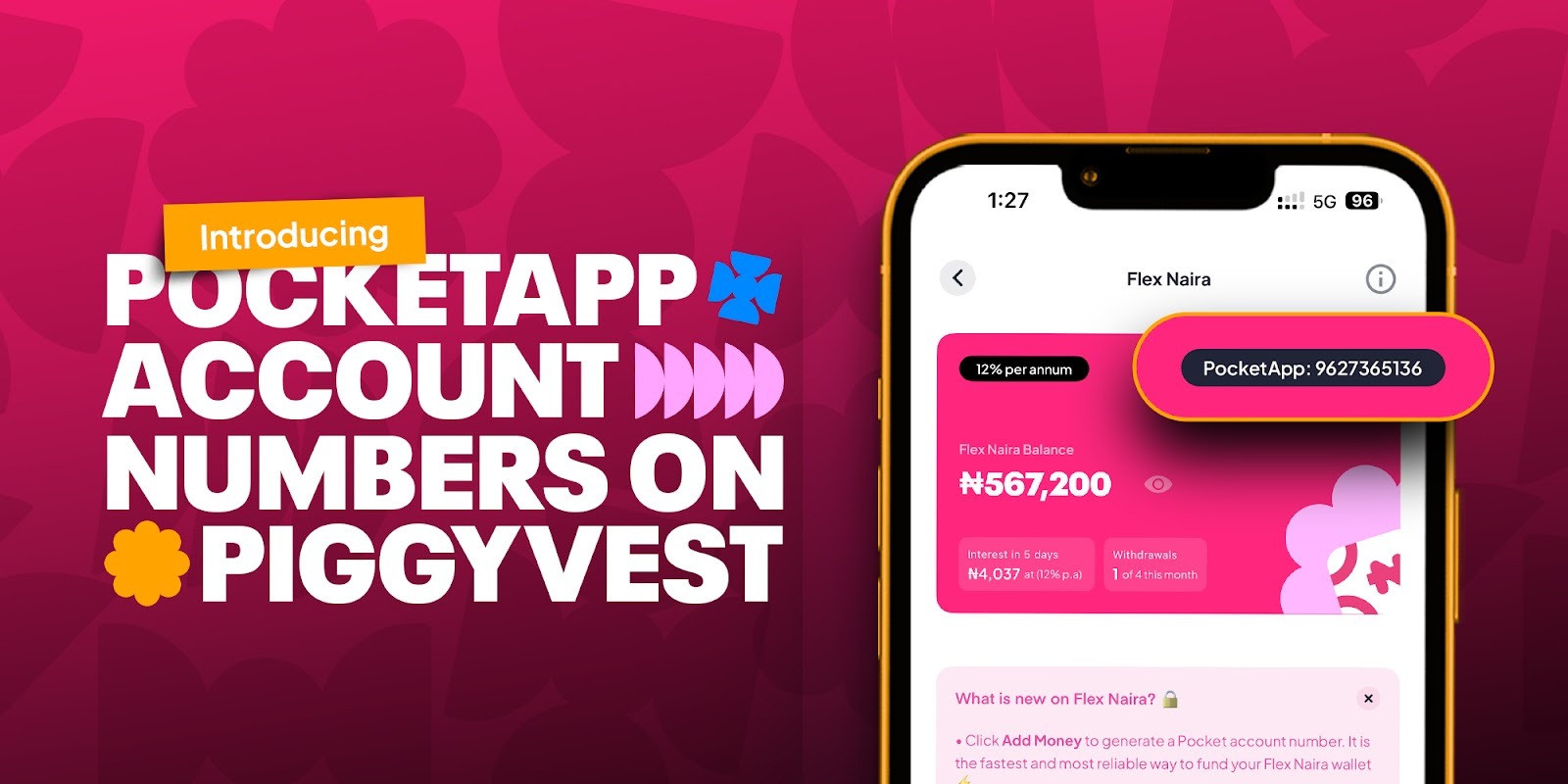

This August, at its OpenHouse event in Ibadan, Piggyvest announced the rollout of its PocketApp account numbers for all Piggyvest users as its new payment infrastructure to solve for unpredictable downtimes. This means that users can now fund their PiggyVest wallets swiftly.

The older system, while foundational for close to 3 trillion worth of payouts and a customer base of almost 6 million users, exposed the company and its users to the vulnerabilities of relying on third-party providers. This often resulted in frustrating transaction delays during partner downtimes. By controlling the end-to-end flow, Piggyvest is maintaining a higher level of service uptime for deposits and withdrawals, ensuring users can access or fund their accounts when needed.

The PocketApp integration: Internalising reliability

This internalisation of payment rails is Piggyvest’s pivotal “Ecosystem Play,” leading directly to faster and smoother transaction flows. This move began in 2021 when Piggyvest acquired PocketApp, originally known as Abeg, which now functions as a mobile money wallet for both small businesses and individuals. Today, PocketApp is licensed by CBN as a mobile money operator.

Joshua Chibueze, Chief Marketing Officer of Piggyvest, stressed the importance of this control: “We started this conversation from when we even acquired the licence for PocketApp, and now, to building out the technological infrastructure that powers the [Piggyvest] account numbers. We can also now improve trust with our customers, because when they transfer to [PocketApp], it’s instant, and you can verify. It works all the time, and if there are any issues, we can trace internally and fix them.”

Currently, Piggyvest users have PocketApp account numbers to fund their Piggyvest Flex Naira and House Money wallets instantly.

New grounds for trust and sustainability

For Somto Ifezue, CEO and co-founder of Piggyvest, the rollout of the new in-house payment framework for Piggyvest users marks a pivotal step in fintech’s evolution, especially as the company enters its tenth year.

“We’ve taken complete ownership of the entire experience of inflows and outflows to guarantee unmatched reliability to our users,” he said. “Beyond that, however, this move is also crucial to our company’s future. It allows us to build a more sustainable and profitable company and continue to deliver the most reliable and secure financial products to our users for years to come. This is the bedrock for our next decade of growth.”

By internalising its most critical operational layer, Piggyvest isn’t just improving service; it’s securing its future and reinforcing its commitment to its users.

For secure and instant payment flows with your savings, join over 6 million users and head over to piggyvest.com to get started.