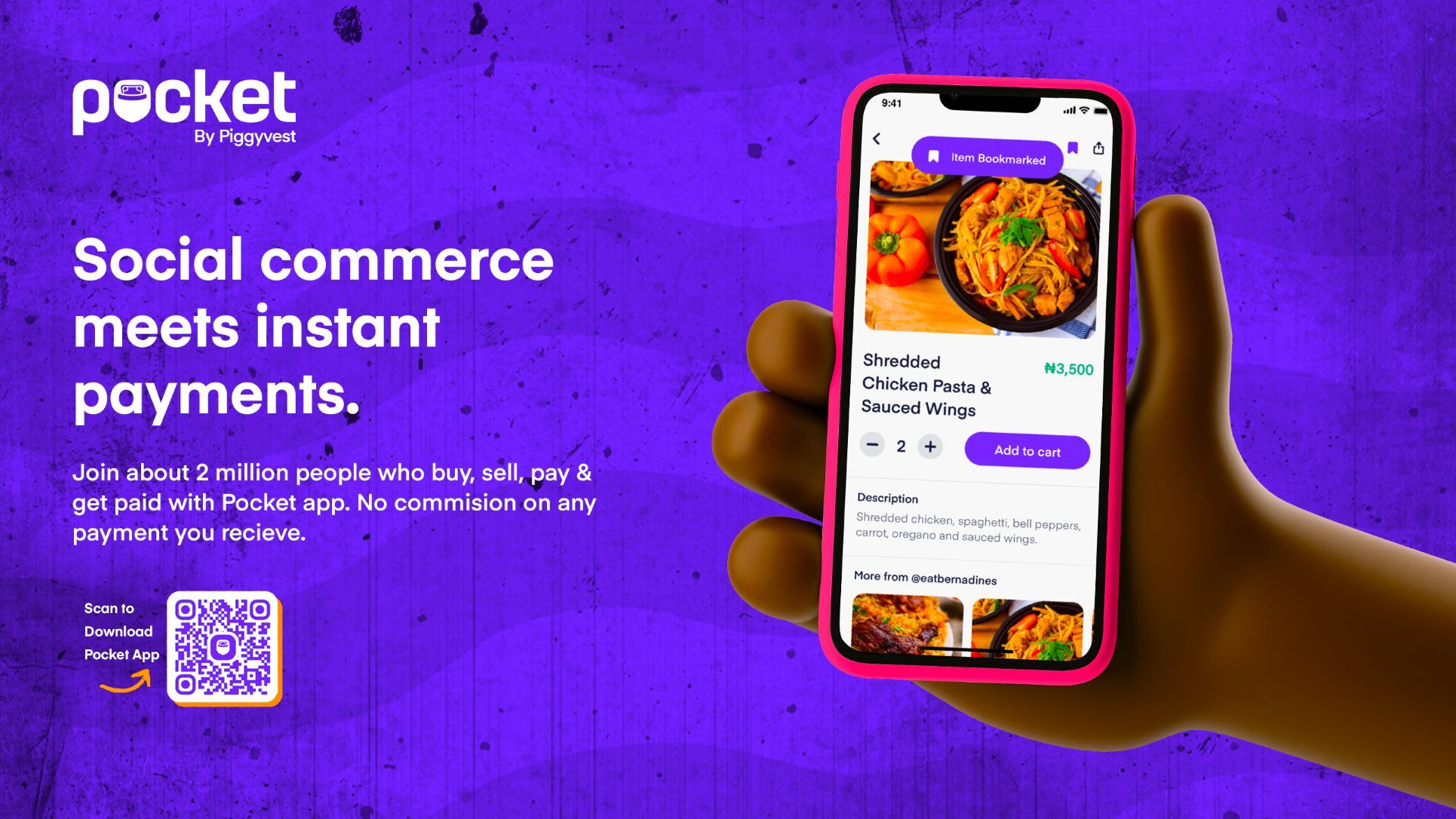

Payment app, Abeg, has rebranded and will now be called PocketApp, a move that underlines its transition from a payment app to a social commerce app. In addition, Abeg, a subsidiary of Piggytech Global Limited, secured approval-in-principle (AIP) for a mobile money operator (MMO) license application from the Central Bank of Nigeria (CBN) to expand the scope of its social commerce operations across the country.

Founded in 2020 by Dare Adekoya, Muheez Akanni, Patricia Adoga and Eniola Ajayi-Bembe as a platform that allows users, mostly Gen Z, to send and request money through a wallet-based system, it enjoyed some virality on Twitter due to its catchy name—derived from a Nigerian slag used to ask for favours. It got downloaded 5,000 times in its first 2 weeks. However, it didn’t gain massive prominence until it became headline sponsor of Big Brother Nigeria (BBN), the most-watched reality TV show in Africa, in 2021. Abeg was acquired by Piggytech Global just before the show began airing, and while it entered the show with 20,000 users on its newly launched app, it claimed to have amassed almost 2 million users by the time the show ended. But after blitzscaling to millions of users in a couple of months, its success was trailed by questions about whether it could retain those users.

Piggytech Global co-founder and Chief Marketing Officer (CMO) Joshua Chibueze told TechCabal that PocketApp is the answer to that question. “So, what we did last year was to get everyone to get the app first. It was very successful, we got over a million users. But this time around, we are going for retention, we’re trying to create a brand or an app that everyone can use. But for now, we’re targeting small micro-businesses and people who sell on Instagram and WhatsApp.”

PocketApp will support seamless payments and online commerce throughout the country by adding new functionalities for users to buy and sell items via virtual Pocket shops.

“We’re pretty much focused on people being able to open a pocket shop and sell online for free. Over 65% of Piggvest’s current users sell something, it made sense for us because we’re trying to create extra value for our current customers,” Chibueze told TechCabal.

PocketApp has expressed interest in tapping into Nigeria’s social commerce market which is estimated to reach US$23.8 billion by 2028.

The MMO license will allow the PocketApp to issue e-money, create and manage wallet creation, enable USSD, recruit, manage and pay money to its agent, and manage pool accounts—all of which are central to expanding social commerce.

PocketApp, like MTN and Airtel, who have received similar approvals-in-principle in the past year, also voiced its support to the Nigerian government’s goals for financial inclusion. “PocketApp affirms its commitment to the financial inclusion agenda of the CBN and the Federal Republic of Nigeria and will continue to make it easier for our teeming young population to seamlessly carry out their transactions while saving them costs and giving them more access to get paid,” it said in a statement sent to TechCabal.

PocketApp COO, Patricia Adoga, said that the PocketApp infrastructure has been in the works for over 18 months to enable secure social commerce because social commerce thrives better in a more trusted environment. “So we added escrow to our payment infrastructure, protecting buyers and sellers and many other features, ensuring a smooth shopping experience on the app,” Adoga said in a statement.

The company said in a statement that as a full social commerce app, it will connect buyers and sellers across Nigeria, and soon, other African countries. “People can discover you from anywhere, as long as you do honest work and you have a smartphone,“ Chibueze told TechCabal.

Chibueze explains that PocketApp hopes to break through geographical limitations and connect sellers and buyers in different parts of the country. “A strawberry trader in Lagos can buy strawberries from a vendor in Jos who has a pocket shop. That way, the price will be way cheaper because you’re dealing with the vendor directly,” he said.

In Nigeria where e-commerce is nascent and people are more comfortable with buying goods physically, e-commerce companies have to build trust with their users. He explains that trust is one of PocketApp’s major offerings. “So what we’ve solved for commerce is trust. Anybody can sell anything online in the safest way possible. And anybody can sign in now with confidence. Because if you pay for an item, and you’ve not gotten what you want, you’ve got to deliver whatever it is, and always ask for your money back.”

Commenting on PocketApp’s approval-in-principle, co-founder and COO of Piggytech Global, Odunayo Eweniyi, said in the aforementioned statement, “We’re incredibly pleased that PocketApp has been granted an approval-in-principle as a Mobile Money Operator in Nigeria. We will now work closely with the Central Bank to meet all its conditions to receive the full operating license, enabling us to continue growing and expanding the scope of our social payments, social commerce and other digital financial products to reach millions of Nigerian micro-entrepreneurs.”