The Y Combinator-backed fintech is embedding compliance directly into payment flows with its tax management feature

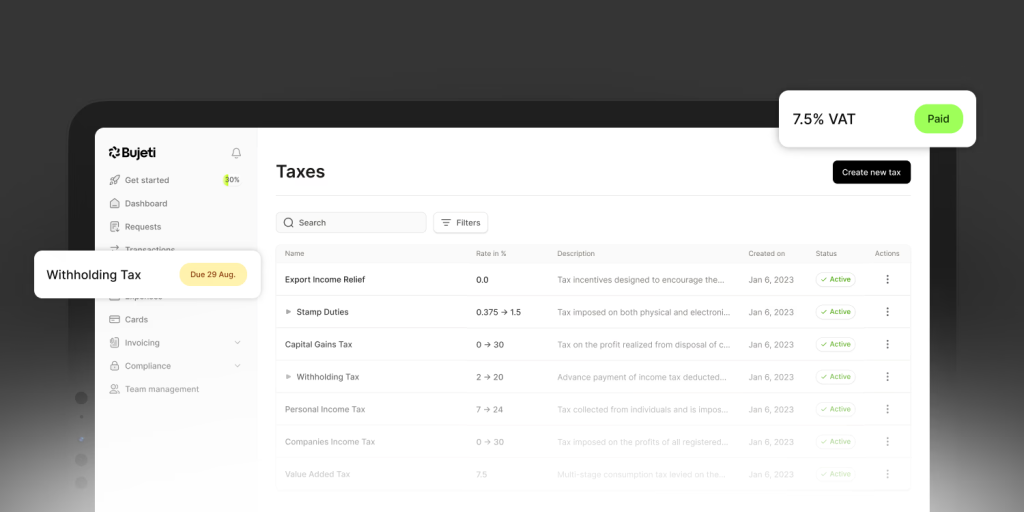

Bujeti has launched a tax management product that calculates, separates, and tracks tax obligations inside its finance management platform, a move some are describing as a direct response to Nigeria’s 2025 Tax Act, which compressed compliance timelines and raised penalties for businesses that miss filing deadlines or remit late.

The Lagos-based fintech, which serves over 5,000 finance professionals across Nigeria and Kenya, built the product in four months after engaging tax experts from Forvis Mazars and independent consultants to ensure the software matched real-world compliance workflows, not just regulatory text.

Bujeti’s “Tax Vault” automatically ring-fences collected VAT and withheld taxes, preventing the common problem of businesses accidentally spending tax funds before remittance is due. When filing time arrives, the money is already separated, eliminating the liquidity scramble that often forces non-compliance.

The product went live this month, just days after Bujeti formalized a partnership with Nigeria’s Presidential Committee on Economic and Financial Inclusion as part of the “SheIsIncluded” initiative targeting 10 million Nigerians.

The big picture

Nigeria’s tax reforms are forcing a structural rethink of business software. What used to be end-of-year accounting cleanup is becoming real-time operational infrastructure, and platforms that embed compliance into everyday workflows—rather than offering it as an add-on—may gain structural advantage.

Bujeti positions itself as a “finance control centre” rather than a bank account substitute. The platform issues corporate cards with spending limits, enforces multi-level approval workflows, automates bulk vendor payments, and now calculates taxes at the transaction layer.

CEO Cossi Achille Arouko describes the product as a financial “cockpit”—a control layer that governs money flows before approval, at execution, and after settlement.

“Banks are built for money to come in and go out,” Arouko commented. “We’re building for everything that needs to be controlled before and after that happens. And taxes are a major part of that”

The timing matters. SMEs contribute 46% of Nigeria’s GDP but often lack in-house tax expertise. The 2025 Tax Act offers lower tax burdens for some—companies with turnover below ₦100 million pay zero company income tax—but stricter filing obligations for all. Missing deadlines can cost exemption status. Misclassifying transactions triggers penalties.

Bujeti also recently launched mobile apps for iOS and Android, extending approvals, fund requests, and transaction tracking to smartphones. With over $2 million in funding and clients including Selar, Mono, and Eden Life, the company is expanding across Africa and adding multi-currency support as it positions for cross-border growth.

Notably, Bujeti’s all inclusive suite of products largely outranks other financial management platforms in Africa in scope, capabilities, and reach. The company knows this well, and fittingly describes itself as the Finance Control Centre for African businesses.

Nigerian businesses can now manage their taxes on Bujeti

Room for disagreement

Not everyone believes SMEs will adopt compliance software at scale. Skeptics argue that businesses with turnover below ₦100 million—exempt from company income tax—may continue relying on spreadsheets and external accountants, viewing software as an unnecessary cost.

There’s also the question of enforcement. Nigeria’s regulatory history suggests inconsistent application of rules, which can reduce urgency around compliance infrastructure. If penalties remain theoretical rather than systematically enforced, businesses may not invest in prevention.

Bujeti’s counterview: penalties under the new Act are steeper, and refunds for overpaid taxes are rare and difficult to obtain. “Once money leaves your account as tax, getting it back is almost impossible,” Arouko said. The platform’s value proposition isn’t just avoiding penalties—it’s preventing overpayment.

Notable development

Bujeti’s institutional partnerships signal maturity beyond early adopters. In May 2025, the company formalized a strategic alliance with the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) to digitize thousands of SMEs. The recent Federal Government partnership through the Presidential Committee adds credibility as regulators push for greater transaction visibility.

Caleb Nnamani, who leads storytelling at Bujeti, frames the tax launch as a “compounding moment.” Nigeria’s B2B fintech sector is growing at 13-15% annually, and African fintech revenues are projected to reach $30 billion by 2025.

Whether Bujeti can convert regulatory pressure into adoption at scale will define its next chapter.