Instead of trying to serve retail users at scale, Africa’s telecoms industry should concentrate 5G on transforming the continent’s industry and business operations.

In the 11th episode of Season 1 of our eponymous show, Next Wave, Big Cabal Media CEO, Tomiwa Aladekomo, had a chat with Angela Wamola, head of sub-Saharan Africa at GSMA, the telecom industry group; and Mazen Mruoé, group chief technology and information officer at MTN, one of Africa’s largest mobile network carriers. The topic was 5G, and the question under review was how 5G would fare in Africa.

5G deployment is well underway in Africa. | Infographic: Mobolaji Adebayo & Ayomide Agbaje – TechCabal Insights.

This week’s Next Wave is my extension of that conversation with a simple argument, i.e., we are making a mistake by thinking, talking about and orienting 5G capabilities in Africa for individual retail or small business users. Should ordinary people like this writer have access to faster internet to play online games or stream the latest motion picture on Netflix with a much smoother experience? Yes. But should Africa’s 5G development be oriented towards serving this market of personal users? I think not. Here’s why.

4G has a long way to go. Leave it to retail users

More than 90% of Africa’s internet connections are mobile. Fixed broadband internet with a penetration rate of 11.5% lags behind other world regions, per research from Omdia, a technology research consultancy. 5G constitutes just a small fraction of this penetration. 5G connections also make up a small percentage (about 4%) of mobile internet connections in Africa.

According to the GSM Association (GSMA), 3G represented 57% of mobile connections in Africa, 4G was at 16% and 2G represented 26%. 4G connections have since grown to account for a fifth of mobile connections in sub-Saharan Africa, still far short of the global average of 55%. The data is unequivocal: there is a lot of room for improvement in the adoption of fourth-generation internet networks, and the opportunity for this will remain for some time. GSMA expects 3G to remain at 57% by 2025 while 4G will grow to 26%. 5G will only begin to dent the network connection makeup by connecting 4% of mobile internet users in Africa from 2026. One can look at this and shrug at the embarrassing growth rate prophesied for 5G in Africa. Or we can accept that and seek to make this 4% count.

Since fixed broadband internet and mobile broadband have a long way to go, telecom firms rushing to roll out 5G services have come under some criticism. I have also argued separately that rather than rushing to deploy costly untested consumer 5G, we could invest in understudying 5G in other markets. I wrote: “Without any first-mover advantage to be gained, (and since Africa is sadly not contributing meaningfully to the development of 5G technology) we might avoid costly first-mover pitfalls by taking time to understudy 5G in other markets instead.”

I have now taken my own medicine and undertaken a snapshot of what I find interesting about the 5G market in other countries and that I believe deserve more attention from decision-makers and policy heads. If 4G has a long way to go to serve consumers fully, why should 5G also not target consumers, or what should it focus on instead?

The answer in one sentence is: Focus on private 5G networks.

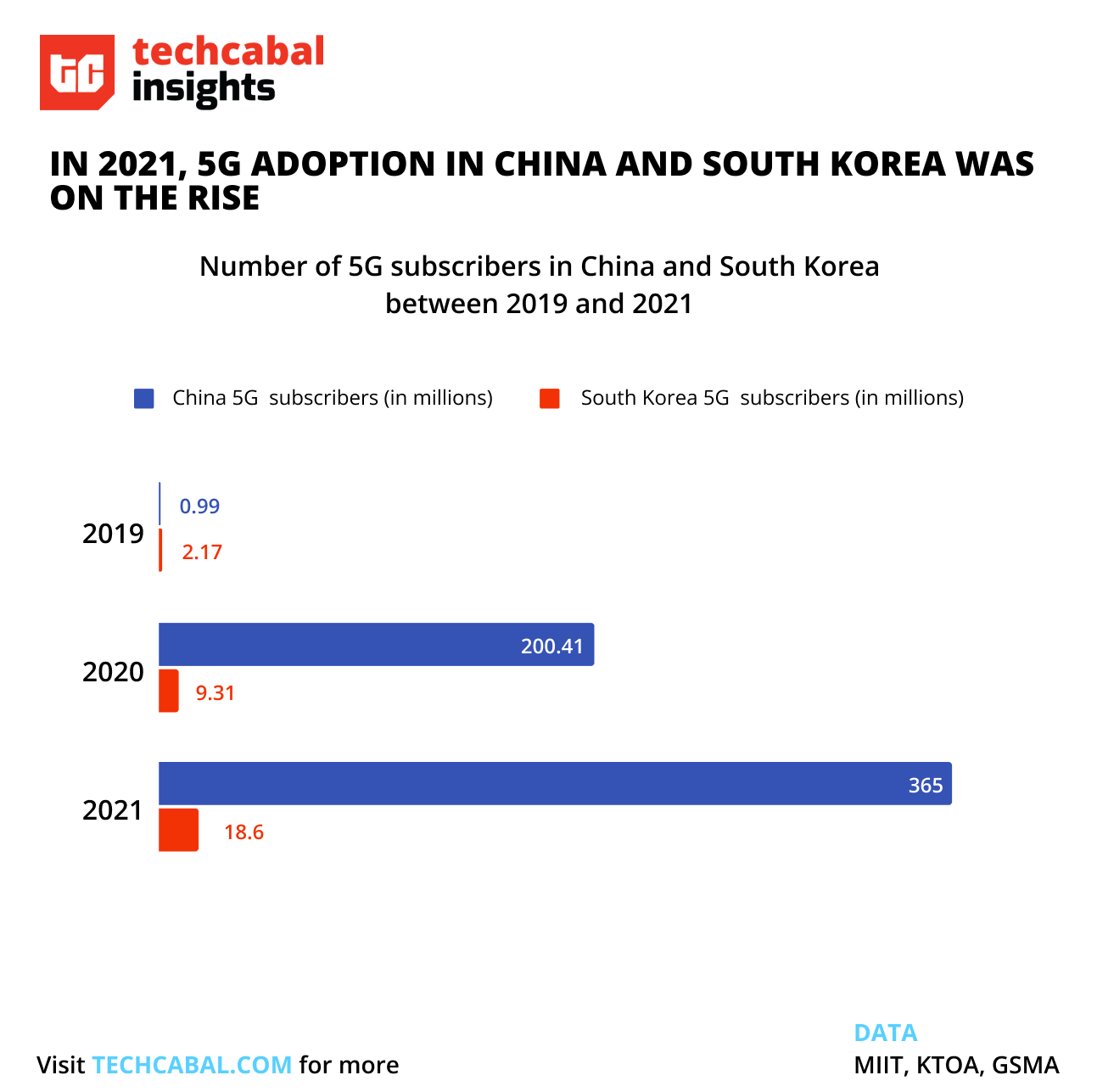

The China/South Korea example

After deploying commercial 5G networks in 2019, by the end of 2020, South Korea was one of the most advanced countries with respect to 5G adoption. It had 11.8 million 5G subscriptions out of a population of 52 million people. At the time, the country’s three operators had deployed 166,250 5G base stations, which is the equivalent of 19% of the country’s 870,000 4G base stations. But if you only look at the consumer growth of 5G you may miss something else.

South Korea was the first country to launch commercial 5G, but in 2018, months before telcos in South Korea launched commercial 5G, the country’s government assembled 19 companies, including SK Telecom Co, Samsung Electronics Co, Microsoft Korea Inc., Ericsson-LG and Siemens Korea, to explore ways 5G technology could help the Asian country’s manufacturing sector. This 5G “Smart Factory” Alliance is part of the government’s broader plan to create 30,000 smart factories and 10 smart industrial zones by 2022 to upgrade the South Korean manufacturing industry’s competitiveness, Yonhap News Agency reported.

In China, which leads the world in 5G deployments, the Ministry of Industry and Information Technology released a report titled, “Ten Typical Application Scenarios and Five Key Industry Practices of 5G + Industrial Internet”. From China’s standpoint, a key use-case for 5G technology is to “accelerate the process of China’s new industrialisation, and inject new momentum into China’s economic development,” according to Hebei-headquartered Forlink Embedded, a telecoms equipment manufacturer in Hebei province, China.

5G adoption in China (pop. 1.4 billion) and South Korea (pop.52 million) continues to rise. but there’s more to the story than the number of people using 5G networks. | Infographic: Ayomide Agbaje — TechCabal Insights.

GSMA cites several examples of how this policy works in practice. One case study (find details in from p.27 of this report) shows how ZTE Corporation, Midea Group, and Gree use 5G mobile transmission, edge computing, and positioning capabilities to develop automated guided vehicles (AGVs) with autonomous navigation to “raise logistics turnover efficiency, reduce site space usage, and lower manpower costs and paper costs significantly”.

The Wall Street Journal explained Chinese industry’s embrace of 5G-led automation thus: “China is racing ahead in building the infrastructure of 5G networks, but it is inside factories, coal mines, shipyards and warehouses where the technology is really taking off.”

The Chinese know something we only talk about—if we even do. To quote Forlink Embedded again, “The real value of 5G lies in supporting the high-quality development of the real economy, and there is an urgent need to integrate and apply innovation with the real economy.”

Feel free to copy the Chinese (at your level)

The greatest value opportunity and weakest (digitally) for improvement in Africa’s economic performance lies in the real economy, especially the part concerned with making, storing and moving things and managing the people who handle the different aspects of this part of the economy. Large swaths of how Africa makes and moves things remain undigitised, to say nothing of being online.

Of course, Africa has a weak industrial sector. But this is no excuse. Our industrial output continues to deteriorate. Per the 2022 African Industrial Index (AII) report published by the African Development Bank (AfDB), Africa’s share in world manufacturing value had declined to 1.5% by 2010 from 1.9% 30 years prior, in 1980. Part of the reason for the decline has to do with political and corporate mismanagement, but it also speaks to the continent’s failure to even meet rising domestic demand for manufactured goods. I am reminded of a viral video (unfortunately, I cannot find it now) where the speaker declared, in no uncertain terms, that Africa lacks value as a manufacturing centre, from a global perspective. 5G networking will not suddenly make Africa a peer with China or even India at the industrial level, but it could do for industry what 2G networks did for individuals. It could help us integrate innovation with the manufacturing aspect of the real economy.

These inefficient undigitsed and offline spaces are areas where concentration and partnerships with connectivity providers can improve efficiency and industrial productivity. Think what transformation a concentration of 5G base stations supporting light manufacturing, mining and industrial process automation (including for the oil industry) can do. Especially when deployed to help monitor and manage environmental impact or to reduce response times and tighten production timelines.

Some of the big problems that dampen production in industries start small. Integrating 5G-enabled monitoring devices may help by preventing small problems from becoming full-on crises by catching them early. Think how trade logistics, especially port operations, can be improved when painful micro-processes are streamlined and managed remotely. Or how improvements in urban traffic management and transportation can improve productivity for workers.

As more variable power-generating units come online in South Africa, for example, utility managers may find value in working with 5G-powered monitoring and automation systems to manage load, distribution and generation at scale. And in disaster planning and mitigation, quicker response times can mean the difference between life and death, and also reduce (if not prevent outright) the cost of rebuilding programmes post-natural disaster. This is important as Africa increasingly faces climate-change-related natural disasters.

No one says we should do this all at once, but these telcos operate across several markets with different need profiles. Simply rolling out 5G for streaming movies faster or playing games is, for lack of a better word, shortsighted. What’s more? The market for this luxury is limited—Africans are unfortunately still poor. Why not offer (and persuade to accept) this luxury i.e., 5G internet in concentrated doses to Africa’s industrial sector?

If you missed the 5G conversation on the Next Wave show, you can rewatch and subscribe to catch new episodes. Click here to watch

We’d love to hear from you

Psst! Down here!

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine,

Senior Reporter, Business and Insights

TechCabal.