A food delivery app’s pitch to a restaurant sounds like this: we’ll help you find new customers, expand your addressable market without the extra cost of building physical branches, and even throw in some free advertising. In return, we’ll take a percentage of the cost of each order as a commission.

While the model is straightforward, the razor-thin margins of restaurant businesses mean the commissions eat into profits.

It’s a delicate dance but restaurant owners are now familiar with the steps: pay the commission—which typically ranges from 10-30% per order—and reduce already meager profits or pass on all or part of the commission to customers who order online.

“If I charge ₦6,000 for a plate of Abacha, I only get about ₦4,200,” said Kennedy Elobuike, a restaurant owner whose business is listed on Glovo and Chowdeck.

Glovo and Chowdeck did not respond to a request for comments.

“Giving away nearly one-third of the value of your food can have serious cost implications, and the potential impact has only increased with food inflation.” While Elobuike claims he doesn’t mark up his prices on the platforms, he doesn’t frown at the practice.

These markups are a key part of the delivery process, even for big restaurant chains that negotiate lower commission fees—some restaurant chains pay as little as 10%—because of their size and scale.

A pot of 8-piece chicken which costs ₦12,800 at a Chicken Republic outlet in Lagos is sold for ₦13,300 on one food app while a ‘maxi’ pot of chicken that’s available for ₦20,900 in-store is listed on another delivery app for ₦22,100.

Since restaurant customers don’t want to pay prices that reflect how expensive deliveries are, these markups are a workaround for everyone in the value chain. It’s similar to retailers adding part of the delivery fee to the cost of the item so that customers aren’t discouraged by high service fees. However, this strategy has its critics.

“I watched my orders from Jumia Food [dwindle] from over 100 to nothing in 2021 when Glovo came in offering free delivery and later ₦250 [half of what Jumia charged at the time],” said Olamide Olaleye, the founder of ChopNowNow, a restaurant that offered free delivery for five years before it paused operations.

“Most of the users this strategy attracts are price sensitive and disloyal, Adjusting the subsidised prices to reflect the true cost of delivery will send many of them shopping where delivery is cheaper.”

Some restaurant owners stay off delivery apps despite the promise of more customers.

“The cost of goat meat has gone so high that sometimes I sell on a ₦20,000 loss,” said one restaurant owner in Lagos who once considered onboarding on one of the delivery apps.

“I still have to pay staff and pay rent from my sales. The commission is too expensive for me.”

Yet it’s not all gloom. Startups like Mano that charge a flat fee of ₦1,400 have shown that there are customers who are open to paying true prices.

“The convenience of delivery is worth it as long as the price difference between delivery and walking in is not excessive,” Pascal* who earns around ₦1 million ($600) monthly told TechCabal.

“I think that the days of marking up to offset delivery costs are behind us,” said a ghost kitchen operator who no longer marks up prices. “People who use these platforms are the exact kind of customers we are looking for, and we know we can win them over [to our food delivery platforms] with quality food.”

Ultimately, commission fees and restaurants’ margins are a universal concern. While some restaurants treat the commission as marketing costs, others prefer to pass it on to customers. Bolder delivery players will simply charge customers more and keep the clients happy. While it’s a balancing act for everyone in the value chain, the customer wants their food now or ten minutes ago when they placed the order on the app.

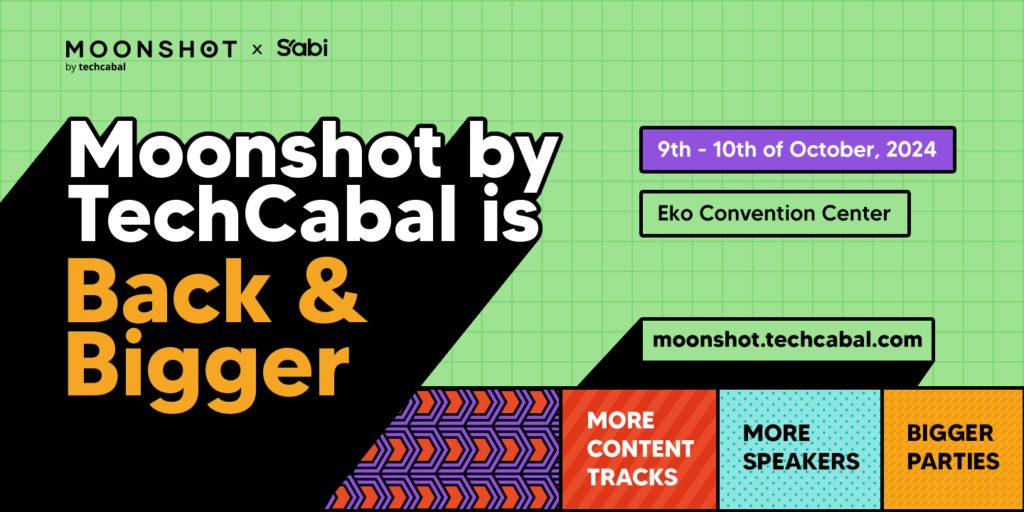

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!