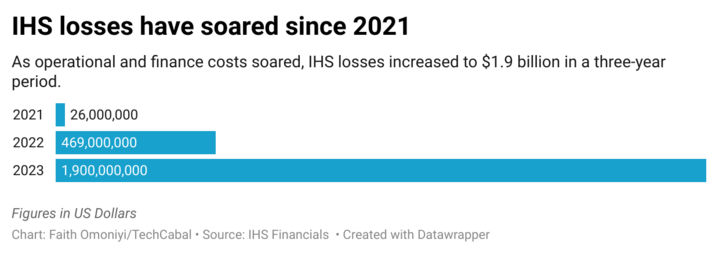

When IHS Towers began life as a public company on the New York Stock Exchange ($IHS) in 2021, it was valued at $7 billion, making it Africa’s most valuable technology company. It has suffered a reversal of fortunes with losses increasing twenty-fold to $470 million in 2022 and climbing again to $1.9 billion by 2023 as operational and finance costs soared.

While a significant portion of those losses is unrealised and linked to naira devaluation, skittish investors have reacted negatively, sending share price tumbling and wiping out $6 billion in market value.

$IHS closed at $2.98 on July 14, 2024($992.5 million market value) continuing a downward trend that has persisted since its listing at $21 per share in 2021. In 2023, its second full year on the NYSE, the share price fell below $4.5.

IHS Towers did not respond to a request for comments.

The company’s attractiveness to investors depends on macroeconomic conditions in Nigeria, its primary market. IHS Towers is Africa’s largest infrastructure company with over 40,000 towers across 10 countries and three regions. Nigeria, where it counts MTN Nigeria–which owns a 26% stake in the tower company—and Airtel as clients, accounts for half of its revenue.

Headline inflation in Nigeria is at an 18-year high and unstable FX prices have increased operational costs. IHS spent $88.8 million to power its towers across all its markets in Q1 2024; power is the company’s largest operating cost.

“Every base station you see in Nigeria is powered 24 hours a day by diesel generators,” said a telecom expert who asked not to be named.

The average retail price of diesel in Nigeria rose from ₦840.81 per litre in March 2023 to ₦1,341.16 per litre in March 2024. According to a 2023 sustainability report, IHS began moving to solar and grid electricity, saving $20.2 million in power costs and maintenance.

“As of December 31, 2023, in our African markets (excluding South Africa), 48% of our sites were powered with hybrid power systems (a combination of diesel generators with solar and/or battery systems), 12% with only generators and 32% with grid connectivity and back-up generators,” the company said in a corporate filing.

Sam Darwish, the chairman and CEO said in a June 2024 Annual General Meeting that the company achieved commercial growth after renewing contracts with MTN and Airtel.

“With MTN Rwanda MLA just signed, we have now completed all contact renewals and extensions with MTN outside Nigeria covering the five countries of Cameroon, Côte d’Ivoire, Zambia, Rwanda, and South Africa—a total of over 12,200 tenancies renewed or extended into the next decade,” Darwish said.

However, shareholders want to see more revenue growth and lower operating costs, which may point to another problem for IHS: many of its shareholders have no patience with the complexity of the tower business.

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!