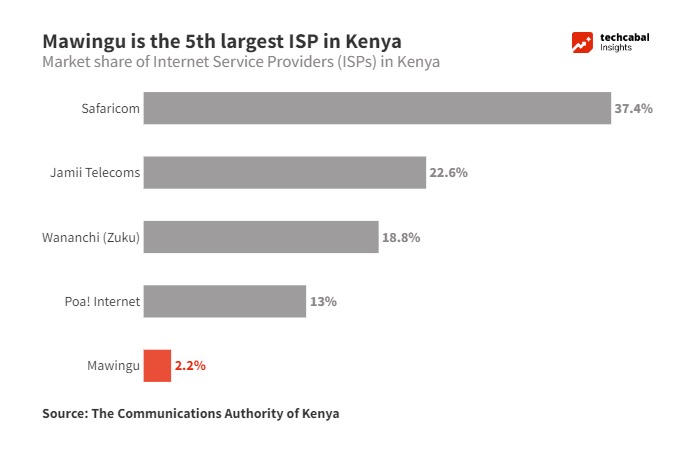

Mawingu, Kenya’s fifth largest internet service provider (ISP), will exclusively offer fibre and fixed wireless services in a highly competitive market dominated by Safaricom and Jamii Telecoms, both of which also provide fibre connectivity to homes and businesses.

The strategic shift was informed by Mawingu’s business objectives, as the Microsoft-backed ISP, with over 30,000 subscribers as of June 2024, aims to expand its reach into more peri-urban areas.

Mawingu, which has now moved beyond central Kenya to traditionally overlooked regions in northern and western parts of the country, claims that around 10% of its customers will be connected to fibre before the end of the year.

Mawingu CEO Farouk Ramji told TechCabal on Friday that the company has laid 20 kilometres of fibre in Isiolo, a town in Eastern Kenya, and plans to do the same in Garissa and other areas. Its packages start at KES 2,500 for a 10 Mbps connection.

Mawingu, a project born from the Kenyan government’s unused TV frequency initiative (also known as TV white space) and Microsoft, began experimenting with these frequencies in 2016. The goal was to expand internet access in underserved areas using solar-powered stations and TV white space technology. This trial was a response to Kenya’s digital migration from analog to digital TV broadcasting, which freed up valuable spectrum.

While the ISP was licenced to test the frequencies for internet connectivity by the Communications Authority (CA), TV white space was not a core focus for the company, Mawingu told TechCabal.

“We don’t use TV white spaces any more. It was a trial. We are just using fixed wireless on the 5GHz channel,” Farouk Ramji, Mawingu CEO, told TechCabal.

Setting up TV white space infrastructure requires substantial capital investment, making it a business challenge for smaller ISPs.

“The biggest hindrance to TV white space is the unit economics. A single customer premises equipment (CPE) costs about $2,000. You can get the distance (for internet availability) for 20 kilometres, but the economics don’t make sense for rural/peri-urban areas,” Ramji said.

It has managed to survive by serving customers in areas outside the coverage of larger ISPs. Telcos like Telkom Kenya attempted to cater to these customers with services such as the now-defunct Loon service in partnership with Google, which allowed customers to go online using internet-beaming balloons.

Even with its initial high costs, Elon Musk’s Starlink aims to capture this market. Fifteen months after launching in Kenya, Starlink has attracted over 4,000 subscribers and introduced packages that have disrupted the fixed internet market.

Market leader Safaricom responded by upgrading speeds for its fibre services up to five times. Starlink countered this by introducing a residential lite package for price-sensitive customers.