Good morning! ☀️

We hope you had a great weekend. We are still buzzing from the stellar reviews of our moonshot conference. Attendees raved about engaging conversations and were delighted by the beautiful brand experience. If you missed out on this year’s edition, mark your calendars for October 15 and 16, 2025.

We weren’t the only ones receiving accolades over the weekend though. Elon Musk’s SpaceX made history after the Starship rocket was captured on its return to the launch pad. It was a world-first.

Elon Musk’s Tesla also made the future history over the weekend with the launch of two autonomous vehicles, a robotaxi and a robovan, alongside Optimus, a humanoid robot.

Economy

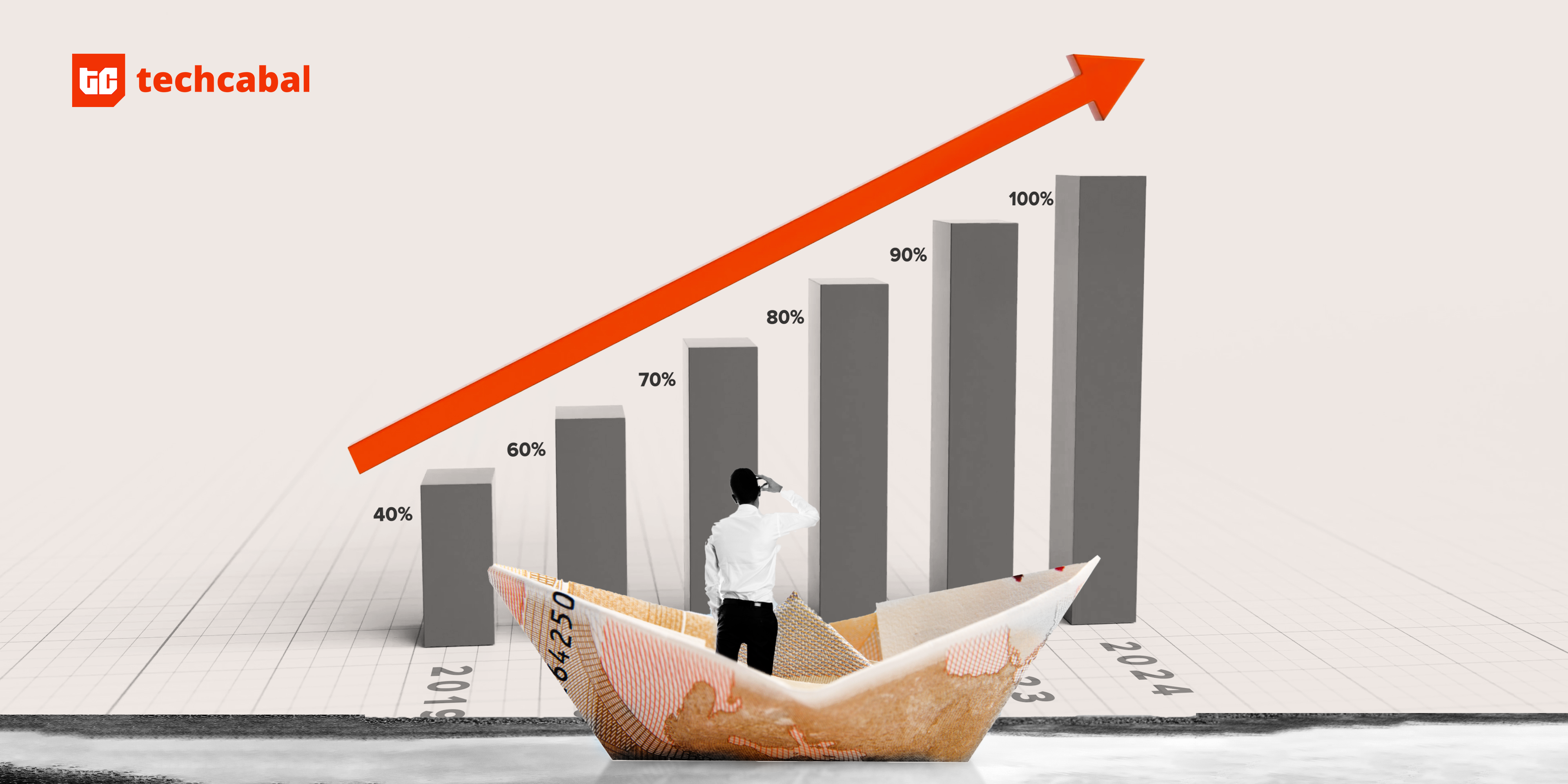

Nigeria’s Inflation forecast for September is tricky

“It’s difficult to predict.”

That’s what one analyst told me when I asked his thoughts on Nigeria’s September inflation number. While headline inflation has eased for two consecutive months, analysts I spoke to wouldn’t be drawn into predicting September inflation figures.

A food harvest season and a six-month free import duty on food drove down food prices which contribute more than half of the key metric—the CPI index—for judging inflation rate. However, a 45% increment in fuel prices has driven transport prices up, a second determing factor of infation rate.

Given Nigeria’s current harvest season, the increased demand for food transportation, primarily by road, will likely elevate fuel consumption. This, in turn, could contribute to a rise in the inflation rate, argues Basil Abia, an analyst at Veriv Africa.

Regardless of what figures the National Bureau of Statistics show, the CBN is leaning towards a continued tightening of the monetary cycle arguing that core inflation continued to rise in July and August. In September, the Central Bank Monetary Policy Committee delivered a shock 50 basis point interest rate hike, increasing borrowing cost.

The National Bureau of Statistics (NBS) will announce interest rates on Wednesday.

Read Moniepoint’s Case Study on Funding Women

After losing their mother, Azeezat and her siblings struggled to keep Olaiya Foods afloat. Now, with Moniepoint, they’re transforming Nigeria’s local buka scene. Click here for a deep dive into how Moniepoint is helping her and other women entrepreneurs overcome their funding challenges.

Energy

Adani and KETRACO agree $736 million energy deal in Kenya

Adani Energy Solutions, a subsidiary of the Indian conglomerate Adani Group, has agreed a KES 95.68 billion ($736 million) deal with Kenya to build three transmission lines and two substations. It is a build-operate-transfer (BOT) arrangement that will see Adani construct and operate the power lines for 30 years.

Adani will finance the project—its first in Kenya and the first made by any Indian company in the country—through debt and equity. It will construct 388 km of high-voltage transmission lines spanning the entire country, in collaboration with the Kenya Electricity Transmission Company (KETRACO).

Kenya’s power grid is aging, causing country-wide blackouts . Repairs and maintenance were previously funded from taxpayers and grants which became insufficient. Adani Energy Solutions will recoup its investment from new charges on households’ monthly electricity bills, which will likely go higher.

For Adani Energy Solutions, which operates more than 21,000 km of power transmission lines worldwide—playing a key role in electricity transmission across India’s Gujarat and Maharashtra regions—it has landed one deal it has desperately pursued since December 2023.

Issue USD and Euro accounts with Fincra

Whether you run an online marketplace, a remittance fintech, a payroll, a freelance platform or a cross-border payment app, Fincra’s multicurrency account API allows you to instantly create accounts in USD and EUR for customers without the stress of setting up a local account. Get started today.

Fintech

Lupiya, micro-lending fintech eyes Nigerian expansion, plans to raise $10 million

Zambian microlending fintech Lupiya, which raised $8.25 million in series A funding in 2023, plans to expand into Nigeria . After entering Tanzania in March, the fintech company is betting on Nigeria’s microlending market which already has players like Fairmoney, Branch, and Umba.

In the last five years, South African fintechs Jumo, Yoco, and Stitch have expanded to Nigeria, with varying levels of success.

Nigeria’s huge fintech market and the presence of key players like Flutterwave and Paystack presents an opportunity. But Zambian startups haven’t often expanded into Nigeria. Instead, Nigerian fintechs have been more likely to enter Zambia. For example, Flutterwave, Paystack, and Chipper Cash, with its acquisition of Zoona in 2022, have all expanded to Zambia.

For Zambia, only Union54, which provided card issuing services to fintechs like Busha, and Zazu—which now has no marked presence in the country—have entered Nigeria.

Zambia and Nigeria both have young and tech-savvy populations, which makes fintech adoption higher. Like Zambia, Nigeria is also consumption-based, with huge capital demand from retailers who are typically shut out of credit provided by traditional banks. But that’s where the similarities end.

Zambia has low internet penetration and faces challenges with financial literacy, both of which could be problematic for digital-first neobanks like Lupiya. Evelyn Kaingu, Lupiya’s co-founder, has acknowledged these challenges in Zambia, where over 135 microfinance institutions provide consumer credit. Nigeria, on the other hand, has a larger population and a more developed fintech ecosystem. With three times the number of fintechs compared to Zambia, the competition in Nigeria is fiercer.

Yet, Kaingu is confident of Lupiya’s ability to compete. The startup is currently raising a further $10 million in a series B funding round to enable it to compete with other microlending players in Nigeria with deep pockets.

Introducing Pay with Pocket on Paystack Checkout

Paystack merchants in Nigeria can now accept payments from PocketApp’s 2 million+ customers. Learn more →

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $63,928 |

+ 1.71% |

+ 6.21% |

|

| $2,531.74 |

+ 2.73% |

+ 4.41% |

|

|

$2.24 |

– 0.46% |

+ 112.51% |

|

| $151.60 |

+ 3.65% |

+ 8.95% |

* Data as of 06:20 AM WAT, October 14, 2024.

Jobs

- Big Cabal Media – Sales Operations Lead, Deputy Editor (Zikoko) – Lagos, Nigeria (Hybrid)

- Paystack – Finance and Strategy Specialist – Lagos, Nigeria

- Pandora – Content Manager, Creative Designer, Social Media Strategist – Lagos, Nigeria (Remote)

- Earnipay – Digital Marketing Specialist – Hybrid (Lagos, Nigeria)

- Mono – Technical Product Specialist, Senior Sales Associate – Lagos, Nigeria

- When – Sales and Marketing Operations Specialist – EMEA, Remote

- Zipline – Product Marketing Manager, Africa – Lagos, Nigeria

- Spacefinish – Associate Designer – Lagos, Nigeria

Issue virtual USD cards for you and your customers

Do you want to issue virtual USD cards for your customers and business expenses? Use Kora’s APIs to issue cards, customise your card program, and set your customers’ funding limit to your risk level. Get started here.

Written by: Faith Omoniyi & Emmanuel Nwosu

Edited by: Olumuyiwa Olowogboyega

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 10 AM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.