Paystack, the Stripe-owned Nigerian fintech, has integrated a payment option enabling merchants to accept payments directly from millions of OPay accounts. The integration continues Paystack’s strategy of building payment methods on bank transfers, which accounted for over half of all transactions it processed in 2023.

This approach cuts out debit cards, which have long been a payment intermediary between merchants and consumers, as card payments carry additional costs that often inflate the final transaction amount.

The “Pay by OPay” feature is one of the ways merchants can accept payments directly from bank accounts, as Paystack’s payment portal is integrated with 24 Nigerian commercial banks and fintechs like PalmPay and Kuda, enabling merchants to receive payments via bank transfers. However, the integration with OPay enables customers to make payments online directly through the OPay app or web interface.

“It’s important for businesses to offer payment methods that their customers know and trust,” said Shola Akinlade, Paystack CEO.

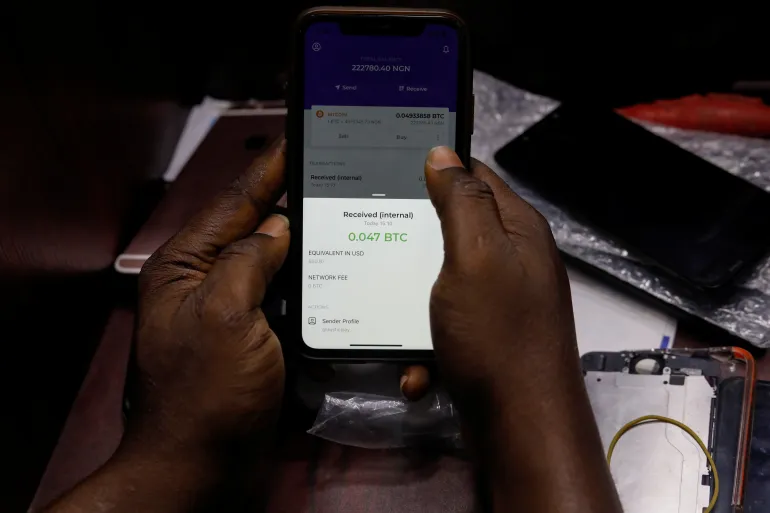

OPay gained prominence as a trusted payment option during a cash crunch in 2023 as Nigerians turned to fintechs after traditional banks struggled with the surge in online transactions. Paystack claimed the integration with OPay will allow customers to experience a 99.9999% transaction success rate.

The fintech first partnered with the Nigeria Inter-Bank Settlement Scheme (NIBSS) in 2023 to launch direct debits, allowing customers of most Nigerian banks to pay merchants through their accounts.

In 2017, Paystack introduced “pay with bank transfer,” which allowed customers to complete transactions without using a debit card. This payment method has since ballooned, rising from under 13% of the company’s total transaction activity in 2021 to over 50% by the end of 2023.

“OPay will continue to build on its strength, which is modern technology, to provide our customers with cutting-edge financial service offerings,” said Dauda Gotring, OPay’s MD.