On a warm August morning in Johannesburg, a Nigerian product builder tapped a few buttons on his phone. Within seconds, funds left his Naira account in Lagos and appeared in a South African bank account, no paperwork, no delays, and no punishing exchange rates. What looked like a simple transfer was, in fact, a glimpse into how Neona Technologies wants Africans to move money across borders: seamlessly, instantly, and on their own terms.

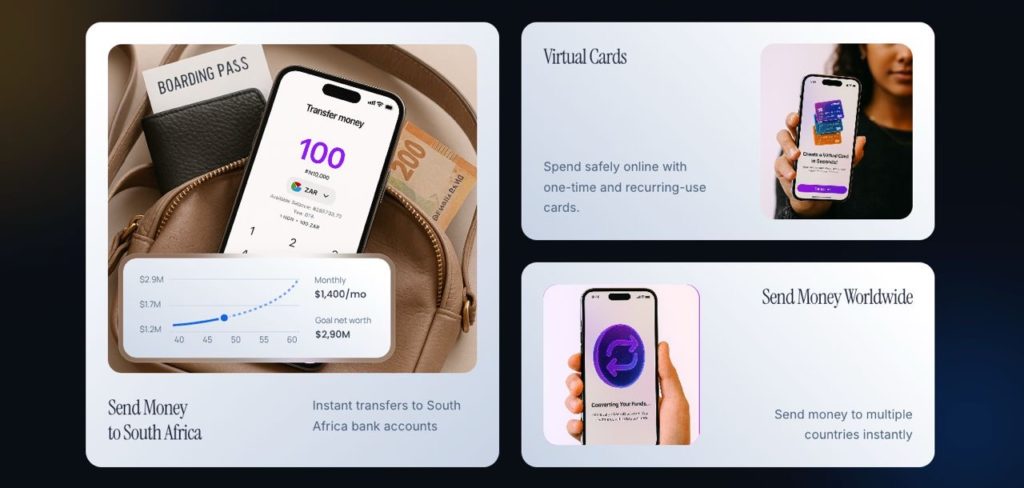

This is the promise of Spendin, a new cross-border payment app from Neona Technologies. By offering real-time Naira-to-Rand transfers, virtual dollar cards, and bilateral payment rails, Spendin is taking aim at Africa’s most stubborn financial pain point: fragmentation.

The friction of African payments

For decades, intra-African commerce has been slowed by currency inaccessibility, FX restrictions, and settlement delays. Migrants in South Africa often find it harder to send money home than to wire funds overseas. Traders struggle with cross-border settlements that can take days, if not weeks. And freelancers frequently lose a chunk of their earnings to hidden fees.

“Every African who moves money across borders knows the frustration of waiting, the fear of being overcharged, or the disappointment of seeing a payment fail,” said Heritage Falodun, Co-Founder and Product Lead at Neona Technologies. “Spendin was designed to turn that frustration into confidence, a tool people can rely on whether they’re supporting family, running a business, or simply living between two economies.”

The app, now live on iOS and Android, allows Nigerians to send money directly into South African bank accounts, with transfers reflecting instantly and exchange rates benchmarked against competitive FX markets. Just as crucially, South Africans can send money back to Nigeria making the system bilateral, not one-way.

Virtual dollars, global doors

But Spendin’s ambitions stretch beyond the Naira–Rand corridor. With its virtual dollar card, users in Nigeria and South Africa can pay for streaming services, shop on global e-commerce platforms, and transact across borders without being throttled by banking restrictions.

The card, while digital, represents something tangible: autonomy. It lets users bypass the bottlenecks of traditional banks while gaining a direct line to the global economy.

Competing with remittance giants

Spendin enters a crowded but still unsolved market. Legacy players like Western Union and MoneyGram dominate remittances, but they come with fees that can eat into 10% or more of the transfer amount. Newer entrants like Chipper Cash, Flutterwave Send, and Eversend have tried to streamline cross-border payments, yet complaints about settlement delays and inconsistent rates persist.

Where Spendin differentiates itself is in its tight corridor focus. Rather than launching in 10 countries at once, Neona is doubling down on one of Africa’s busiest payment routes: Nigeria and South Africa. Combined, they represent two of the continent’s largest economies, with millions of migrants, freelancers, and traders moving between them every year.

Infrastructure, not imitation

Neona Technologies has long branded itself as a “cross-border financial infrastructure builder.” Its portfolio includes liquidity provisioning and remittance optimization tools, with Spendin serving as the consumer-facing layer. Unlike some startups that repurpose foreign templates for African markets, Neona’s team insists that their design choices come from observing African user behavior directly.

“As Africans, we’ve seen how financial systems often feel like they were designed elsewhere and forced to fit our reality,” said Timilehin Kayode, Co-Founder and CEO of Neona Technologies. “We are reversing that model building from the inside out, so the infrastructure truly reflects the way Africans trade, migrate, and connect.”

The bigger play

For Neona, Spendin is more than a standalone app. It’s a wedge into building Africa-wide payment infrastructure, one corridor at a time. If it can prove reliability and scale between Nigeria and South Africa, the company plans to replicate the model across other high-traffic routes: Ghana–Nigeria, Kenya–South Africa, and beyond.

For now, though, the pitch is simple: make moving money between two of Africa’s economic giants as easy as sending a WhatsApp message.

The app is available for download on the App Store and Play Store, or at www.spendin.co.