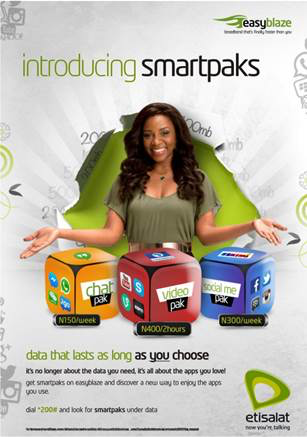

New year, new tricks. Etisalat Nigeria has recently introduced new prepaid data plans dubbed Smartpaks. The smartpaks enable the network’s customers to activate special types of internet access for specific apps on their devices.

App specific data

Etisalat’s touted value proposition for smartpaks is that they will help their customers make smarter data consumption choices.

Any Nigerian who has owned a BlackBerry in the past three years will recognise this one from the myriad BlackBerry special access plans which allowed users enjoy access to various combinations of web, email, IM and social media apps at ostensibly discounted prices. The idea, which Etisalat is now porting to the whole network regardless of device, is that when a customer is subscribed to any of these “paks”, they get unlimited access to therelevant apps for the duration of their subscription. The apps covered fall under three eponymous categories:

Chat pak: Whatsapp, Facebook Messenger, WeChat and 2Go. This pak costs N50 a day or N150 a week;

Social pak: Facebook, Twitter, Instagram and BBM. This pak will set users back N100 a day or N300 a week

Video pak: YouTube, Vine, Skype (interestingly) and other video websites are covered by this plan, and attracts a flat fee of N400 for 2 hours of streaming.

Etisalat subscribers can opt into the plan by dialling *200#, typing 3 for the data menu and choosing “Smartpaks”.

Whether they are really economical is however relative. For a data-conscious consumer who doesn’t do much beyond IM and social networking, perhaps. On the other hand, high bandwidth users who might spend up to N10,000 or more on data every month can probably not be bothered in the first place.

I must admit that of all the paks, it is the most interesting to me. Already, I think nothing of streaming video on my mobile data plan, but there might be instances when N400 for two hours might be a better option. Say for that movie or football match that would be better streamed in HD. This of course presupposes that network quality holds up and doesn’t screw with things mid-stream.

If you would use Smartpaks or already have, please tell us why and how it went.

We have now come to end of scheduled programming and are about to go meta on this business. What do net neutrality experts think about all of these? If you know what “net neutrality” means, then you’re definitely welcome to read on.

Content wars

We have been aware of Etisalat’s plans to move into the video-on-demand game since mid-2014, via an impending deal with Dobox, an internet VOD startup. Dobox’s exclusive license to MTN was said to be expiring that year, according to those familiar with the matter. When we asked about the current launch status of “Etisalat Dobox”, an Etisalat representative replied saying “soon…very soon”.

Speaking of content licensing deals, which are increasingly becoming a competitive sport among Nigerian telcos, I couldn’t help noticing the conspicuous absence of a “Music pak” from Etisalat’s new smartpaks. I reckon that has been taken care of by the Spinlet music service. While originally launched exclusively to the Etisalat network in 2013, the exclusive agreement expired in April 2014, paving the way for a new Spinlet/MTN license and data bundle deal. Etisalat reps say the Spinlet music service and data bundles remain to the network’s subscribers via the same designated shortcodes.

Neutral stance to net neutrality

In any event, all of this brings squarely into our crosshairs, the looming question of the attitude towards net neutrality by Nigerian and indeed African communications and internet service providers.

MTN Dobox, Airtel five Naira videos, and just now, Etisalat Smartpaks all have one thing in common. The mobile networks zero-rate data access to specific content services they promote, giving their subscribers huge incentives to adopt those content services at the expense of others that would consume their data. Admittedly, they have not begun to selectively throttle access quality to competing services, or demand rent like Comcast does to Netflix. But what is to say that won’t happen in the future, as the local telco content wars heat up?

The trend in developed markets (especially the U.S) is increasingly against ISPs granting priority or discriminatory access/treatment to different apps and services in order to discourage anti-competitive behaviour. In November 2014, the Obama administration threw their lot in with net neutrality advocates, setting a global precedent. Notwithstanding, Nigerian/African ISPs appear to be totally unconcerned with the concept.

“Net apathy” in Africa on the part of ISPs is mostly due to the absence of regulation. Going by the moves of local telcos and ISPs, this state of affairs seems to suit them just fine. For its part, Etisalat Nigeria appears content to profess a neutral stance. A representative of the company told TechCabal via email that while the market the nascent market is still yet to evolve to the point that net neutrality comes to the fore, the network is always ready to hew to the position of the regulator.

“For now, we are more preoccupied with how to get broadband access to an even greater number of Nigerians, and for those who have it, guaranteed quality of service”, they said.

One South African technology pundit, Duncan McLeod of TechCentral argues in August 2014 that net neutrality rules are in fact not needed in that country, at least not right away.

“Net neutrality regulations may be needed in South Africa in future — particularly as mobile operators start edging their way into the content game — but the ISPs are right: [Icasa] should watch developments elsewhere with a keen eye, but resist the temptation to impose regulations that are not currently needed”, he says.

His stance is one that local ICT advocates will be none too happy with.

African ISPs are however not the only beneficiaries of an under-regulated industry. In the last couple years, global internet giants like Facebook have undertaken a resolute strategy of partnering with local networks to deliver zero-rated access to gated web experiences. These activities have ramped up considerably in 2014.

Personally, I believe that by the time net neutrality in Africa does become an issue, most of Africa’s internet users will have found themselves in a maze of AOL-esque internet walled gardens from the era of dial-up. There is a reason why MTN bought into Rocket Internet’s Africa Internet Holdings, comprised of Jumia, Jovago, Easy Taxi and others.

But for now, apps race is mostly taking place between local telcos, Smartpaks being Etisalat’s latest jab in the free-for-all. It is only a matter of time before MTN delivers a counter-punch, and appagedon ensues.