Kuda processed $2.2bn in February 2021. It has now raised a total of $36.6m in two years to build Africa’s digital bank.

Nigerian fintech startup Kuda has raised $25 million in a Series A round led by Valar Ventures, the firm co-founded and backed by PayPal co-founder Peter Thiel. Target Global, the European venture capital firm that led Kuda’s last funding, participated in the round.

The Series A follows Kuda’s $10million raise in November 2020, a feat cheered for being the largest seed round by an African startup.

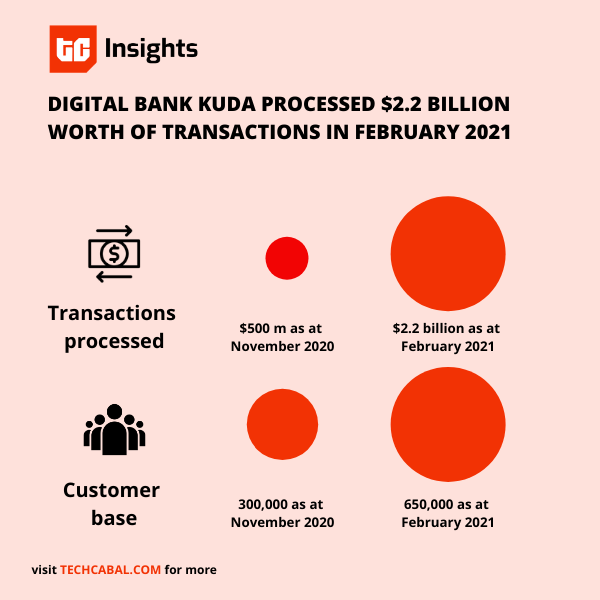

At the time, the company said it had 300,000 customers (which was a mix of individuals and sole-proprietor businesses) and was processing an average of $500 million worth of transactions per month.

Five months later, Kuda says it now has 650,000 customers. Ryan Laubscher, who recently joined Kuda as Chief Operating Officer, told TechCabal that Kuda processed $2.2 billion in transactions in February 2021 alone – a staggering increase from $5.2 million processed in February 2020.

All of this has been achieved just in Nigeria where the company launched as a no-fees, digital-only bank in the second half of 2019 with $1.6million pre-seed funding.

Given these impressive numbers, the large seed round (for an African startup), and their ambition to bank every African in every part of the world, it may have been expected that Kuda would raise a Series A larger than $25 million.

Laubscher said the round stirred interest from multiple investors. However, the startup chose to raise only what was adequate to fund their plans.

“It is very important to us that our metrics are justifying the valuation that investors are buying into with their capital,“ Laubscher said on a call with TechCabal.

“Our growth is at the point where we need to beef up our technology and people. But in terms of our plans for the next 18 months, we’ve got sufficient capital to fund those plans. If we need more capital, it’s going to mean that something is going very right. And if that’s the case, we can raise again.”

Kuda has two co-founders; Babs Ogundeyi, the CEO, and Musty Mustapha, the Chief Technology Officer.

The company has a microfinance banking license from the Central Bank of Nigeria. At the moment, Kuda’s flagship product is a digital-only savings account. Customers can download the app, enter Know Your Customer (KYC) information and have an account within a day.

The new customer can receive deposits into this account, though the maximum balance and deposit amount depends on the level of KYC information provided. Customers request a debit card on the Kuda app and have it delivered to their homes.

Laubscher says Kuda’s Series A round was oversubscribed and a “decent amount of capital” was left on the table.

Their plan is to further accelerate the company’s growth in ways that those investors who couldn’t get in at this round would still be interested in being part of the Kuda story when they raise again.

Last year, Kuda’s seed round was announced after Paystack’s landmark exit to Stripe. This time, the Series A follows a week of enthusiasm after Flutterwave became a unicorn and landed a crucial integration that enables merchants in Africa to receive PayPal payments.

The three startups rank highly on Africa’s fintech funding list, but the money is perhaps to be best understood as a sure signal that Africa is the destination for venture capital seeking tech-based value creation.

In addition to its mobile-first savings account, Kuda is testing a credit product at the moment, but what will differentiate them from traditional banks is the capacity to facilitate easy banking.

“What really excites me is blowing people away with the quality of customer service where they really feel that they are loved by their bank,” Laubscher says.

This customer service focus will be complemented by products that feel tailor-made for each individual. Laubscher says Kuda is building a large data and decision science center in Cape Town. This data center will improve its capacity to make data-driven decisions around credit origination and running the company’s internal operations.

For now, Kuda hopes to be more mainstream and grow its customer base in Nigeria by permeating popular culture. Earlier this year, it unveiled Erica Nlewedim, a very popular housemate from reality TV show Big Brother Naija, as its brand ambassador.

Clarification: An earlier version of this article said Kuda evolved from KUDIMoney. The company has said that Kudimoney is a different legal entity and that Kuda is a whole other company in the UK and Nigeria. Kuda also clarified that it processed $5.2 million in February 2020, not $50,000.