When it launched in 2016, fintech startup KUDImoney, offered small loans of up to US$5,000 to individuals and small businesses, repayable over a period of up to 12 months. A year later, it had incorporated a savings service into its platform. And now, three years later, the rebranded fully-fledged online-only digital bank, Kuda, has raised pre-seed funding to the tune of US$1.6 million from a number of angel investors led by Haresh Aswani, Managing Director of Tolaram Group.

Since its launch, Kuda has sought to trump traditional banking pitfalls with its services by offering banking solutions with no maintenance or service charges as is obtainable with traditional banking institutions, speedy loan disbursements, and more.

“Access to credit is difficult, more so for smaller loans, and even harder when you need it fast,” Chief Executive Officer, Babs Ogundeyi told Disrupt Africa when the company launched.

Ogundeyi told TechCrunch the digital bank now plans to use its seed fund to go from beta to live launch in Nigeria by the last quarter of this year. “Our immediate priorities are continuous product improvement and excellent customer support, so the funds we’ve raised will be used to expand our software development and customer support teams and equip them with the best tools available,” Ogundeyi said in a blog post. There are also plans to expand beyond Nigeria.

“The plan is to build a Pan-African digital-only bank,” Ogundeyi said.

Kuda received a microfinance banking licence from the Central Bank of Nigeria (CBN) earlier in June.

Kuda isn’t the only digital bank operational in Nigeria. Wema Bank launched its digital bank, ALAT, in May 2017. By February 2018, the bank said it had recorded 200,000 accounts registered and over N1.1 billion in deposits. It is unclear what these numbers look like for Kuda or how much it hopes to capture when it launches live. In August, two of Nigeria’s most popular financial startups, PiggyVest and Cowrywise, unveiled new features that raised speculations that they were pivoting to digital banks. Both companies said they remained focused on providing financial planning, savings and investment services especially to Nigeria’s millennials and growing middle class with growing interest in wealth management.

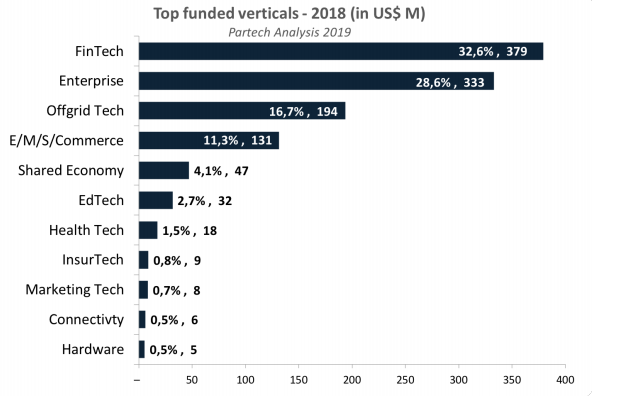

Source: Partech

Financial technology services in Nigeria and across Africa are rapidly increasing and the sector now receives the bulk of VC capital and deal-flow to African startups, according to a 2018 WeeTracker survey. While many are striving to offer conventional banking services in ways that are not only cheaper and more convenient to access, a lot of them are looking to capture the approximately 36.6 million Nigerians who are above 18 years and financially excluded. According to Efina’s Access to Financial Services in Nigeria 2018 survey, 76% of this population have no access to financial institutions. A large percentage of this unbanked group are in rural and low-income communities across the country lacking in basic infrastructure upon which theses services thrive.

The Central Bank of Nigeria hopes to achieve an 80% financial inclusion rate by 2020. At the center of more digital financial solutions, then, must be the last mile users and creating digital solutions and tools that bring them into the loop and expand their ability to send, receive and create value.

Kuda says it will continue in its vision to build Africa’s best digital bank. It will be interesting to see how far-reaching its imprint will be.