Kudimoney is an online service that makes credit more accessible to users, and at the same provides a beneficial way to save and spend money.

The idea for Kudimoney was conceived by Babatunde “Babs” Ogundeyi who has more than 15 years of experience in finance, banking and technology (he was the Senior Special Assistant on Finance to the Oyo State Governor from 2011 to 2015). Together with his team, Babs hopes to give individuals and SMEs access to loans without stress.

In his words, “For as long as I can remember, I have believed in the ability of using technology to make everyday living easier. This combined with my deep finance and banking experience clearly influenced my pursuit of building a financial institution without boundaries.”

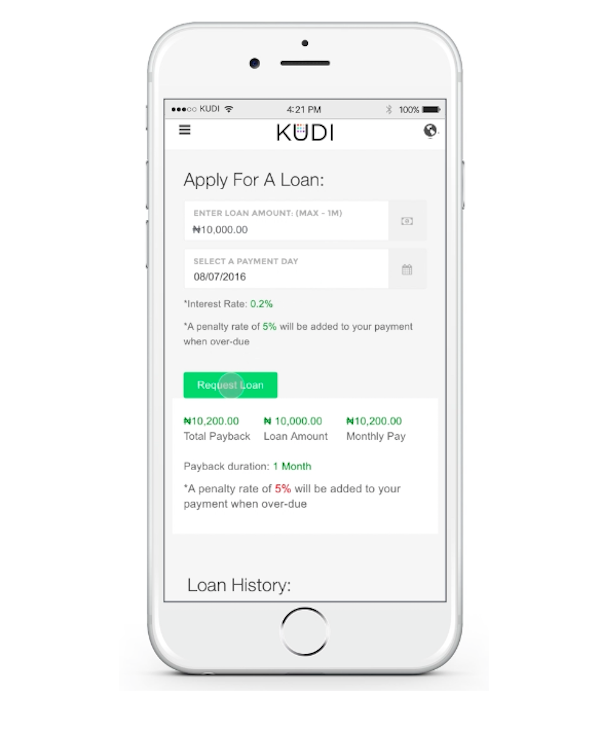

Kudimoney loans are essentially bridge loans (short term means to an end) and users can borrow as much as N1 million for a maximum period of 12 months with interest rates ranging from 0.13% per day to 4% per month. Users are vetted using a proprietary algorithm that helps Kudimoney decide whether or not to grant a loan. According to Babs, “I’d like to think that we are firstly a technology business then finance. Everything we do has a strong tech play. In essence all the money that has been invested in creating the business is geared towards making money easier to access. We are also integrated with Credit Bureaus and other external partners in helping us take the most informative decision with our risk assets.”

According to Babs, “I’d like to think that we are firstly a technology business then finance. Everything we do has a strong tech play. In essence all the money that has been invested in creating the business is geared towards making money easier to access. We are also integrated with Credit Bureaus and other external partners in helping us take the most informative decision with our risk assets.”

Kudimoney is launching in October, but they already have grand plans for the Nigerian financial market. They’ve partnered with Electronic Settlement Limited (ESL) and are looking to branch out to other services by 2017.

Babs says, “We are currently a licensed lender and are looking to become a licensed bank by 1st half of next year. Prospective customers will be able to get a feel of our current and savings account when we release the Kudimoney prepaid card early next year.