IN PARTNERSHIP WITH

Good morning ☀️ ️

Telegram now allows up to 1,000 people to join a group video call!

If a thousand people on a Telegram video call sounds like a lot to you, then grab a seat because Telegram plans to keep increasing this limit until all humans on Earth can join one group call. Quite ambitious innit ?!

In today’s edition:

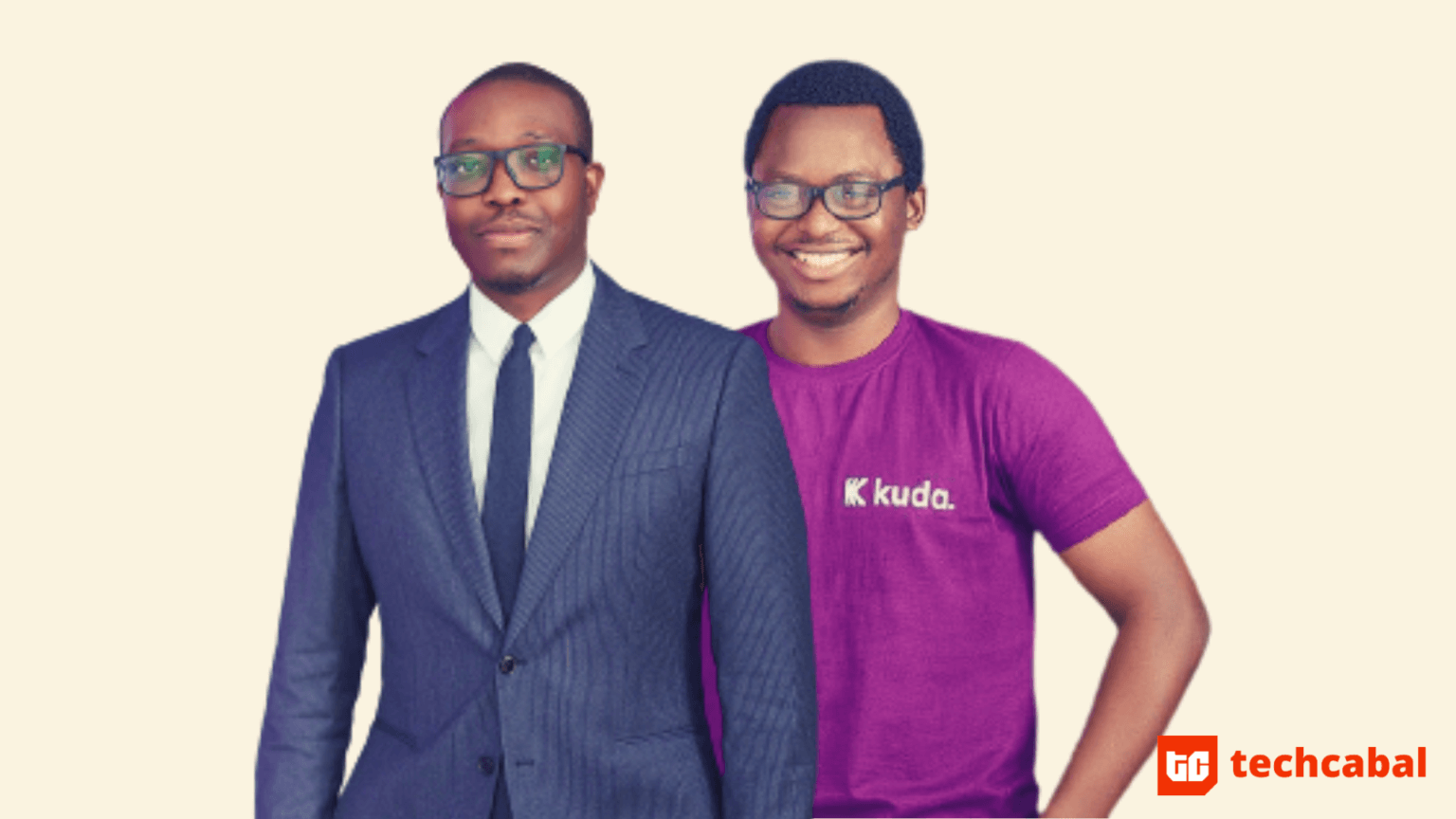

- Kuda Bank closes $55 million with half a billion valuation

- New appointments at Microsoft, MTN, IBM

- Ethiopia to reopen bidding for second telecoms licence

- Bolt raises $712 million as it expands

Kuda Bank closes $55 million Series B round led by Paypal backers

The week started on a bright note with the announcement that Nigerian fintech startup, Kuda Bank, raised $55 million in a Series B round at a valuation of $500 million.

The latest round was co-led by existing investors Target Global and Valar Ventures, the firm co-founded and backed by PayPal co-founder, Peter Thiel. SBI Investment and other previous angels also participated.

Wait, didn’t they just raise $25million four months ago?

Yes, they did.

One question that came to mind when I saw this news was: what did Kuda Bank do with the $25 million?

Possible answer: In the second quarter of 2021, Kuda disbursed $20 million worth of credit to over 200,000 qualified users, with a 30-day repayment period.

How are the loans performing? According to Ogundeyi, Kuda has seen “minimal” default because of its approach. “We use all the data we have for a customer and allocate the overdraft proportion based on the customer’s activities, aiming for it not to be a burden to repay,” he said.

Looking forward: Kuda plans to use the funds to build on its new services for Nigeria as well as prepare for a continental expansion. According to Co-founder and CEO Babs Ogundeyi, Kuda aims to build a new take on banking services for “every African on the planet.”

Read more: Kuda Bank closes $55 million Series B round led by Paypal backers

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

New appointments at Microsoft, MTN and IBM

We’re only a few days into the new month and these three companies have appointed new people in charge of different positions.

Microsoft: Ola Williams has been appointed as the new Country Manager for Microsoft Nigeria. She was previously the specialist sales leader working with the extended team and the company’s partner organizations to grow cloud revenue across enterprise customers. She takes over from Akin Banuso who is the Enterprise Commercial Lead for Middle East and Africa– Multi market region.

IBM: IBM has appointed Saad Toma as General Manager of IBM Middle East and Africa (MEA). He succeeds Takreem El-Tohamy, who has been appointed General Manager, Global Strategic Sales at IBM.

MTN: MTN Nigeria has made two appointments: Shoyinka Shodunkle as Chief Information Officer and Adia Sowho as Chief Marketing Officer.

Shodunkle joined MTN in 2001 and had worked with the telecom giant in different capacities across Africa until last year when he briefly left for Vodafone Ghana.

Sowho who happens to be the first Female CMO for MTN Nigeria, has worked at Deloitte, 9mobile (formerly Etisalat), Migo, and most recently Thrive Agric.

In other related news: CEO of Vodafone Ghana, Patricia Obo-Nai was recognised as the winner for the Telecoms category of Africa’s most respected CEOs.

How would you like to go on a financial ride with your favourite celebrity?

OctaFX is making that happen with engaging forex courses taken by your most-loved lifestyle and entertainment personalities. And it all leads to one place: mastery of forex trading and financial freedom.

Start the journey here.

Ethiopia plans to reopen bidding for second telecoms licence

Looks like MTN’s wish is about to be granted.

How?

Ethiopia has announced it will reopen bidding for the second telecoms licence. The good news here is that it has upgraded the licence to include a mobile money licence.

Remind me, how did we get here?

In May, we announced that Ethiopia’s telecoms licence was awarded to a consortium including Safaricom and the UK’s Vodafone. MTN lost out on the bid for the second license. It’s not clear why but we know that the winning team bid $850 million while MTN’s bid was $600m.

Why bid that low?

In the words of MTN Group CEO Ralph Mupita, “We were particularly focused on the lack of mobile money in the licencing regime, and there were some issues around how the telco constructs would be accommodated within Ethiopia. We certainly priced for those things and near-term risks that we saw, and we felt that the financial bid there was appropriate.”

Sounds like the absence of a Mobile Money licence affected their bid?

Yes, the Ethiopian telecom licence didn’t include a mobile money licence as state-owned Ethio Telecom recently launched a mobile money service called telebirr.

What’s next?

With the inclusion of a mobile money license in this bid, MTN which has earlier indicated that it’ll bid again, is a step closer to gaining entry into the Ethiopian market.

Join the Future Africa Collective – an exclusive community of investors who invest in startups building the future of Africa. With a $1,000 annual or a $300 quarterly subscription fee, you get access to invest a minimum of $2,500 in up to 20 fast-growing African startups each year. Learn More

Bolt raises €600 million ($712m) as it expands across Europe and Africa

Bolt, the ride-hailing and mobility startup, has raised €600 million ($712m) in a round that pushes its valuation to over €4 billion ($4.75b).

The Investors: Bolt secured investment from Sequoia, Tekne, and Ghisallo, alongside existing investors G Squared, D1 Capital, and Naya

How’s bolt doing: According to Bolt, it now has 75 million customers across the markets it is active in. It currently operates across 45 countries in Europe and Africa, offering ride-hailing services, car-sharing, and e-scooters. For Bolt the ultimate goal is to replace private cars. “Our mission is to replace the private car,” CEO and Founder Markus Villig said.

Similar to its rival Uber, it recently launched takeaway delivery division Bolt Food and Bolt Market, which allows customers to order groceries from home. Bolt appears to be fashioning itself as a ‘super app’ for transport and deliveries.

Big Picture: This round has given Bolt more firepower to expand across its different markets and verticals, even as it faces fierce competition from rivals like Uber, Glovo, and Deliveroo.

You probably didn’t know this, but in 2020, the number of times Nigerians searched for “data science’ on Google doubled that for ‘software engineering’.

Google trends show that this popularity began in 2019, and today more young people are looking in and out of the country for opportunities that can help them build the skills they need.

One of such opportunities is the Digital Explorers programme which is funded by the EU. Through the second cohort of the programme this year, 11 female data scientists have secured skills enhancement training and internship opportunities in Lithuania, one of the world’s fastest-growing ICT markets.

Upon completing the programme, participants will also be supported to get employment opportunities with Nigerian companies.

To learn more about the Digital Explorers programme, please visit the Digital Explorers website. Nigerian companies can also sign up for access to their talent pipeline. You can also contact blossom@venturesplatform.com for additional information.