Yesterday, you didn’t care which what colour the automatic teller machine you stuck your debit card into was.

But an announcement from the CBN which hit the presses this morning has changed all of that. Starting September 1, you will be mindful of what bank ATM you use, because withdrawing cash from a bank ATM that is not “your bank” will attract a N65 charge.

Of course those who live in Nigeria will recall that there used to be a N100 charge for using your debit card at a bank other than the one that issued it to you. These transactions are known as “remote-on-us”. The N100 charge for remote-on-us ATM transactions were split three ways. The acquiring bank, which is the owner of the ATM machine dispensing the cash got 35 percent. The issuing bank, or the bank whose card the cash is being drawn on got 35 percent. The switch (Interswitch) got the remaining 30 percent. Everyone was happy.

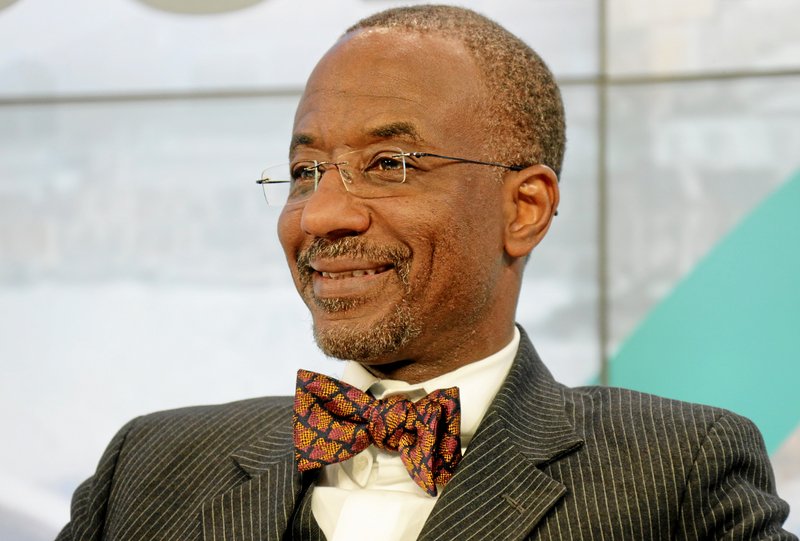

Then in 2012, the former CBN governor, Mr. Sanusi Lamido decided to relieve bank customers of the N100 charge. This was in a bid to encourage people to get used to the idea of electronic transactions, and the ability to use any ATM without incurring charges would definitely increase the uptake. In November, the CBN directive went into effect.

But the charges did not go away. The banks agreed that they would waive fees on the issuing side, leaving N65 that still had to be paid to the acquiring bank and the switch. Therefore, each time a customer made a withdrawal at an ATM other than their bank, it would be their own bank that would have to bear the N65 charge for that transaction. The acquiring bank and more importantly, the (Inter)switch never stopped making money off these transactions.

This led to an interesting outcome where banks became either net issuers or net acquirers, a concept that Akin Oyebode, head of SME at Stanbic IBTC explained to me over the phone this morning. The one a bank becomes depends on their customer to ATM deployment ratio. If a banks has lots of customers relative to the number of its own ATMs available for them to use, those customers would naturally find themselves withdrawing cash from other bank ATMs very often and racking up issuing costs for the bank.

On the other hand, banks that have lots of ATMs relative to their customers would not only incur less issuing costs (simply because there are more ATMs to go around) but will actually make lots of acquisition revenue from the customers of other banks who come to use their machines.

Akin explained it better on his Twitter feed thus.

The current ATM fee structure encourages terminal deployment since the card issuer subsidizes the transaction acquirer. Only banks crying are large card issuers who don’t have a commensurate acquiring (ATM) channel. Basically, if you have 5 million customers, you’re a big issuer, so you will pay other banks when your cards are used on their ATMs. That cost is balanced if you’re also a big acquirer i.e. you have lots of ATMs, since you’re paid when other cards are used on your ATMs.

I did not embed the tweets because Akin used the word “acquirer” in one place where he should have used “issuer”. Yes, my head is spinning too, the whole thing is very confusing.

The developments lend themselves to Akin’s logic that the banks who have unwittingly found themselves in the position of net issuers and are feeling the pinch are the ones raising a ruckus. One way to get out of that losing position would be to increase their ATM deployment capacity relative to their customer base, so they can balance out their costs. But that is a very unattractive proposition. Because the CBN doesn’t allow off site ATMs, a bank would need to create another branch just because they wanted to set up more ATM points, effectively negating the logic of the enterprise. With disruptive technology increasing affecting the financial system and regulatory pressure in form of cashless policies, No bank is gung-ho about increasing its physical footprint and/or opening branches.

Thus, the affected banks are taking the easy and arguably logical way out. Lobbying the CBN into reinstating the remote-on-us ATM withdrawal charge. Under the new arrangement, issuing banks still don’t get a cut. But at least, they have now succeeded in returning the N65 cost to the end users. According to the report by ThisDay, the charge doesn’t occur until the fourth remote-on-us ATM withdrawal effected by a user within a one month period.

Naturally, Nigerians are not happy, and this morning, Twitter lit up with their displeasure, to the point that #65 and other weird hashtags began to trend.

Re-introduction of ATM fee is exploitative. They gradually want to reverse policies introduced by the former CBN gov, Sanusi Lamido Sanusi.

— Y M Rigasa (@YMRigasa) August 14, 2014

The idea of removing the charge was to aid the cashless policy, decongest bank halls and reduce waiting times. Kiss those goodbye.

— Ikemesit Effiong (@JudgeIyke) August 14, 2014

Emefiele has been slowly undoing the reforms that SLS made. Problem is that his undoing has been to favour the banks. It's disgusting!

— Chxta (@Chxta) August 14, 2014

Well if you were delusional and hoped the new CBN governor wouldn't be too bank friendly the return of the ATM charge should cure you

— Naz Onuzo (@IamSnazz) August 14, 2014

I have been favoriting choice tweets of people reacting to the new policy. It’s an interesting mixture of anger, exasperation, conspiracy theories and invective.

A great deal of the ire seems to be directly aimed at the current CBN governor, Mr. Godwin Emefiele, who was picked by President Goodluck Jonathan to replace Mr. Sanusi Lamido Sanusi. The former CBN governor was suspended in March after becoming estranged from the Federal Government for his unsettling and vocal stand on the issue of large sums of money which he alleges to have been stolen from the public coffers.

Sanusi Lamido Sanusi, famous for his no-nonsense disposition, his brusque banking reforms, and lest we forget, his amazing bow-ties did not endear many to himself. As such not many tears were shed on account of his controversial exit from the very prominent role in Nigeria’s economy. But on the heels of the new developments, it seems that many wish he was still at the helm of the apex bank. The reinstatement of the transaction charges, many believe, is a step backward that could undo the progress the previous CBN administration had achieved in its bid to move Nigeria closer to cashless status. But perhaps even more troublesome is the fact that capricious policy that could be possibly influenced by vested industry interests is never a good sign from an independent and highly placed public body with a role as important to the longterm as the central bank’s.

One thing that hampers investment in alternative channels: too many inconsistent policies.

— Akin Oyebode (@AO1379) August 14, 2014

In some quarters, the conversation has turned towards bringing Sanusi Lamido Sanusi back. Even if they were being serious, this is not a very practical course of action in the circumstances. Regardless of if you accommodated for a change of heart by a taciturn Goodluck Jonathan administration, in June Mr. Sanusi became His Royal Highness, Emir of Kano, ruling out the possibility altogether.

For the foreseeable future, Nigeria is stuck with Mr. Godwin Emefiele and his apparently bank friendly disposition. Perhaps if they ask loudly enough, he will return their N65. For the takers and givers, when it all adds up, N65 is a big deal.