Given that Rocket Internet is now a listed company, they now have to publicly disclose their numbers. And we now have the first one.

As Rocket owns Jumia, there is of course no better proxy of the Nigerian e-commerce space at the moment given that the other major players are not compelled to disclose their numbers.

There is a slight wrinkle to the numbers though – this year, Jumia has expanded to Uganda, Cameroun and Ghana. Rocket does not disclose the numbers for each country separately so we have to use some kind of educated guess as to the share of Jumia that comes from Nigeria. So what do we go with? 80%? Let’s be a bit more conservative and say Nigeria represents 75% of the numbers attributed to Jumia in the results. This is just a guess by the way so feel free to disagree with it.

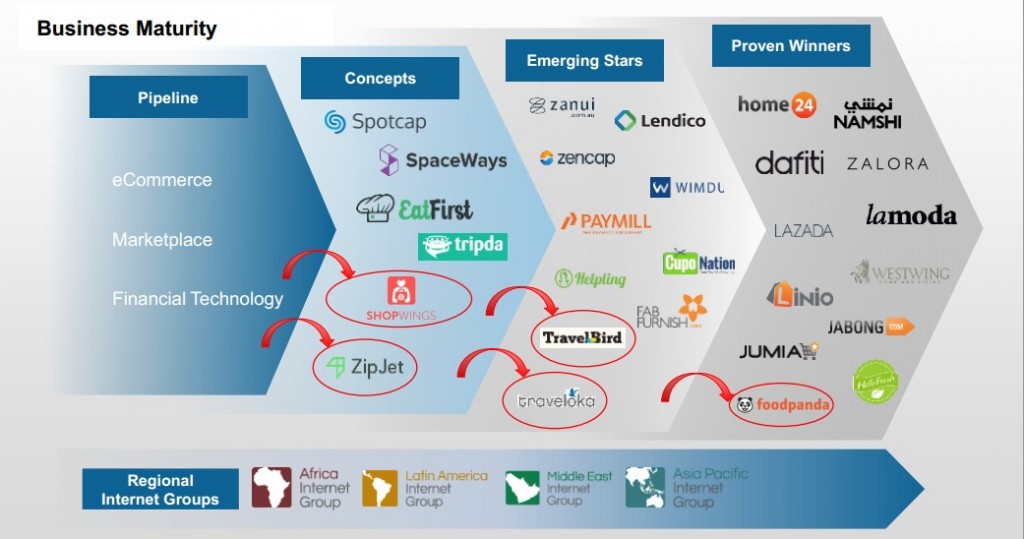

- Rocket has a select group of 12 ‘proven winners’ out of its portfolio of companies. I imagine the term ‘winners’ is used loosely here as none of them is making money at the net profit level (yet). Nevertheless, Jumia is one of the dozen stars as the chart above shows. I suspect what this means is that Jumia, along with the other winners, is now generating enough cash to be quite useful to Rocket. The company has committed to starting 10 new businesses a year, an expensive endeavour, ergo; it will be extracting cash from these dozen winners to do that (along with funding from investors and the IPO proceeds of course).

- Of the 12 proven winners on Rocket’s list, Jumia comes in at 10th position in terms of Half Year 2014 revenues (€20.8m). Only Namshi and Foodpanda had lower revenues than Jumia of the 12.

- In the whole of 2013, Jumia had €29m in revenues. Halfway through this year, it has notched up €21m in revenues. So assuming a neat run rate which makes it end the year with €42m in revenues, it would have grown 45% this year compared to last year. The reality wont be that straightforward of course especially as it has so far managed 430,000 transactions this year, an increase of 150% compared to last year.

- Jumia’s gross profits are 13%, that is to say, every N100 product it sells costs it N87. Most people will take this kind of margin but the trouble begins when it has to pay salaries and cost of diesel etc. Having pulled in €21m in revenues (of which €2.8m was gross profit), it then spent €29m to keep the business running. In the end, it finished with a loss of €26m for the half year, before accounting for interest on any loans, depreciation and taxes (EBITDA).

- The company reports anyone who has made at least one (successful) transaction as a ‘customer’. People who buy and then return products are not counted as such. Based on this definition, it has had 360,000 customers so far (most likely since its inception). Jumia further defines ‘active customers’ as people who have made at least one transaction in the last 12 months before the end of the period. Therefore, anyone who bought anything from Jumia between 1st July 2013 and June 30th 2014 is an active customer. The number of active customers it reports based on this definition is 270,000. In other words, 90,000 people have bought something from Jumia in the past and have not returned to the site in the last 12 months.

- The company has got a fair bit of cash on hand – as at the end of June, it had €6.9m in the bank. It also had €5.9m of working capital at the end of the period. Of that amount, €4.6m is made up goods it has in stock that it has not yet sold. It is owed €10.9m while it owes €9.7m. Netting off those two balances, gives us the rest of the working capital above.

- Jumia is 27% owned by Rocket – the company based in Germany, which produced this report. However this is not to be taken at face value, as it owns a further 17% of the company through Africa Internet Group.The best breakdown of Jumia’s numbers will thus be found in AIG’s accounts but that is unlikely to be made public anytime soon as far as I can tell.

- So far this year, it has spent €1m on capital expenditure i.e. 5% of sales. In the whole of 2013, it spent €1.2m on capex so it will almost certainly end the year with a higher spend, all things being equal.

What then to make of all of this?

This is a tough business that is not for the faint of heart. And it should be sobering to people who like to talk up Nigeria’s ‘huge market’. To be sure, there is a market there (somewhere) but getting that market to deliver useful revenues and profits is a herculean task indeed. In its 2 years of existence, only 360,000 people have bought something from the website. Is this the extent of the market? Most certainly not, but in a country of 170 million people with terrible infrastructure (and traffic), more people should have been buying stuff online. The appeal of shopping on the internet is not just there yet despite more and more Nigerians coming online everyday.

The results make it clear what Rocket plans for Jumia – it is going to move away from a consignment model to a marketplace. When you look at the numbers for unsold inventory and working capital, it is not hard to understand why. When Amazon started selling books in Jeff Bezos garage, it didn’t keep much stock given that when people made an order, it could quickly fulfil it by linking directly to the publisher. This is not possible in Nigeria given that almost everything Jumia sells is made abroad. This is a huge fixed cost on businesses like Jumia – you must hold physical stock which you have paid for.

So instead, Jumia wants you to sell your stuff on its platform while it provides delivery and logistics services for you so that it does not have to hold any stock. There really is no other way to turn a profit on a business like this. €26m in losses in 6 months in Nigeria, is a frightening prospect. With so much instability and uncertainty with coming elections, no one is guaranteed to make a return.

I suppose you can tell how confident a company is about the future by how much it dedicates to capital spending. Amazon is spending $1bn this year on its cloud business alone. So what does Rocket’s spending of €1m on capex so far this year tell us? Moderation. To be fair, this is a Rocket theme across its businesses but the reality is that it is not building warehouses or fulfilment centres across the country in a mad rush to claim the profits of the future.

And now for a bit of trolling.

On any given day, you can find a rant in the Nigerian tech media space about how Rocket is awful for Nigeria and how all their assets should be appropriated and redistributed among Nigerians. Some even quote Churchill while at it. And yet, here is the reality – there is not much fun in this. It is hard work and I don’t know many people who would do it.

Some day in the future, online shopping will explode in Nigeria (Amen) but given that Rocket itself does not seem to believe in that future, they might not eat out of the food they are currently helping to cook. Rather than whining and complaining about how these bloody foreigners are gobbling up the market space, it strikes me that we should pray that they hang around for as long as possible until when this type of business will be less terrifying to attempt.