IN PARTNERSHIP WITH

Good morning 🌞

TechCabal’s latest newsletter, TC Weekender, launches this Saturday.

Keeping up with a daily newsletter can be hard. We’ve all got lives to lead, hearts that need breaking, tweets to tweet, and work to procrastinate on.

But what if you could still keep up with all the African tech news you missed during the week? That’s what Weekender is.

The weekly newsletter will bring you concise recaps of everything you missed during the week. That’s it.

Cut through the noise. Sign up to receive TC Weekender every Saturday by 9 AM (WAT).

In today’s edition

- Solving Africa’s $4 billion cybersecurity threats

- YouTube Go is going away

- TC Insights: Africa’s open banking potential

- Event: Cyber Africa Forum 2022

- Job opportunities

SOLVING AFRICA’S $4 BILLION CYBERSECURITY THREATS

As African businesses grow in number and reach, the importance of cybersecurity in Africa must be reiterated. More Africans are coming online, increasing the continent’s contribution to the global economy, and everyone from businesses to governments and individuals must learn to protect their data and digital sovereignty.

Globally, businesses lose about $1 trillion per annum to cybercrime. From ransomware attacks and phishing scams, to cryptojacking and malware, cybersecurity threats are on the rise as the world moves to become a “global village”.

African countries are often erroneously tagged as the countries where most cybercrimes originate from, but this has consistently been proven false. China, Russia, Brazil, India, and the United States have repeatedly topped the charts, and only 1 African country—Nigeria—has frequently made some of these lists.

Although many African countries might not have the largest cybersecurity threats, they are still at risk of cyberattacks. Interpol’s Africa Cyberthreat Assessment Report states that over 90% of businesses on the continent are operating without the necessary cyber security protocols in place. In 2021, cybercrime reduced GDPs across Africa by 10%, resulting in a $4 billion loss. The top 5 cyber threats are online scams, digital extortion, business email compromise or BECs, ransomware, and botnets, and most were distributed through emails. Over 679 million cybercrime-related emails were detected last year alone—with 219 million of this emanating from South Africa.

As these threats grow, so do the development of cybersecurity organisations like Ciberobs, an Ivorian cybersecurity firm providing analysis, information, and tools for governments and businesses. Ciberobs also hosts an annual cybersecurity conference—Cyber Africa Forum (CAF)—where decision-makers across sectors gather to highlight the cyber threats facing Africa, and how to address them.

Last week, we held a conversation with Franck Kie on how this $4 billion cybersecurity issue can be solved.

Read it in Can conversations at Cyber Africa Forum help solve Africa’s $4 billion cybersecurity threats?

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

YOUTUBE GO IS GOING AWAY

The stripped-down version of YouTube, YouTube Go will be taken off the Play Store as it seems to have served its purpose. YouTube Go is one of several lightweight versions of Google’s services. Others—including Google Go, Maps Go, Gallery Go, Google Assistant Go, etc.—were designed for low-end smartphones that have low hardware specifications and constrained connectivity. They were majorly used in emerging markets.

Emerging markets like India and Africa account for over 80% of mobile phone usage so Google made a laudable business move, introducing Youtube Go to India in 2016 and to African countries like Kenya, South Africa, Zimbabwe, Tanzania, Ghana and Senegal, a year later. The app expanded to other countries soon after.

Why Youtube Go is saying goodbye

This farewell has obviously been in the works for a while because though the lightweight app has been installed more than over 500 million times, Google last updated it 5 months ago. The app is no longer available for download except for those who already have it. It will shut down for good in August.

This is because the standard YouTube app has improved. Google says it has optimised the performance of the main YouTube app to support low-end phones and slow network connections. It also features options to comment, post videos, create content, and use the dark theme as key features of the app, which were not available in its lighter version.

Will other Go applications go away too?

It remains to be seen what this new update by Google means for other Android Go versions and apps.

Google has rolled out Android 8 Oreo Go Edition, Android 9 Pie Go Edition, Android 10 Go Edition, Android 11 Go Edition, and Android 12 Go Edition. Will we see the Android 13 Go Edition launch later this year, or will the optimised version of the other apps roll out and their Go versions discontinued?

Are you a developer, designer, product manager, or a tech professional building payment products?

Join Fincra Hub, a community of skilled techies where you can get resources to build reliable financial products, connect with techies from all over Africa, get firsthand information about job openings at Fincra and its partners, and get exclusive event invites and more.

This is partner content.

TC INSIGHTS: AFRICA’S OPEN BANKING POTENTIAL

Across Africa, the adoption of digital financial services has grown at a dramatic rate. Banks, fintechs, and non-traditional financial service companies have been pivotal to this switch.

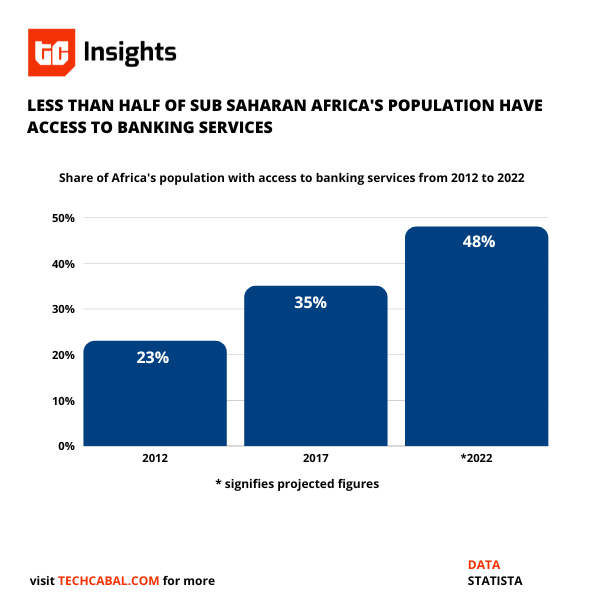

Investments have followed suit, with fintechs taking a lion’s share of VC funding year-on-year. Indeed, the potential remains enormous for Africa, being one of the regions globally that has suffered from limited access to financial services. For instance, data from Statista reveals that only 48% of Africans will have access to banking services by 2022. This presents a significant growth opportunity for fintechs across the continent.

To unlock this, it is crucial for banks and fintechs to embrace open banking. Open banking provides third-party financial service providers open access to consumer banking, transaction, and other financial data through application programming interfaces (APIs).

As an open-source technology, it allows third-party developers, such as fintechs, to access data held by banks and to develop applications or services based on such data. This seamless connection of data enables customers to access products best suited to their needs thereby helping to lower costs, facilitate customers’ onboarding process as well as stimulate innovation and inclusion.

“Currently, Africa isn’t doing as great as it should. Only a few jurisdictions (Nigeria, Kenya, Rwanda) are driving their (open banking) rollout, and even at that, things are pretty slow,” Adedeji Olowe, a Trustee at Open Banking Nigeria, shared in a text with TechCabal.

“The major obstacle is the lack of urgency by regulators and larger stakeholders protecting their tuffs. The Nigeria Data Protection Regulation of 2019 is modelled on the Global Data Protection Regulation yet, it is hardly enforced by anyone despite the constant breach of data privacy by tech and non-tech companies in Nigeria. Without a decent level of enforcement, open banking may also open up customers to abuse,” he further shared.

Open banking provides an opportunity for financial services to grow in Africa and this growth could drive real economic benefits for the majority of Africans. In the short term, open banking would drive financial accessibility and could improve access to credit facilities provided regulatory enforcement is ensured.

You can download all our reports here and watch videos from our events. Send your custom research requests here.

Pocket up to $50 when your friend makes their first trade!

Follow these easy steps:

- Login to your Trove app, Get your referral link.

- Get your friends to sign up using your link.

- Get up to $50 when they place their first trade.

Download the Trove App and start referring.

This is partner content.

EVENT: CYBER AFRICA FORUM 2022

The second edition of Cyber Africa Forum—organised by Ciberops—is set to take place in Abidjan, Côte d’Ivoire, on the 9th and 10th of May, 2022.

The theme of this edition will be “Digital sovereignty and data protection” and the programme will examine the cybersecurity risks facing African companies as they digitalise their practices.

Eighty decision-makers from 25 countries will be speaking at the event including Léon Juste Ibombo, Minister of Telecommunications for Congo; Desire-Cashmir Kolongele Eberande, Minister of Digital for the Democratic Republic of Congo; Lydie Ngo Nogol, Chief Information Security Officer for Francophone SSA at PwC; and Jean-Louis Menann-Kouame, CEO of Orange Bank Africa.

The programme will host 23 conversations on cybersecurity spanning topics like cybersecurity and governance, data protection, and digital sovereignty as well as a hackathon that includes a Catch the Flag game.

JOB OPPORTUNITIES

Every week, we share job opportunities in the African ecosystem.

- TechCabal – Editor-in-Chief, Journalists – Lagos, Nigeria

- M-KOPA – Head of Design, Senior Product Manager – Africa

- Paystack – Business Lead, Head of Finance, Expansion Product Manager – Various Locations

- Big Cabal Media – Head of Events, Associate Art Director, Associate Video Editor – Lagos, Nigeria

- Seamfix – Product Designer – Lagos, Nigeria

There are more opportunities here. If you’d like to share a job opening or an opportunity, please fill this form.

What else we’re reading

- Power and Turaco partner to provide affordable insurance for gig workers across Africa.

- Whistleblowers claim Facebook’s chaotic Australia news ban was a negotiating tactic.

- Elon Musk thinks he can double Twitter’s revenue through subscriptions alone.

- Funding is slowing down, and layoffs are ramping up. Should African startups be concerned?