The internet enables the free flow of information, which enables transparency and informs decision making. In the context of retail ecommerce, buying decisions. If Konga and Jumia stock the same item, buyers will naturally compare prices.

PriceCheck has been only player doing online price comparison in Nigeria. Till now, that is. The South African MIH held consumer internet platform will be joined shortly in the game by PricePadi, a new comparison site that launches officially on the 1st of September.

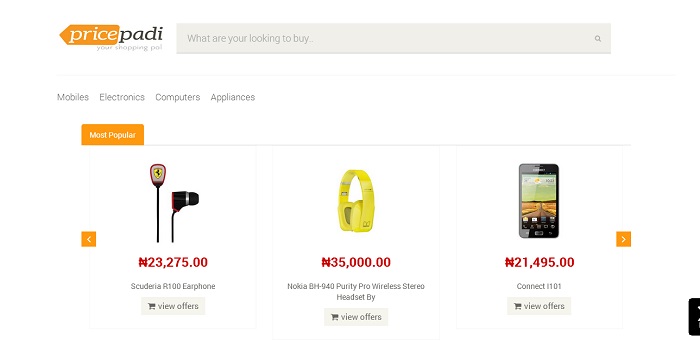

The newcomer is making its debut with a limited feature set. Supported categories are are mobile devices, computers and other electronics. Appliances (?) and cars are coming soon. Current offerings are available from just three merchants — Jumia, Konga and RegalBuyer.

On the business side, PricePadi looks to be employing the standard affiliate link/commision model that makes money on clicks and conversions. The site also plans to offer display advertising from day one.

In its current iteration, PricePadi won’t be making that much of a splash. Should PriceCheck be concerned? Not right away. Casting the newcomer as head to head competition would be a stretch. PriceCheck has a near two-year headstart in Nigeria since its late 2012 soft launch, has released native apps across most mobile platforms, offers listings from dozens of merchants online and even offline.

But if I were PriceCheck, I would keep close tabs on PricePadi still. Mostly because of its creator. Oduntan Odunbanjo, 30, co-founded Twinpine, a mobile display advertising network in 2011. In April 2014, he left to found Iconway media, the holding company for the new price comparison product. Before Twinpine, Oduntan had brief stints at MTECH communications and Google.

Considering where Nigerian retail ecommerce is in 2014, it makes sense to do this right now. Timing is in fact critical. Even though Nigerian ecommerce has been an obvious hit since 2011, it’s taken a while to get to the point in its evolution where the substrate can support derivative business models at scale — logistics as a service, gift card and loyalty schemes, marketplaces, price comparison engines would not exist without the first wave of giant ecommerce plays with broad retail offerings as well as the second-wave niche ecommerce websites that cater to narrow but deep consumer segments.

By its nature, price comparison is a hyperlocal business, one whose viability is directly proportional to the robustness of local ecommerce industry. In plain terms, price comparison only works when there are enough (online) merchants who deal in similar goods. If the merchant pool is too small, there would be too few things to compare, and the model breaks down, as some early explorers found out the hard way. PriceCheck has been around since 2012 and is here still because it can afford to.

I believe that PricePadi is only one of the first of many, not just in the third wave of Nigerian retail ecommerce, but specifically on the price comparison front. I expect that more price comparison websites will emerge before the year is out.

Photo Credit: TheBusyBrain via Compfight cc