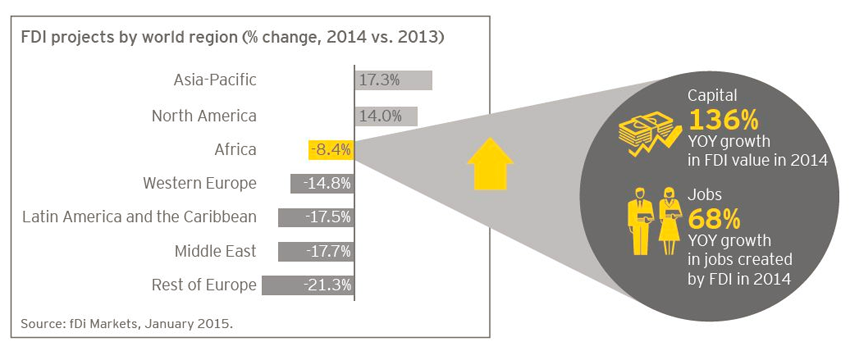

Capital investment in African is at an all time high with up to 136% year-on-year increase, according to the 2015 Ernst and Young’s Africa Attractiveness Survey.

Despite a general shortfall of 8.4% in foreign direct investment projects, the report says that capital investment into Africa rose to $128 billion with average investment per project rising to $174.5 million from $67.8 million in 2013.

There was a general lull in FDI projects reported worldwide with only Asia-Pacific and North America recording an increase in FDI projects.

The capital investment number of $128 billion outshot initial projections of $80 billion, but investor’s perception of Africa as a secure investment concern has slipped. Political risk factors, such as instability and corruption, remain the main barriers that discourage investment in Africa, the report says.

The survey also reported a 68% increase in the jobs created by Foreign direct investments in 2014 in Africa.

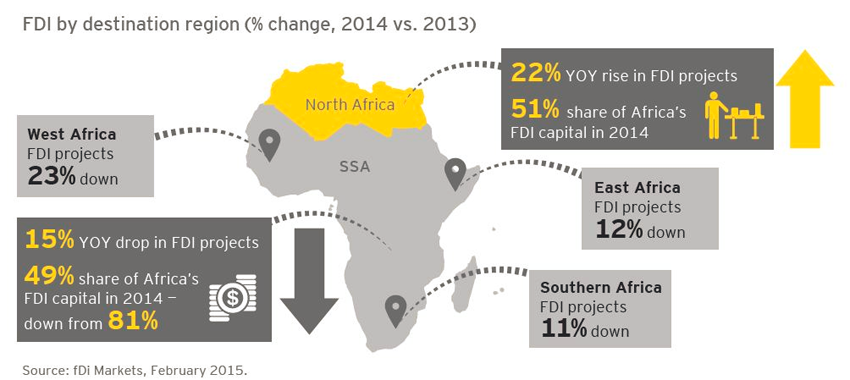

“North Africa received the highest number of FDI projects and capital. Political uncertainty following the Arab Spring in 2011 is beginning to fade, and North Africa is becoming more attractive as an investment destination. FDI investors returned enthusiastically to Egypt and Morocco,” – the report.

The region received 22% YOY rise in FDI projects and 51% of FDI capital in the survey period. About 52, 000 jobs were created in Egypt alone.

On the other end, the economies of South Africa, Angola, Nigeria, Ghana and Kenya, received fewer FDI projects

The report highlighted shared value, entrepreneurship, regional integration, infrastructure development and partnerships as structural transformation drivers that will engender sustainable growth in the region.

Photo Credit: UNAMID Photo via Compfight cc