Flagship killers, as a concept, grew from an earlier development of a batch of smartphones that were expected to put an end to the blazing market lead the revolutionary Apple iPhone had. At that point they were tagged “iPhone Killers”, they ended up being anything but. The iPhone had the first mover advantage, had patented most of the smartphone design language and predominated mobile tech. It was, in fact, in a class all by itself.

Most of that advantage would peter off when a worthy challenger in the Android ecosystem – Samsung – stepped up. Shedding its mediocre beginning and entering a long term project of smartphone-market domination, it aped the iPhone dress sense, cloned some of Apple’s user experience and encased Android with their in-house interface called TouchWiz. Then, they sold it cheaper than Apple’s offerings. Those who wanted an alternative with more openness than the iPhone found one.

Android rode on this popularity to gain traction in the battle for supremacy in mobile tech. Apple wasn’t about to let that happen without a fight. Litigations after litigations brought the duels to the courthouses. To survive, Original Equipment Manufacturers (OEMs) of Android devices were forced to differentiate themselves, in hardware and software, from everything Apple.

As always, Samsung led that drive. It increased its screen sizes and threw in all sorts of bells and whistles it felt would sway buyers its way. From sensors that tracked eyeballs to keep the screen awake while the eyes remained on it to heart-rate monitors, whatever they could think of, they jammed into devices that were constantly increasing in size. Then, they became the “Toyota” of smartphones, furnishing buyers with smartphones for all pocket sizes.

Samsung had come of age. It had become an OEM with a flagship that others had to battle. That others had to kill. The Android competition took notice, and borrowing pages from Samsung’s playbook, began to develop “flagship killers” to dethrone flagships from Samsung and from Apple.

It wasn’t long before the world then added the word “phablet” to it’s lexicon as a result. It referred to smartphones that were too big to be called phones but not big enough to be called tablets. These devices were between a “phone” and a “tablet” hence the new classification “phablet”.

The buyer-hunger for ever bigger screens was an eye opener for OEMs. Apple however resisted the urge claiming a lot of thought and research for one-handed use of touchscreen phones went into its decision to use the screen size it preferred. Larger phones made the iPhone appear toyish but Apple was obdurate.

Samsung continued to give Apple a run for its money. BlackBerry slowly dying. Windows phones looking like relics. The dregs left for the others to contend with.

Phone components became more available and affordable. The tech finally caught up and hardware improved enough to match the processing demands of the software. With its Open Source model, Android grew in leaps and bounds and in some instances overtook Apple in functionality. Apple made do with consistency and premium quality but there came to be a plateauing of growth in what could be offered. It got to the point where the competition was just how to better, in slight incremental proportions, what was already on offer.

Concurrently, Android’s conditional free OS allowed inexpensive but less-powered devices from Asian OEMs to flood the middle- and lower-income earning market. Those poorly executed products conspired to give the platform a bad reputation with many concluding that Android as a whole was a terrible OS to be involved with. Among other considerations, this led Google to place emphasis on standards and engineer Android to work as efficiently on the low-end phones as it did with flagships.

This move triggered the possibility of smartphones priced at under $50, and coupled with component-availability and affordability, it began the time when not only the flagships shipped with quality and efficient components. It was then that flagships began their death march.

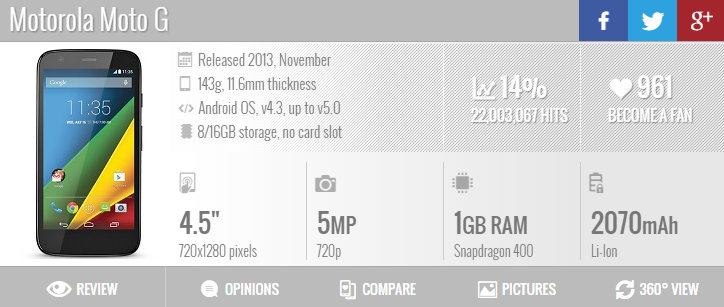

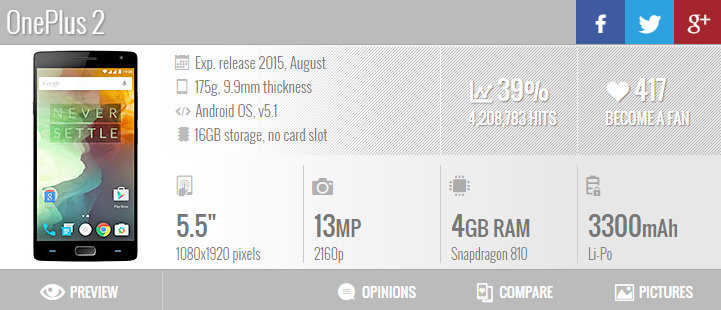

Two devices have “appeared” with enough gravitas to stake their holding to that promise; the OnePlus 2, and The Moto G. Their quality (which ooze from every pore), the premium-ness, their functionalities, the possibility of personally customizing both, their specs, their differentiation and their low-end pricing for all the mobile-tech punch they pack, make them prime candidates.

Read on these two, then, ask yourself why anyone will spend over a 100k for a flagship when these devices are available at these price points and with these specs? That question, in its very essence is what happens when a true flagship killer is born and experienced for the first time.

For the most part, ignorance plays more than a pivotal role in the continued dominance of a flagship. Those who break their banks for flagships do so from a deep lack of the knowledge of the existence of comparative and inexpensive alternatives. Obviously, there remains the caste who do so, willingly or otherwise, for the class symbol these flagships carry. Definitely. However, knowledge is a defining characteristic in the emerging death of mobile flagship.

Will this emergence hurt Apple’s flagship? The jury is still out on that for now. But, can it force Apple to alter anything? Maybe.

Apple won’t change their business model for anyone’s sentiment. They have become the most valuable company today as a result. It’s simple – control the design process and make it premium; control the software and optimise it to the fullest since you also design the hardware; control the pricing and the merchandising since you make both hardware and software; sell at a premium because you control hardware, software and merchandising, all and because you define a status and symbolise class.

With so much power and a compelling catalogue of premium products, you call the shots and no other competing manufacturer can make you sneeze or catch a cold with their attractive device releases. Mostly.

Although Android development has altered some Apple standards going forward like making phones with bigger screens and allowing permissions for some third-party applications that are favourite for smartphone users, Apple remains a stubbornly selfish yet veritable force in mobile tech. And it works for them that way. It doesn’t work for their business model to sell cheap. Their iPhone C, which was supposed to designed as cheaper alternative for those who couldn’t afford the flagship model, flopped spectacularly. I doubt they’d try it again.

Yet, this mobile tech market isn’t entirely predictable. If clamshell phones (what we call flip phones) are making a comeback in 2015, who am I to speculate that Apple wouldn’t do another cheap device tomorrow? After all, pressure from Android sales forced Apple’s hand and made them enter the mini tablet market though their late visionary founder, Steve Jobs, had earlier labeled that genre of mobile devices dead on arrival.

Who knows? But, there is this certainty; the flagship killers will never be out of job as far as flagships exist.

Editor’s note: Jude Obafemi is a Business Development Executive with Eminent Communications. Connect with him on linkedin.

Photo Credit: Caro’s Lines via Compfight cc