As at the time of this writing, Cape Town-based media and internet group, Naspers, is Africa’s biggest publicly traded company by market value – at around $ 65 billion. So it must be doing a whole lot of things right.

In Nigeria though, the company seem to have been swinging and missing royally since it started investing in the country’s internet and e-commerce space.

So far, Naspers has made more than half a dozen investment dabbles in Nigerian internet startup scene. Of those, only the ecommerce website, Konga is performing satisfactorily. (We are not including Naspers’ runaway success with DSTv because the focus of this article is on internet and technology startups).

Despite these misses, Naspers is not looking to let go on Nigeria just yet. If anything, it is doubling down. The company’s development spending for the coming year was bumped by up to 33% to $11 billion, according to a Bloomberg report – a huge chunk of which will go into Nigeria, India, South Africa, Brazil and Turkey. These are countries that Naspers CEO, Bob van Dijk said feature high in the company’s development and merger and acquisition spend.

More Naspers investment will unfalteringly be streaming into Nigeria soon, but for now, here is a brief history of Naspers’ investments in Nigeria, as of July 2015.

1: Konga

Konga is the Nigerian general merchandize e-tailer that began operations in 2012. Naspers participated in Konga’s $10 million seed round in early 2013 and followed on in Konga’s $25 million series B in December 2013. In October 2014, Naspers led Konga’s series C that was reported at around over $40 million. Konga is still running and giving local Rocket-funded competitor, Jumia, a tough day in the park.

Status: Thriving

2: Kalahari

Kalahari – fully owned by Naspers – was a model of US-based Amazon; selling books, DVD and stuff, but it never quite picked up Nigeria when it was introduced in 2010. Naspers shuttered the service in Nigerian in late 2011.

Status: Dead

3: Mocality

Mocality, the online business directory came to Nigeria in September of 2011 and was shuttered in February 2013 for never quite getting the expected girth of uptake. Naspers owned 100 percent stake in Mocality.

Status: Dead

4: Dealfish

Dealfish Nigeria was scuppered in 2012 and collapsed into OLX, which at the time was the largest catalogue of classifieds ad in the world. Naspers owned 71 percent stake in Dealfish.

Status: Dead

5: PriceCheck

Talks about Naspers launching PriceCheck, its price comparison website began to surface in Nigeria in 2011. By Q4 2012, the site was already up.

PriceCheck is still operating in Nigeria but very little has been heard in terms of growth from the startup.

Status: Middling

6: OLX

OLX was launched in Nigeria in 2012. Naspers owned a 81% majority stake in OLX as at July 2012. The startup recently acquired a local competition, Tradestable. OLX’s performance in Nigeria is not in top form, certainly not as much as Naspers imagined when it folded Dealfish into the company in 2012.

Status: Middling

7: BitX

The lucky number seven, BitX is a bitcoin startup, and is Naspers’ latest investment portfolio in Nigeria. With $4 million in the bank, BitX seems off to a good start. It’s too early to call how the startup will perform. Current bitcoin players in Nigeria haven’t made much in terms of traction, from what we can see. This could mean a number of things, 1) Nigerians are not digging bitcoin or 2) Current players are going about it wrong. Either way, BitX has its work cut out it and locking down bitcoin here could be a big win for Naspers … finally?

Status: Off to a good start

From its track record, Naspers doesn’t appear to care much for investment portfolios that don’t have good numbers and it’s very likely Naspers may be cutting off support to some of these companies with middling performances as well.

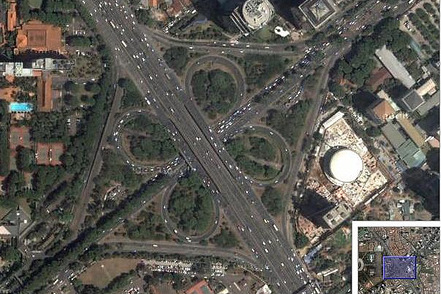

Photo: map-semanggi via compfight cc