It’s not everyday that a Nigerian tech company is in the national mainstream press, but one is currently getting all the attention, albeit, in an unflattering corner.

Remita, a payments platform owned by SystemSpecs, a Lagos-based Fintech company is presently at the center of what is building up to be a national inquiry into the Nigerian Treasury Single Account (TSA) which it manages along with the Central Bank of Nigeria and commercial banks in the country.

The TSA is a consolidated account domiciled with (and managed by) the Central Bank to pool the government’s revenue – tax, fines and charges from Federal Ministries, Departments and Agencies (MDAs).

The goal is to avoid misapplication of public funds. And it is also an interpretation of the section 80 (1) of the Nigerian 1999 constitution that stipulates that all government revenue be remitted into a single account.

Where Remita comes in, we hear, is in making final same-day remittance of funds from commercial banks, to the CBN consolidated account – the TSA.

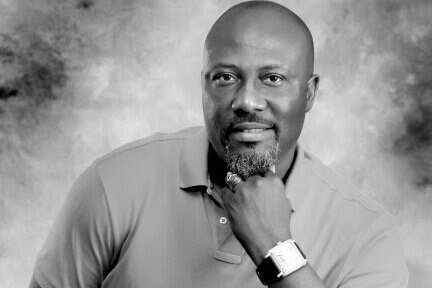

Agitations for the investigation of Remita began when a member of the country’s Senate, Dino Melaye, accused the business of making N25 billion ($125,615) per month in revenue as transaction charges on the transfers via its platform. At the session, the Senate approved an investigation into the claims.

Remita charges a 1% processing fee on the total amount moved on its platform. The senator also contested the legality of Remita as a platform to collect funds on behalf of the federal government. Mr. Melaye argued that the CBN Act and the Banks & Other Financial Institutions Act of 2007, precludes Remita from performing this function, since it is not a bank.

However, in a letter to the Nigerian president, Remita’s CEO, John Obaro dismissed the N25 billion yearly revenue quoted by Dino Melaye.

“It is grossly exaggerated.” Mr. Obaro told Premium Times. “We are talking of one per cent. What is one per cent of the money? Have we collected up to a trillion? That is a completely misleading information. Even at the beginning of the TSA the estimation of all the movement of federal government funds into the account is N1.2 trillion,”

It’s instructive to note that the 1% also isn’t only payable to Remita. According to the TSA agreement, the fee is shared between Remita, commercial banks and the CBN.

“A tariff of 1% of the funds collected shall be charged for the government revenue collections: i. Platform Owner/SystemSpecs: 50%, ii. Collecting Agents/DMBs (banks): 40%, iii. Introducer? CBN: 10%,” the agreement, quoted in Premium Times, reads.

Before Mr. Melaye raised the motion to investigate the company last week, the company had reportedly paid its share of the commission – around N3.5 billion – back to the CBN after a letter from the Apex bank directing the company to “refund all charges (1% cost of collection) made into the MDAs accounts as a result of the implementation of the TSA.”

Obaro said in the Premium Times report that the purpose of the move by the central bank was to allow parties involved renegotiate the terms of the contract.

Observers have questioned Dino Melaye’s motives behind calling for an investigation of the TSA process and many have also accused him of little rigour in researching the veracity of his claims.

There is also a strong political undercurrent to the story. While some believe this is an attempt to smear the anti-corruption stance of the current administration, some hold the opinion that Remita and its fees are a rehash of a similar widely reported (but largely ignored) racket in Lagos where a senior member (and renowned financier/influencer) of the ruling APC, Bola Tinubu, was reported to have mooched off of the state’s revenue via a shadow company, Alpha Beta.

The firm has denied any affiliations with Mr. Tinubu.

Despite evidence invalidating Mr. Melaye’s position on the amount of money collected by Remita as processing fee, Melaye says he maintains his position still.

I stand by my motion. I have exchange of letters between CBN and REMITA. Nigerians should wait for the result of investigations by d senate.

— Senator Dino Melaye. (SDM) (@_dinomelaye) November 13, 2015

This is a developing story…

Image via: PeaceBenWilliamsBlog