Mobile technology is a double-edged sword. Surely, the convenience of having a smartphone/tablet – with which you can (instantly) buy almost anything on earth – has to have telling consequences on the debit column of your financial ledger.

I’m a victim, myself. I did a quick calculation, and asides from other eCommerce purchases, I’m spending around $160 per month, on online subscriptions – half of which I don’t use that often.

From Dropbox, to Apple Music, to Deezer, to Soundcloud, to Google Apps for Work, etc. I also found that I spend inordinate amounts of money on airtime now, that I no longer have to take cash and walk round, looking for a vendor.

Tragic part is, I’m definitely not alone. Millennials are generally terrible money managers.

Anyhoo, I found Piggybank.ng, and they promise to help remove the self-control element to our spending problem. They will “automate the process of saving tiny amounts, daily, weekly, or monthly”, and keep your money for three month spells.

During that period, they can do god-knows-what with it, and if you try to withdraw before the predetermined withdrawal interval you will get charged a 5-percent penalty (damn). Obviously, the reasoning behind such a steep penalty, is to…encourage you to leave the money untouched, until your savings target is reached.

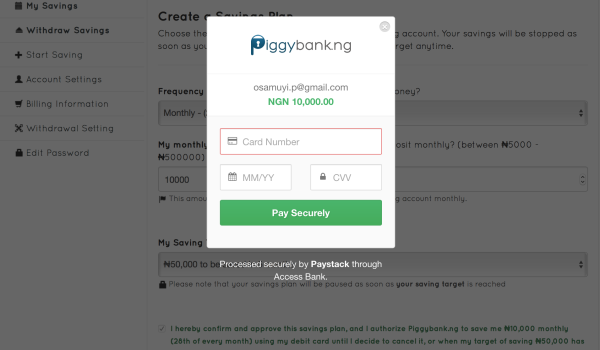

I’ve signed up already (I need epp), and after a quick phone verification, I was able to create a savings plan – set a deposit frequency, deposit amount and savings target, and that was it.

Acorn, Digit.co, Level Money, and Mint are some Silicon Valley-built analogues, to this service. Piggybank isn’t the first Nigerian company to try to move into this space though; Save & Buy – though with a slightly different value proposition – launched at DEMO Africa in 2013. And they had one problem – payments. Online payments in Nigeria is a clusterfuck, and is the cause of many-a-headache for end users and merchants alike. Piggybank won’t have that problem though, because their debit layer is built on Paystack, and Paystack supports recurring billing.

Piggybank.ng is owned by Sharphire Global Limited, the same guys behind online recruitment platform, Push CV (I knew the colored lines at the top of the website looked familiar). People will no doubt raise questions about security, and regulation – normal, for any institution collecting people’s money, but Piggybank.ng is a product that hinges on existing (read: regulated, legitimate) financial institutions, to manage the funds, while they focus on the marketing and technology layers.

Shut up, and take my money.

Photo Credit: David Luders via Compfight cc