Back in early February, I stumbled on a Medium post titled Making a Case for Subscription Businesses in Nigeria by one Segun Adeyemi. I remember putting it in our Slack because of the plug-to-insight ratio1, and asked Bankole whether he’d heard about the plug, Slushpay.

Fast forward a few months, and Slushpay is finally getting its big launch, only this time, it’s been (re)branded Amplify. For some reason, the old site is still live (I’m sure they’ll do the necessary redirects soon), but Segun detailed the rationale behind the new name in a post on his Medium page this morning.

“we wanted a name that better communicated what we stand for–we are a payments company that helps you grow and build a rich, long-lasting relationship with your customers”

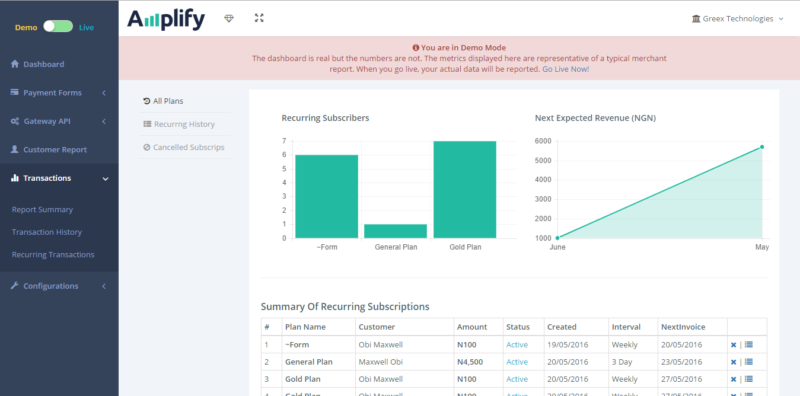

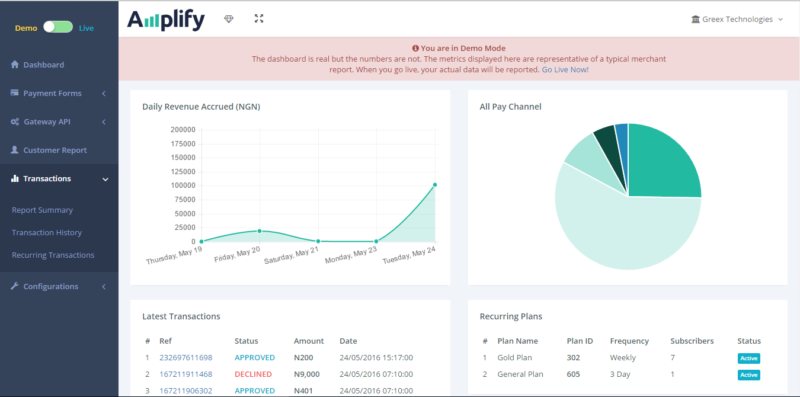

They are zooming in on cardless and recurring payments, and it makes sense to me. Recurring payments enables a whole ‘nother layer of innovation. Startups like Piggybank.ng are suddenly made possible, and even traditional companies can begin to shift their pricing model to a more convenient subscription plan. And companies can deduct money from your account on a regular basis without requiring you to manually enter card details every few seconds. Seriously.

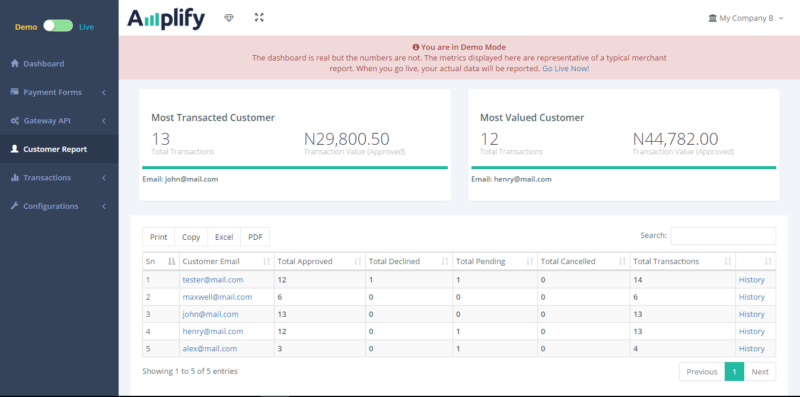

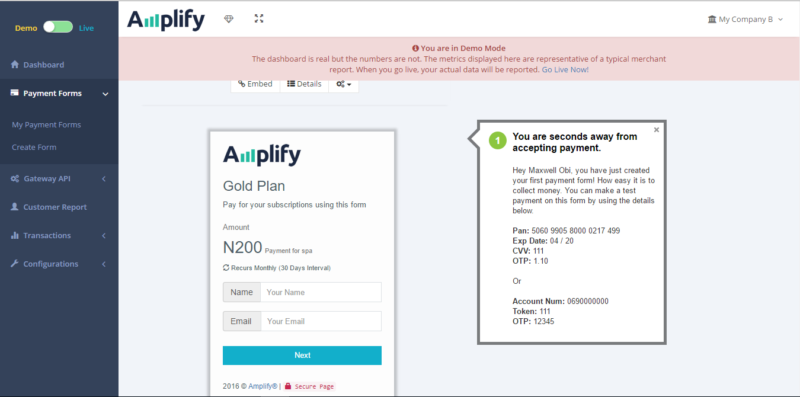

Amplify’s founders, Segun Adeyemi, a former Hotels.ng employee, and Maxwell Obi, a former Unified Payments employee are offering merchants deep analytics, an Android SDK, a slew of reports pages, something they’ve called Card Correction Technology (which retries failed transactions for up to 3 days) and a few other value-added services they’ve listed in here. This is what their merchants dashboard looks like.

“Many businesses in Nigeria accept recurring payments,” Segun says, “but it is surprisingly difficult to accept and manage these payments, they improvise with methods like post-dated cheques, regular transfers and direct debit mandates. In 2015, Nigerians paid over $1.3 billion in automated direct debits alone. We built Amplify to make setting up and managing recurring payments simple for subscription businesses, lending companies, insurance companies, and others.”

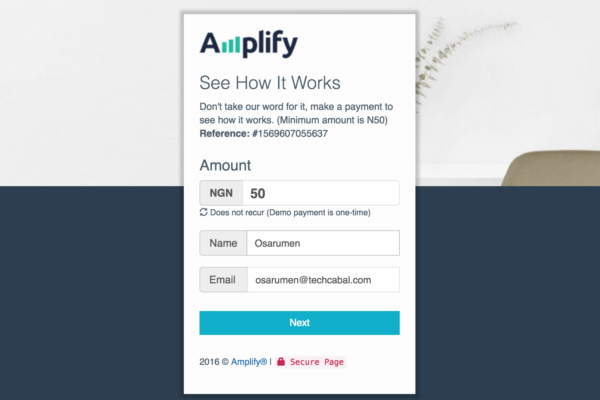

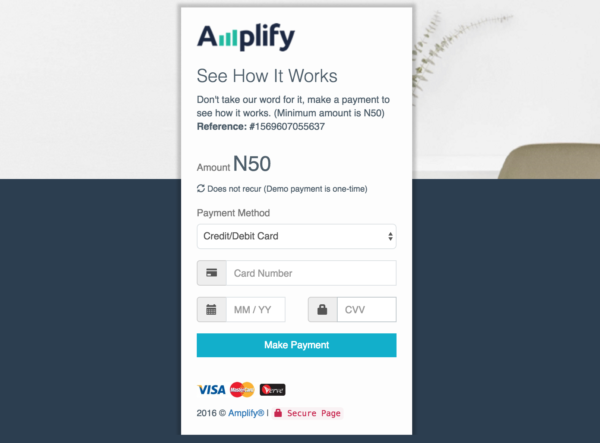

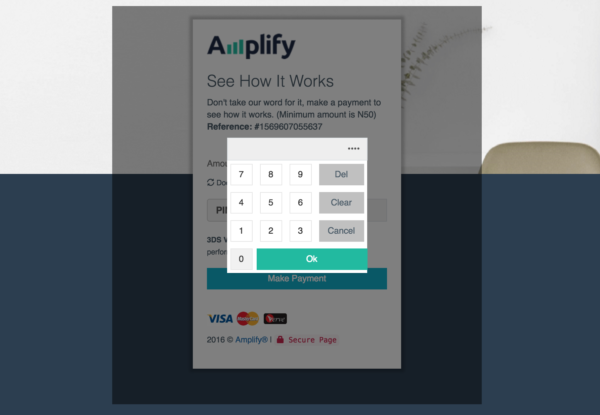

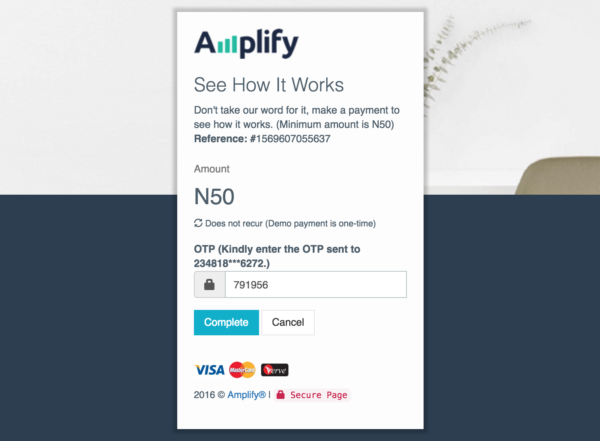

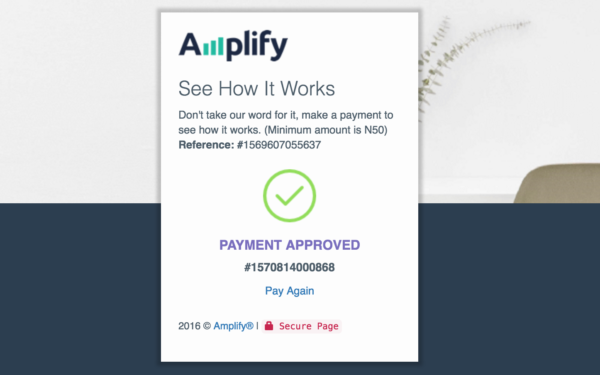

I just visited the site, and did a quick demo with my Mastercard. I did the usual payments dance – enter card details, enter personal details, wait for OTP, enter OTP, wait for notification – and I saw 50 naira shaved off my net worth in a few seconds. What I’d give to have my account number at the receiving end of a payments platform test link.

I’m tempted to start a hashtag at this point. #Fintech2016. Amplify, Paystack, Simplepay, and a bunch of others all claim to solve the same problem. Amplify’s demo page worked for me, and it probably will for you. The only question is what happens after they launch tomorrow, June 7, and (hopefully) get a lot of merchants signed up.

I’m sticking around for that one.

[separator type=”thin”]

1. For the uninitiated, the plug-to-insight ratio is one of the indicators we use to determine how useful an article is. There’s a little more about all that in here.