A large number of off-grid solar startups operating in Africa target consumers in the rural communities and understandably so. More than 80% of those without electricity in Africa live in rural areas and this represents over 40% of those without power in the world. So it completely makes sense that many solar startups are targeting rural Africans. However with the falling prices of solar equipment, environmental impact and a number of other reasons which I would mention, it makes sense for startups to begin targeting urban Africans also.

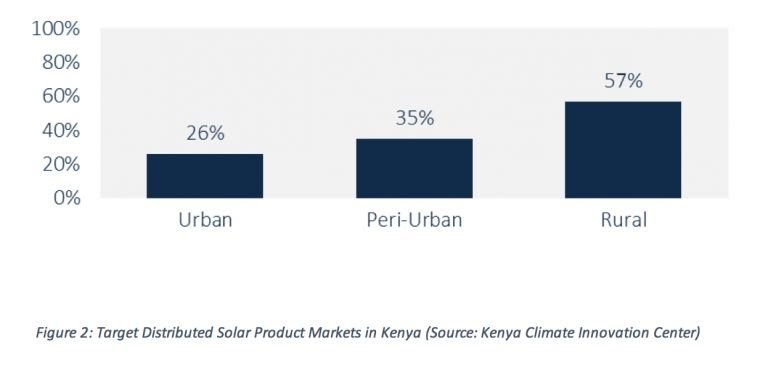

Some off-grid solar companies are beginning to recognize the opportunity. One example is d.light which has begun targeting peri-urban customers. 35% of solar lighting products sales in Kenya are made in peri-urban areas. However, continuous interest from investors (mostly impact investors) in startups focused on rural communities makes it more attractive for founders to align their focus.

Credit: Greentech Media

Size Of Urban Energy Consumption

Given the income levels of many in urban Africa, individual consumption levels are significantly higher than those in rural areas. The demand per household is higher and therefore requires bigger solar appliances and in many cases solar panels. The higher energy demand means that revenue generated per customer would be higher. As Uvie Ugono (CEO Solynta) told me in a chat, “we have estimated a demand for 40 million units (solar systems) for urban consumers currently using generators in Nigeria alone”. Uvie added that the average consumer uses a 1 KW system which costs about $3,000 to install. Solynta allows consumers pay over a certain period of time in order to eventually own the system.

One of the challenges of targeting urban consumers in the past was the fact that it was difficult to completely replace their primary energy sources (e.g. diesel generators) with solar solutions. It was not economically viable as costs were very high and it made no financial sense to consumers. Over the last few years the reverse has been the case and solar energy has gotten much more affordable with an array of flexible payment options. The falling prices of solar equipment means that “new solar are starting to get competitive with electricity generation from existing fossil fuel and nuclear power plant,” according to Zachary Shahan (Chief Editor, Clean Technica) in an article.

Capital and Falling Solar Prices

Another challenge that solar start-ups are facing is the capital required to meet the demand. Since urban consumers require larger appliances and panels, the cost is significantly higher than deploying solar lanterns and other low-energy items to rural communities. Falling prices means it will be more affordable for start-ups to acquire the solar systems they need to service demand.

With the uptick in investments going to the off-grid solar sector over the last few years, expectations are that investors will also begin giving attention to start-ups with a focus on urban areas. As an example, Nigeria’s Rensource Energy recently raised debt financing of $579,000. As Guilhem Dupuy (Investment Manager at Gaia Impact Fund) told me via a call “We expect to see more solar start-ups begin targeting urban consumers too and we would be happy to invest in those that align with our vision”.

Customer Acquisition

Customer acquisition is generally easier for solar start-ups targeting urban consumers. They can use digital marketing to acquire customers unlike rural consumers who in many cases aren’t plugged into the digital economy. To acquire rural consumers solar start-ups would typically need to visit the communities or use agents to sell the products.

Environmental Protection

“In Nigeria (for example) there are over 60 million generators,” said Uvie Ugono. These generators are majorly in urban centres causing significant noise and air pollution. Urban consumers recognize this as it’s very inconvenient to sleep with a lot of noise and dirty air. Consumers are open to alternatives that can help them lead healthier lives. Serving these consumers will take many of the fossil-fuel generators off them thereby reducing the amount of carbon emissions and protecting the climate.

Generator imports (mostly fossil fuel based) in some African countries are huge. One report puts the 2014/2015 figures in some countries as follows: Egypt ($58.6 M), Nigeria ($51 M), Ethiopia ($19.9 million), South Africa ($18.6 M), Congo ($6.9 M), Zimbabwe ($5.4 M), Niger ($5.3 M) and Mozambique ($4.4 M).

There have been a number of fire accidents as a result of petrol generators in some urban centres in Africa. In some cases, generator fumes was responsible for the deaths. Clean energy is generally safer, startup founders can therefore think of their products as life-saving for these urban consumers.

Economic/Financial Effects

Urban consumers spend a lot on alternative sources of energy. As at 2015, Nigerians were spending about three times on fuel generators what they were spending on direct supply.

Solar energy helps urban consumers save cost over time. This has a positive effect on households and businesses and also endears them to the solution. This means they are willing to spend more if the need arises, get the brand to new consumers via word of mouth and also impacts a nation’s economy as there’s more money to spend on other goods and services.

While the need to reach rural Africans with solar energy is without question, urban consumers desperately need clean energy sources too. It makes sense for more solar start-ups to also target them in order to protect the planet and grow their own businesses. The economic impact on these consumers are substantial and they will show their gratitude with their money (loyalty) and spreading the word.