In a recent interview, Babatunde Fowler, the Chairman of the Federal Inland Revenue Service (FIRS), disclosed that his agency is considering imposing a new tax specifically for e-commerce.

The plan is to deduct a five percent value added tax (VAT) for all local online retail transactions. Implementation of the policy could begin as early as the first half of 2020, Fowler said.

Although the news sent shockwaves across social media, it is actually not a new policy. The FIRS chief first announced the plan in May, describing it as a practice that “actually should be in existence.”

However, this is the first time the agency has disclosed how much should be paid as VAT on each online transaction. In addition, Fowler disclosed that deduction of the tax will be automated right at the point of payment, in conjunction with banks.

Tunde Fowler, the Chairman of the FIRS, believes that the new VAT is something that “actually should be in existence.”

With Nigeria’s Federal Government reliant on revenue from the petroleum sector, the new VAT is part of the agency’s measures to shore up the country’s revenue base.

“Nigeria has hurtled into a fiscal crisis with 70 percent of revenue going to debt servicing today,” said Tunde Ajileye, an economist at SBM Intelligence, a Lagos-based risk advisory firm.

“Hence the FIRS is likely to be looking for a way to extract tax to grow revenue from what they consider a fast-growing sector of the economy,” he added.

A new VAT is double taxation and could slow growth in the e-commerce sector

With the Nigerian ecommerce industry now valued at $13 billion, the market is an easy target for the tax body. But the five per cent VAT would make it expensive to shop online.

“VAT is applied to the good or service itself, the same VAT that would be applied if one is buying offline,” Ajileye explained. The proposed VAT means tax is “applied based on the channel which is online”, he added. “This amounts to double taxation.”

“This is the kind of tax you apply on something you want to discourage,” Feyi Fawehinmi, a Nigerian commentator, wrote on Twitter. “Nigerian consumers are incredibly sensitive to any price change especially in a sluggish economy,” he added.

Kalu Aja, a finance analyst, explains that the “VAT is a cost” that will make consumers rethink their online spending. “Patterns of spending really depend if consumers can avoid the tax,” he added.

According to some sources, ecommerce stakeholders like Jumia and Konga were not contacted by the FIRS before the news about VAT was made public.

Jumia, Africa’s biggest e-commerce platform, says the tax could have “huge implications for all online businesses and their customers.” In an email to TechCabal, Jumia advised the FIRS to consult industry stakeholders to understand the impacts and challenges before implementing the new tax policy.

This suggests stakeholders like Jumia may have been caught unawares about the proposed tax.

For e-commerce companies, there are key issues that will need to be addressed before the new tax plan should be implemented.

First is how the FIRS will handle reversed transactions. E-commerce companies each have item return policies that allow customers to return an item and get a refund when the item is not what they expected. But with the FIRS’ tax plan automated at point of sale, it means deductions will be done when payment is made.

Meanwhile companies usually calculate and pay their tax liabilities after all reversals have been accounted for. This could cause customer uproar against these companies if reversals are not made in a timely fashion.

Other issues that need to be addressed include: how to differentiate trade and non-trade transactions and how to drive card payments among customers who might prefer cash on delivery to avoid paying the VAT, an industry insider said.

Together, these issues could discourage users from using e-commerce platforms.

The FIRS has introduced numerous measures to improve Nigeria’s tax collection. Nigeria is one of the worst ten tax collectors in the world, with a 4.5% Tax-GDP ratio.

Thanks to its taxation pursuits, the FIRS made a revenue of N5.3 trillion in 2018; the highest amount ever recorded by the agency. However, it wants to rake in greater amounts going forward. For instance, in 2019, the agency aims to grow its revenue to N8.8 trillion, a 60 percent increase from last year.

So with this revenue target, it is no surprise the agency is looking to introduce a levy on the e-commerce sector.

However, the proposed VAT could have serious implications for both the e-commerce industry and the implementation of the cashless policy of the Central Bank of Nigeria (CBN).

New VAT and CBN’s Cashless Policy

Introduced in 2011, the cashless policy is the brainchild of the CBN that aims to reduce the amount of cash in circulation by encouraging more people to use point of sale (POS) terminals and online platforms for transactions. Among other things, the policy was designed to reduce the cost of banking services and increase financial inclusion.

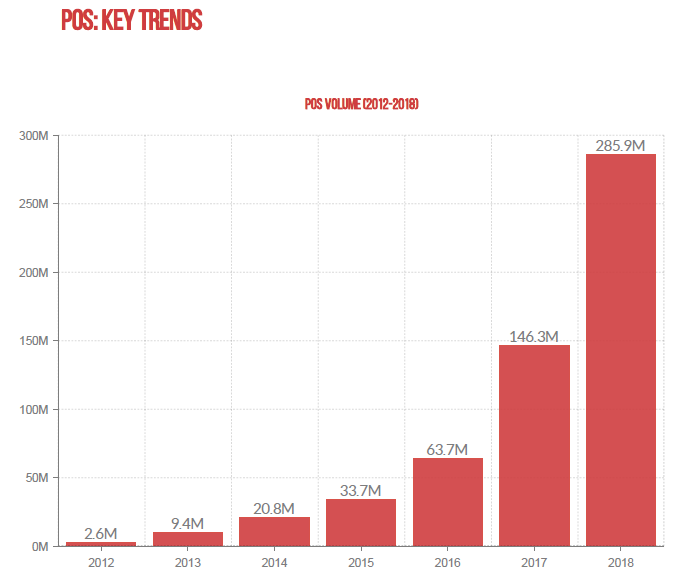

The impact of the policy has been evident in multiple ways. For instance, in 2012, the volume of POS transactions stood at 2.59 million, that figure grew four times to 9.42 million in 2013 (PDF). By 2018, the volume of POS transactions in Nigeria stood at 285 million. The value of POS transactions in 2018 was N2.3 trillion (PDF), rising from N400 million in 2012.

The volume of Nigerian POS transactions between 2012 and 2019. Source: Nigeria InterBank Settlement System (NIBSS).

This number is set to rise by the end of this year, with statistics showing that over N1.4 trillion worth of transactions have been made so far in 2019.

The growth is largely due to the efforts of the CBN to open up the financial sector and the arrival of disruptive fintechs and other mobile services.

However, the FIRS’ proposed VAT could significantly affect the adoption of these services once its implementation begins in 2020.

“There will be reversals of many of the cashless gains, as customers opt to make their payments in cash,” Ajileye said.

“Cash option will be “cheaper for not only the merchant but also for the customer since they will only pay VAT on the item and not the second VAT on the payment means,” he noted.

Considering the importance of the cashless policy, some analysts believe the FIRS may have not consulted the CBN.

“The cashless policy has definitely not gotten to the point where you might say most people are inside it and then you can start applying taxes when they have no alternatives,” Fawehinmi noted. He concluded that “people have alternatives so this can set the cashless policy in reverse.”