The Chinese backed startup OPay is continuing its move to become a super app with the launch of OCar, its ride-hailing service in Lagos, Owerri, Port Harcourt, Abuja and Benin.

OCar is the company’s latest vertical in an ecosystem that already includes offerings for food (OFood), bike-hailing (ORide), classifieds (OList), three-wheelers (OTrike) and bus-hailing (OBus).

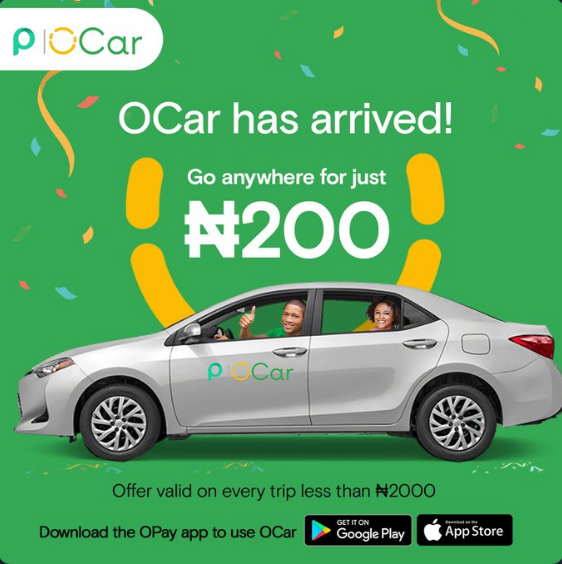

And true to form, OCar has launched with a massive discount offer of just N200 for every ride. It will prompt casual observers to ask again: what is Opay’s grand plan?

What Is OPay’s Play?

Earlier this week OPay announced a Series B raise of $120 million led by existing investors Meituan-Dianping, Source Code Capital, IDG Capital, Sequoia China and GSR Ventures who funded the company’s $50 million raise in July.

And Meituan-Dianping potentially provides a pointer to what OPay’s play is. Meituan-Dianping is a Chinese super app which lets customers do everything from ordering food, booking hotels to buying movie tickets.

Here’s how dominant the app is: it has 40% of the market share for food delivery services in 2019.

Like Meituan-Dianping, OPay will prioritise expansion over profitability as it becomes a super-app, but the real question is: why will a company put profitability second?

Super apps have been shown to improve user retention. It’s easy to argue from there that keeping users within the app lets users spend more.

The trick is to find the vertical customers are most interested in to get them onboard the app and then impress them with other offerings. For Meituan, food delivery was their way in.

For OPay, it has been ORide, the bike hailing service which has become of the more popular services in Lagos and Ibadan.

Although food delivery is a complex business, ride-hailing has proved to be equally tasking. OCar will launch in a space which already has established market leaders.

Launching in a crowded cab-hailing space

The taxi-hailing space in Nigeria can be summarised as Uber and Bolt. Over the last five years, both companies have the biggest market share with a combined presence in cities like Lagos, Abuja, Ibadan, and elsewhere.

While both companies have competed on the basis of pricing, their market strategies mostly involve promos, infrequent discounts and availability of drivers. But the real challenge with ride-hailing is the need to provide a demand and supply balance.

Customers will use apps with a large spread of drivers in their city. Drivers will not sign up on an app without ready users: this is the only way they’re guaranteed to earn.

As simple as this business problem sounds, it remains one which has confounded all but a few ride-hailing services.

Does OCar realise the scope of the challenge?

It’s early days but it remains to be seen if OCar will crack this problem or if it will choose to trigger the kind of price war which started when Bolt launched. While price wars are great for customers, they are unsustainable as a marketing strategy because they reduce earnings.

Summary: Fares are cheap, customers are happy, but no driver wants to drive for hours to earn pennies.

An ex-Uber driver told TechCabal: “During that period, earnings went down because they were both cutting into drivers earnings but Bolt paid drivers more so people stuck with them.”

OgaTaxi, GidiCab and in-driver all launched after Bolt but no other taxi-hailing app has since enjoyed significant adoption. OPay’s latest play will look to change that. With more than $120 million in the kitty and their popular discounting strategy, it will be hard to bet against their chances of success.