Helping emerging enterprises and individual borrowers access reliable credit is good business. When your model also helps banks guarantee recurring returns, chances are you’ll get business requests from various zip codes.

That’s the two-sentence synopsis of Migo’s expansion from a money lending startup with an office in Lagos and registered in San Mateo, California, to an international financial services firm about to take on South America.

The Brazilian adult population without access to formal banking services is similar to Nigeria’s by size – about 90 million people. Its economy is developing, with innovation-enabling institutions and infrastructure being set up to engineer future national prosperity. In June 2019, the Ministry of Economy collaborated with its central bank and two other agencies to launch a fintech regulatory sandbox that will “respond to innovation” happening in fintech. By the second half of 2020, open banking initiatives will kick in there.

Beyond the lure of market size and business environment, the secret sauce for Migo’s expansion into the world’s ninth-largest economy comprises ingredients deserving of the African tech entrepreneur’s attention.

Intentionality

When a company like Migo intends to expand beyond its shores, “you start off with asking your investors if they have contacts in relevant shortlist of countries you are looking at,” according to Adia Sowho, Migo’s vice president for growth.

I am in her office on the second floor of a building at Ikoyi, the quintessential highbrow Lagos suburb. Before she arrives for our scheduled chat, I probe the ambience around the waiting area, snooping for signals: how has this four-year-old startup of which little is known matured for international expansion?

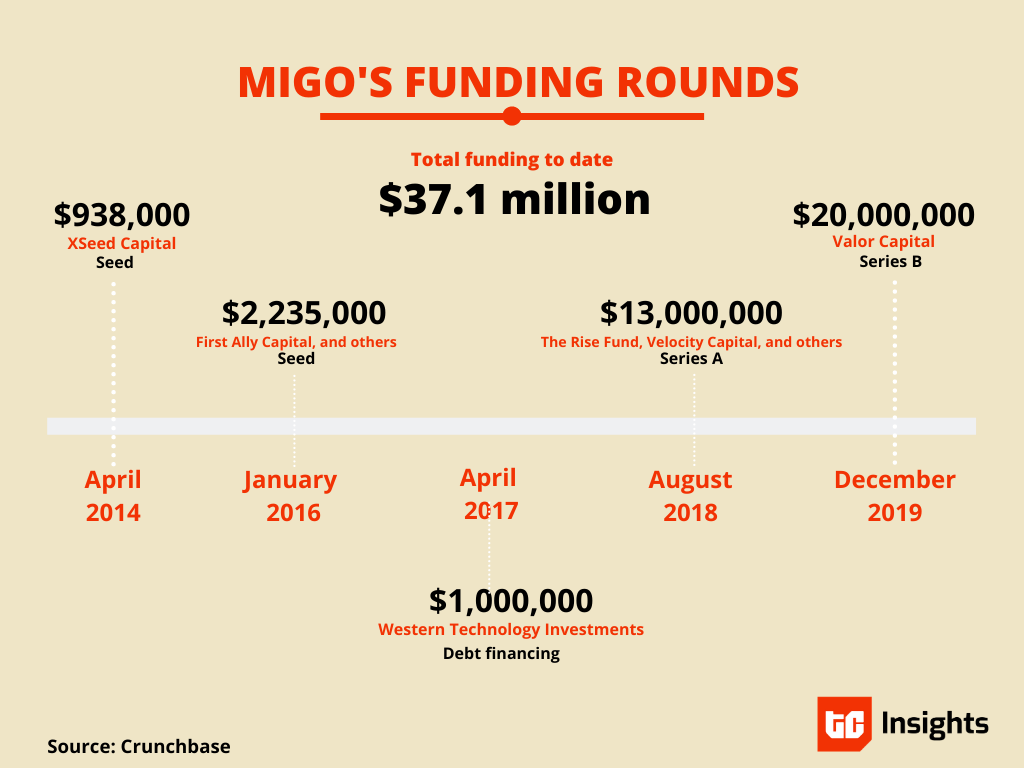

Migo has consciously defined itself as an emerging markets company, rather than merely an African one. After raising $13m as Mines.io in an August 2018 Series A round, CEO Ekechi Nwokah mooted a move to South America. A mural at Migo’s HQ features, among other things, depictions of Lagos’s iconic danfo buses. Atop that and other paintings is Christ the Redeemer, Brazil’s most famous public art monument. The mural, I confirm from a staffer, has been there since they began operations in 2015.

Migo’s digital lending in Nigeria hinges on three pillars. First, they create data-based credit products using artificial intelligence algorithms to determine what fits consumers best. They offer these products to banks or other financial services providers like mobile operators. Earning percentages on each transaction justifies the unique value offered.

Then, they harvest data from those transactions, ostensibly ensuring better credit products. It’s a cyclical process of progressive iteration, where data feeds product and product produces invaluable data. Migo’s partners in Nigeria include 9Mobile, where Sowho once served as the Director of Digital Business.

The Brazilian deal

With a mind to expand beyond Nigeria, it was necessary to consider the “lowest shock approach,” Sowho says.

In other words, Migo had to pick a country where they would be doing essentially the same thing they had done in Nigeria, subject to similarities in market size and operational realities. Mexico was under consideration but they ultimately decided against it for not meeting their strategic ambitions.

From conversations within networks of former clients and friends, and from being at important fintech events, an opening popped up in Brazil. “We found a company that wanted to offer credit to their customers with our platform,” Sowho says. She wouldn’t divulge who this company is or what they do – whether it is a bank, telco or a mobile money operator – or how many partners they will be starting off with.

Osarumen Osamuyi, an African technology analyst, believes Migo’s model in Brazil will mirror their lessons from Nigeria. They will partner companies with the largest user bases and will market their credit products to those companies’ existing customers. In that sense, they are not entering a new market to start customer acquisition and distribution from scratch.

Migo’s strategic entry into Brazil will lean into the expertise of Valor Capital, a venture capital firm with a focus on connecting the US and Brazilian technology markets. Valor led their latest Series B round and it is a relationship that they intend to leverage to understand the market and establish themselves.

“Business is enabled by relationships,” Sowho says. Relationships are just as important as a company’s track record. In Valor, they have an investor with deep knowledge of the Brazilian environment, as well as one that can activate relationships on Migo’s behalf, either from portfolio companies or partners that can enable them.

Scaling by flexibility

Four years is probably not the longest period to master a market. But if Migo has learned one thing from Nigeria, it must be that it pays to be flexible and adaptable.

In their dealings with banks and mobile operators, their aim has been to work with partners on what the latter need. Same will apply in Brazil, Sowho confirms: successfully transplanting their model requires them to “meet partners at their point of need rather than taking a fixed, set product and try to force-fit it into their environment.”

They have had to be flexible in Nigeria. For example, by not insisting on brand attribution for the credit products they offer banks, it has enabled their clients sell to customers conveniently. Migo then focuses on managing the process of product development, distribution, data collection and underwriting. For businesses in emerging markets, successful partnerships are built on this form of flexibility “rather than a rigid approach to making money,” Sowho says.

Nigeria as a test bed for expansion

After four years, Migo is profitable, according to Sowho. They have a million unique users and have arguably disbursed more loans than any fintech in Nigeria. “That’s the sure footing we are going to Brazil with.”

That is in spite of the peculiar challenges of running a technology business in Nigeria. Osamuyi doesn’t think Nigeria is the best test bed for proving the viability of an innovation as there are lots of baggage that increase operational costs without adding value. However, there is an advantage to being profitable in Africa. “It’s reasonable to launch here, scale here and move elsewhere,” Osamuyi tells TechCabal.

While they have been successful in using data for product development, Sowho anticipates a learning opportunity in Brazil. “They are a few steps ahead of us in the use of data to make credit decisions.”

Talk of future expansions is already in the air at Migo. Nwokah talked up a potential entry into the United States following their $20 million Series B in December 2019. “We will go where we are welcome and where doors are opened to us,” Sowho says.

“Of course, warmer introductions are better than cold: you don’t want to go to a country that has not said we need you.”

Future expansion plans will have to pass relevant evaluations of market size and consumer willingness to pay for services.