Nigeria could be joining the number of countries introducing digital taxes. The recently signed Nigerian Finance Bill quietly gave the Minister of Finance full powers to impose digital taxes in Nigeria.

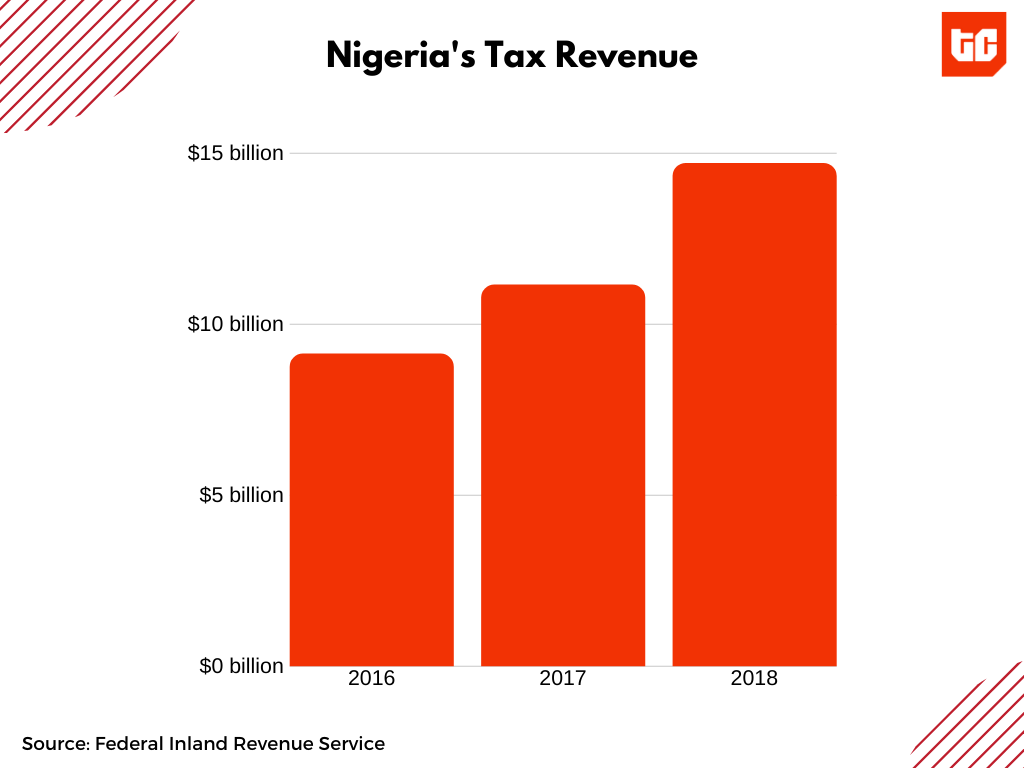

On Monday, January 13, Nigeria’s President Muhammadu Buhari signed the Finance Bill 2019 [PDF]. Essentially, the bill amends several portions of the Nigerian tax laws. It allows the government to draw more people and businesses into the tax net and increase its tax revenue base. The bill also fixes confusion around the 7.5% value-added tax (VAT), personal income tax, among other issues.

But the Finance Bill also contains sections regarding the digital economy. It introduces new laws that give the government powers to implement taxes on digital services providers even if these companies have no physical presence in the country.

According to the bill, digital businesses will be taxed if they have “significant economic presence in Nigeria”. Foreign companies that provide technical, professional and consultancy services in Nigeria over the internet could also be roped in to pay the digital tax if they have “significant economic presence in Nigeria”. “The bill seeks to broaden the triggers for domestic taxation of income earned by non-resident companies in Nigeria through dependent agents and via online market platforms,” the signed document states.

The bill does not give a breakdown of what “significant economic presence” means. However, it gave the Minister of Finance full powers to determine when and what digital services can be taxed.

This could affect businesses including: e-commerce platforms, application stores (like Google Play Store), electronic data storage (like Amazon Web Services), online adverts, online payments, social media, among others.

What does this mean in practice?

Here are some examples.

Amazon Web Services (AWS) is a popular cloud service with data centres in different countries. It does not have any data centre in Nigeria. Yet, if a Nigeria-based company buys cloud storage from AWS, under the newly signed finance bill, AWS would have to pay a certain portion as tax to Nigeria.

Adobe which offers paid services for its softwares, such as Photoshop and Premiere Pro, would be liable to pay taxes for revenue made from Nigeria.

Another example is Facebook and its advertising revenue. With over 30 million users in Nigeria, Facebook could pay taxes from its revenue from Nigerian users.

The same goes for e-commerce platforms like Amazon, eBay, Alibaba among others.

Is Nigeria alone in this?

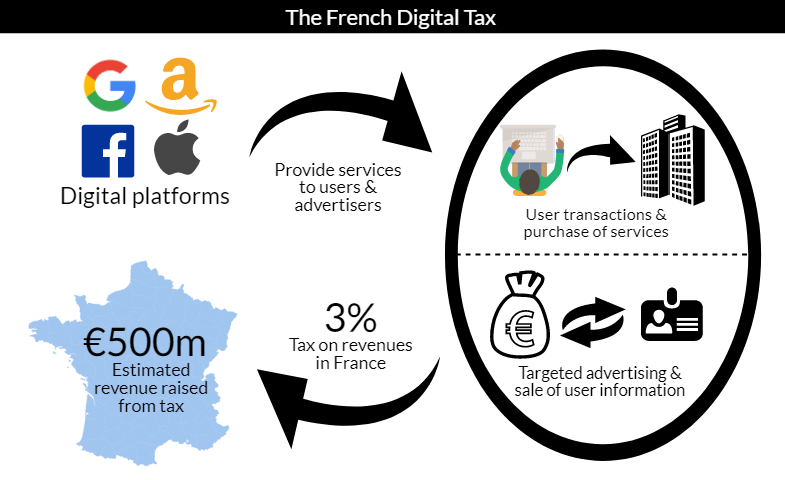

Nigeria is not the only country making laws taxing digital platforms. The move is part of a global trend by governments to introduce digital taxes.

Many governments want to be able to tax businesses like Facebook and Google that are making money from their citizens by providing digital services. Countries want to tax businesses as long as they make money from citizens in that country. But unlike physical goods which are easy to tax, digital services fly across borders and are difficult to pin down.

For instance, at what point should Facebook pay taxes in Ghana for advertising revenue from Ghanaian Facebook users?

Meanwhile, international tax rules that should provide an easy fix are outdated. International tax rules have seen very little changes since 1920. Yet the world has changed so much since 2000 thanks to digital services and tech companies.

So there is no global consensus on how to tax digital businesses. In the absence of a global solution, individual countries are imposing their own taxes. Kenya, France, Italy and the UK recently implemented their own laws. In November, Kenya signed into law its own Finance Act that mirrors Nigeria’s on Digital Taxes.

The UK passed the Digital Services Tax in 2019. It imposes a 2% tax on social media platforms, search engines and online marketplaces used by UK users. Digital platforms with global revenues exceeding £500m revenues and UK revenues of over £25m will pay the tax.

The Organisation of Economic Cooperation and Development (OECD) is working on a proposal that would be acceptable to all countries. It has promised to provide a solution sometime in 2020. However, for now, countries are taking matters into their own hands and Nigeria is one of them.

What happens now?

As it appears at the moment, Nigeria has no serious digital tax plans. The Finance Minister still has to define what criteria for the potential tax. According to Pricewaterhouse Coopers (PwC) “until the minister defines the criteria for significant economic presence the proposed updates would be redundant as they can only be applied if the criteria are defined.”

Regardless, the mere existence of this law is significant. By sneaking it under the Finance Bill, it reduces the legal, political and civic resistance to any future digital tax plan. And giving the Minister of Finance full power regarding this makes it easy for Nigeria to implement the OECD plan when it is ready.