100 years ago, no one would have thought the entire value of gold coins and paper money could be stored in a simple card.

Credit cards, debits cards, the emergence of card payments spurred commerce and made it easier for bank customers to access their funds. The ecommerce industry emerged and boomed with the development of card payment technologies.

But financial innovations ushered in by the 2010s are changing how people think about payment cards. Rapid adoption of smartphones and apps increased the reach of technological innovations. Banks have developed more competent apps. Governments increased support for instant payment solutions that gave birth to more collaboration in the industry.

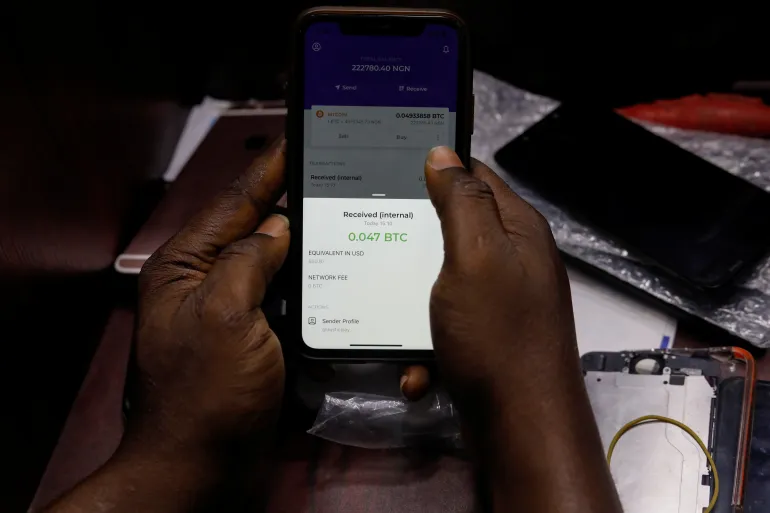

Meanwhile fintech companies ranging from Venmo, Stripe, OPay, PayPal, AliPay and WeChat developed mobile payment technologies, including mobile wallets, QR codes and peer-to-peer transfers that reduce the need for plastic cards. Flutterwave, and other fintechs have introduced virtual cards that completely replace ATM cards.

Non-fintechs like Apple and Google have also jumped on the payment trend developing payment solutions such as contactless options like NFC-based payments.

Safaricom’s mPesa has completely created the mobile money trend in Kenya and East Africa. In 2019, mobile money transactions stood at $38.5 billion, nearly half the GDP of the country.

So why queue at the ATM when you can buy a product using a QR code? In 2000, Nigerians wouldn’t have believed it could be done.

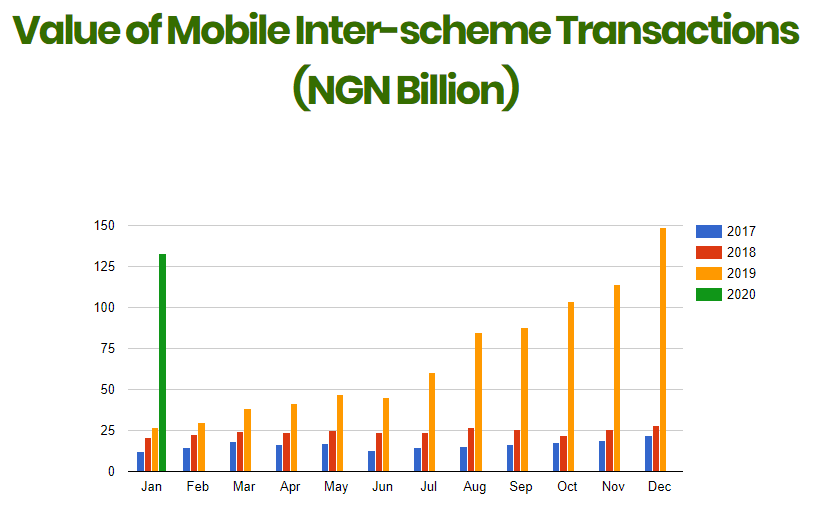

But today, Nigerians have embraced digital solutions as the push for financial inclusion intensifies. Data from the Nigeria Inter-bank Settlement Scheme (NIBSS) shows that the volume of digital payments grew 494% in 2019. In January 2017 Nigerians made ₦12.09 billion ($32 million) worth of transactions using mobile solutions. By January 2020, that figure has jumped to ₦133.2 billion ($352.4 million).

A source at NIBSS disclosed to TechCabal that two things are pushing the growth of payment in Nigeria: mobile apps and USSD. Not plastic.

All these beg the question: what is the future of plastic cards?

Will cards disappear anytime soon?

Short answer, no. Long answer: while mobile payment has ballooned over the last ten years, its adoption outside of Asia is still gradual.

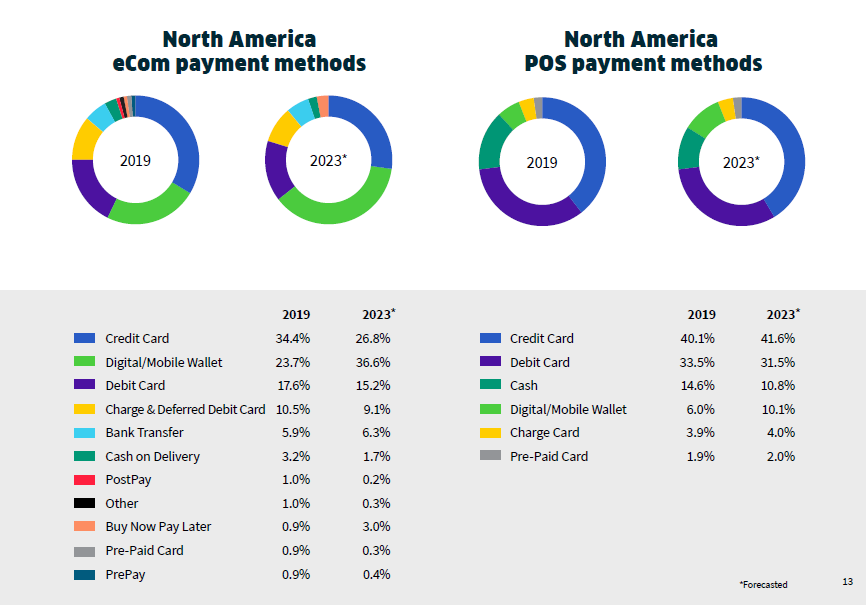

In North America, plastic cards are still preferred. Credit cards, debit cards and prepaid cards account for a whopping 63.4% of all ecommerce transactions in the region in 2019. In contrast, in Asia, card payments was 26.6% in 2019, while Digital wallets was used for 58% of transactions.

Outside Asia, we’re still too attached to ATM cards. While the value of mobile transactions in Nigeria stood at ₦133.2 billion ($352.4 million) in January, POS transactions (which are card-based) was ₦313.4 billion ($829.2 million).

Here’s the thing; it’s not that we like the stress of queuing, it’s because outside of Asia, many businesses still prefer cash payment.

In Africa, but not Kenya, it’s more common to find businesses that have POS terminals but no digital wallets or QR codes.

This is why companies like Square exist in the US. They’re making it easier for people to accept card transactions using their mPOS solutions. Square’s technology allows merchants to accept payment using a smartphone connected card reader.

But the future of card payment is an inevitable one. Cards will disappear eventually. But how this will happen will be decided by the trend of digital banks and superapps.

Digital Banks vs Superapps

Digital banks, aka neobanks or challenger banks, are fintech companies that are upending traditional banks. Digital banks are branchless but provide banking services directly to customers using mobile apps. They also provide users with debit cards to make transactions.

Digital banks were the original finance industry disruptors. The model is popular among fintechs in Europe and North America.

In Asia however, the fintech revolution is led by superapps. Superapps offer payment services and a number of non-financial services. WeChat, a Chinese superapp, is a messaging app that does everything from food delivery, ride-hailing and payments. Singapore’s Grab does the same in different countries, and Gojek does similar in Indonesia.

Unlike digital banks, superapps are more focused on peer-to-peer transactions. With their ecosystems, these apps support digital wallets and allow users to make payments to different services without leaving the app.

The peer-to-peer nature of superapps is why wallets are so popular in Asia. It is also the reason why the region is leading the world in mobile payment adoption. WeChat, Gojek and Grab are mobile apps.

Across different regions, the decline of plastic card usage could be decided by the adoption of superapps or digital banks. While digital banks still allow users to use cards, superapps will accelerate their decline thanks to their omnichannel nature. This is what companies like PalmPay, OPay, Flutterwave and others are aiming for in the Nigerian market.

US fintech, FIS, predicts that 52.2% of all ecommerce transactions globally will be done via mobile wallets. By then, card payment would have declined to 31.1%, down from its current 46.2%, the FIS report showed.

The coronavirus may accelerate this. Following the outbreak of the virus, the Bank of England and the World Health Organisation (WHO) warned that paper money may be spreading the disease. “When possible it’s a good idea to use contactless payments,” said a spokesperson for the WHO.

Kenya recently removed transaction fees on mobile money transactions to encourage non-cash transactions.

The US House of Representatives is also considering an unprecedented move. In a historic coronavirus stimulus package, the US Congress will create digital wallets and a “digital dollar” to disburse between $1,500 and $7,500 to Americans affected by the pandemic. That would shoot wallet adoption rates sky-high.

All these will affect the use of card payment and nudge people to adopt alternatives like wallets and contactless payment solutions.