Nigerians should prepare for a tsunami of fake news, scams and cyber attacks

Britain’s Queen Elizabeth has been infected with COVID-19, at least that’s the fake news that on Saturday, March 28. It went viral on Twitter. Users with thousands of followers retweeted the news. Many didn’t care to check if the story was verified, neither did they care that not a single UK publication wrote about it. But that’s one example of how vulnerable Nigerians are to online gimmicks.

The country is under a 14 days lockdown to tackle the spread of the pandemic. Schools have closed, offices are shut, markets have restricted operations and people have been asked to remain at home. These social distancing efforts could help tackle the virus, but there’s little it can do to control misinformation and online scams.

Fake news menace

As the virus spreads, it is creating a fertile environment for fake news to emerge. In Uganda, rumours claimed that imported second-hand clothes could spread the disease. Other fake news made the rounds said black people are immune to the disease and that the African climate is too harsh for the disease to survive. On WhatsApp, everyday people have medical experts sharing “coronavirus cures”, like mixing garlic and honey. Prices for lemon and garlic have increased in Ethiopia as a result.

This behaviour is not new. During the ebola outbreak in Africa a few years ago, fake new claimed bathing in saltwater cures the disease.

The current wave of misinformation is a challenge for health workers fighting the coronavirus. But it can be hijacked by mischievous people.

Scams and hacks

The Nigerian police warns that criminals are on the loose and ready to take advantage of people’s anxiety to cause havoc online. The trio of fake news, scams and cyberattacks could increase during this period warned INTERPOL, a transnational police organisation. “Scammers are trying to take advantage of the pandemic situation to dupe people,” it said.

The Nigerian Police said scammers have created and set up fraudulent ecommerce platforms, websites, social media accounts and emails to defraud victims. A typical scam tries to convince people to buy coronavirus-related medical products. Victims are then asked to pay via bank transfer,” the police said.

Other scams impersonate the government. One example is a fake donations request letter from the Federal Ministry of Finance. It took advantage of the fact that recently a number of affluent individuals and companies have announced donations to Nigeria’s efforts to control the virus.

Many of these already public donations were listed in the fake request, and it asked people to “give the little you have to aid the fight against COVID-19.” “Nothing is too small,” the fake request wrote. Nigeria’s Ministry of Finance has disowned the letter.

Hackers are another group trying to exploit the anxiety caused by the pandemic. A high number of white-collar or services workers are mandatorily working remotely. They are accessing sensitive business data on corporate networks from their devices and sometimes use third-party services to improve their productivity.

This is a hacker’s delight; as they hope people’s devices and software are insecure enough to infiltrate. Hackers are carrying out phishing scams and other hacks to get people to give up their information.

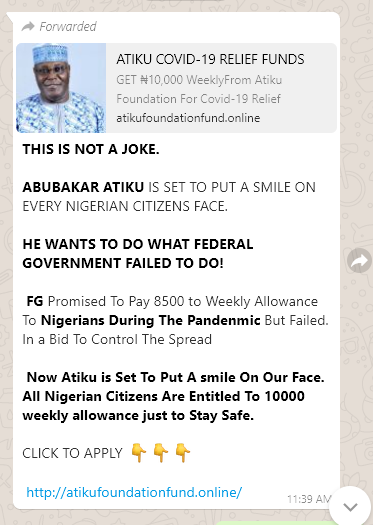

One example is ongoing: the “Atiku Care Foundation Relief Funds for COVID-19”. The fraudulent website promises to give people ₦10,000 weekly and is asking them to provide personal information like their phone numbers and emails.

In South Africa, the number of network attacks has spiked with the rise in coronavirus cases in that country. The country is vulnerable to cyber-attacks and has suffered breaches on different occasions since the past year. But between March 8 and March 18, network attacks have spiked from less than 25,000 attacks per day to over 300,000 according to Kaspersky, an internet security company.

Could Ponzi Schemes Emerge?

While some criminals are using COVID-19 as a cover, other scam artists want to exploit the country’s economic situation.

Nigeria is suffering from double negative impacts caused by the pandemic and the crash in oil prices. The pandemic has disrupted different businesses and threatens the jobs of millions of people.

But the crash in oil prices exacerbates things and is nudging the country towards a recession. The government has been forced to slash its 2020 budget by 14% and it has devalued the naira by 5%; the first devaluation since 2014.

This puts a serious strain on household income. Prices of food items were already increasing before March, but the lockdown is causing prices to surge some more. The lockdown in Lagos, Abuja and Ogun states will last 14 days. The already strained household income of many could take another knock.

The state and federal governments have announced relief support for households. But it is not trickling down fast enough. People need money and will look for it one way or the other.

Digital lending platforms are their quickest option. But these platforms are introducing stricter terms and giving fewer loan amounts to reduce the risks of defaults.

If these terms are too strict for people, many may turn to the next available options: wonder banks or ponzi schemes.

Ponzi schemes have long existed in Nigeria. But like other businesses, by adopting the internet, it increases their reach.

On March 11, Nigeria’s Securities and Exchange Commission (SEC) said it “observed the proliferation of the operation of unlawful investment schemes, with promises of huge, but unjustifiable returns.” It listed 12 of these platforms and warned people to stay clear of them.

But people rarely listen to these warnings. During the recession in 2016, the SEC and the Nigeria Deposit Insurance Company (NDIC) warned people about the MMM platform. Few listened. When it crashed, millions of people lost more than $49 million. And recently in January, thousands of people lost their money when the Racksterly ponzi scheme collapsed.

The economic condition of Nigeria is ripe again for such schemes to thrive. People need to be watchful.

How can people stay protected?

The first step is welfare for people. The government is making serious efforts to provide relief materials to people in locked down territories. The push has been slow, but it’s not insignificant. The Lagos government is distributing food items in some locations. Meanwhile, the Federal government has announced a relief fund for households and small businesses.

The government and other bodies are also working hard to tackle misinformation. The Nigeria Centre for Disease Control (NCDC) is working closely with social media platforms to distribute verified information. It is using free ad slots from Facebook to reach more people. It is also working with Nigerian telecom companies to send SMS notification to people frequently.

Meanwhile, the Nigerian police is on high alert for cybercrimes. It is coordinating with the Interpol National Central Bureau in Abuja to identity threats.

“The NCB which houses the cybercrime unit of the Force shall work closely with other Interpol member states across the globe to carry out intense monitoring of the internet highway in the most legitimate and ethical manner,” the police wrote on Twitter.

Fintech companies, Flutterwave and Paystack, told TechCabal that they haven’t seen any indicators to prove that there will be an increase in ponzi schemes. Both platforms have developed tools and review systems to help spot fraudulent platforms. Regardless they said they’re on the lookout.

“Since some of these businesses are dubious they are likely to signup under false pretences,” Paystack told TechCabal. Both fintechs have advised people to look out for red flags before signing up on any new investment platform at this time.