Voice services account for over 60% of revenues for Nigerian telecom companies, possibly making them vulnerable should more subscribers switch to digital communication services.

As Nigeria went into lockdown in late March and people began to work from home, Nigerian telecom companies came under pressure.

With more people using the internet for data-heavy activities, telcos had to adjust their infrastructure to absorb this surge in traffic. But as subscribers spent more on data, they complained the existing data bundles were both inadequate and expensive.

“In the UK, Vodafone gives 30 days free mobile data to put a smile on the faces of British people during this Coronavirus period,” one Twitter user wrote. “Nigerians are not even asking for free data. They are only asking for affordable data.”

#CutDataPrices trended online for a few days as people vented. To their frustration, nothing happened.

However, it is not that telcos could not reduce the price of data during this pandemic. The challenge is that they can’t.

Data is not the major revenue stream for Nigeria’s four major telecom companies. Only 22% of MTN Nigeria’s revenue came from data in Q1 2020 according to the company’s latest financial report. Despite the growing adoption of Airtel Africa’s 4G services, data brought in 22.2% of its revenue in Q1 2019, it wrote in its IPO prospectus [PDF].

Mobile voice is the major source of revenue for these companies. Voice revenue comes from charges on domestic and international calls, in addition to charges each telco collects when their subscribers call other domestic networks (interconnect fees).

Over 68% of MTN’s revenue in 2020 came from voice services, its Q1 report shows. Airtel Africa says mobile voice is its largest revenue stream. The telco operates in 14 African countries yet over 60% of its revenue comes from phone calls. In Nigeria alone, voice revenue stood at $739.8 million, or 66.9% of its earnings in the country according to its IPO documents.

Meanwhile, that revenue stream is now under threat, in part from digital platforms. Voice revenue is increasingly coming under pressure as mobile subscribers adopt digital services for their communication.

Airtel Nigeria subscribers made more phone calls in 2019 than any other time in the company’s history. The volume of calls increased from 134.6 million minutes in 2017 to 207 million minutes in 2019. But with new industry competitions, including pressure from internet platforms, Airtel and other telcos adjusted call rates. Airtel’s annual revenue per user (ARPU) for voice services dropped from $2.25 in 2017 to $1.69 in 2019.

This challenge from online services isn’t new. In 2013, Nigerian telcos lost 30% of their revenue on international calls as people adopted Skype, Google Hangout, Viber and Tango.

However, the threat is more pronounced now.

Lockdown pushes more Nigerians to use digital services

The recent lockdown forced millions of Nigerians into their homes. The country’s white-collar workers are now working from home and using more digital services in their daily routine.

“[W]e started experiencing a change in traffic patterns with a drop in voice traffic which was partially offset by an increase in data traffic on the network,” MTN wrote in its latest quarterly report.

Data traffic spiked as subscribers “began to adopt digital channels for most of their activities and routines including telecommuting, entertainment and social media engagements.”

A significant portion of Nigeria’s workforce, particularly white collar workers in the services sector are adopting services like Zoom, Google Meets, Microsoft Teams, and WhatsApp Calls for their communication needs.

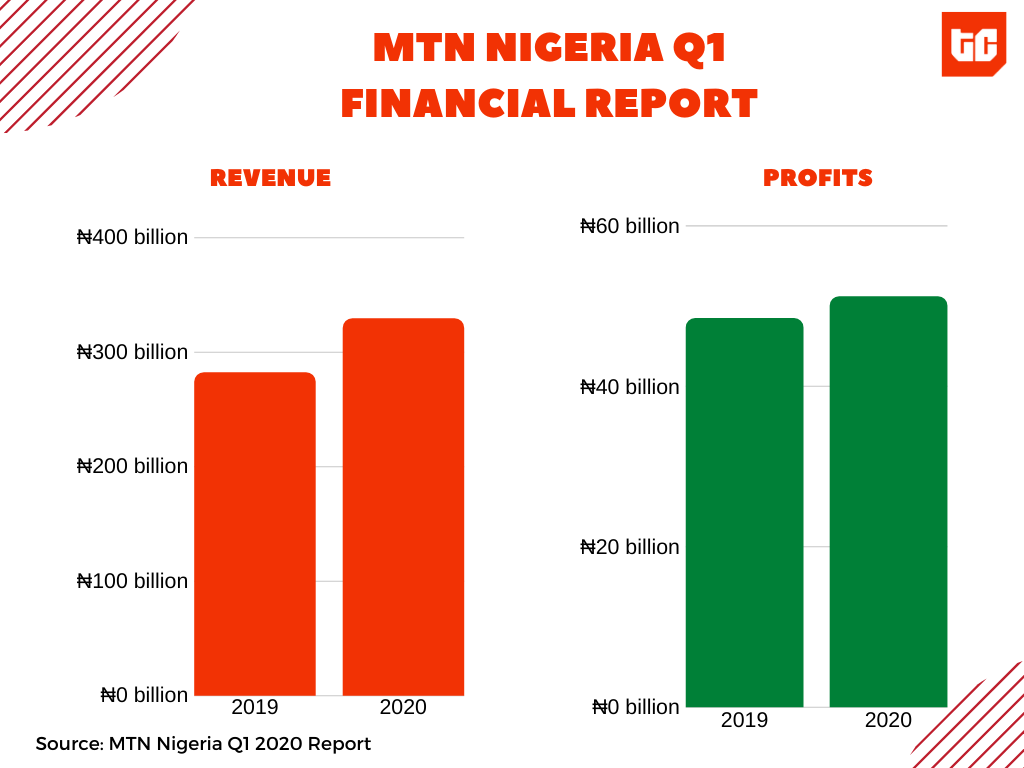

Companies like Airtel and MTN admits that this trend is increasing their data revenue and they are frequently improving their infrastructure as a result. However, MTN admitted in its latest quarterly report data revenue is still not high enough.

“Although we have witnessed growth in data revenue, it does not fully offset the decline in voice revenue,” said Ferdi Moolman, CEO of MTN Nigeria.

Young Nigerians are digital natives

Meanwhile, young Nigerians, estimated at over 100 million, have also taken to the internet for leisure and education in recent years. These digital natives will re-define the telecom market with their preferences for internet calls over regular phone calls, Airtel told investors ahead of its IPO.

Over 300 million voice and video meetings are held on Zoom daily. Users on WhatsApp and Facebook Messenger engage in over 700 million calls every day. 400 million people are sending billions of texts using Telegram.

Globally, these services are wiping billions of dollars in revenue for telecom companies while thriving on telecom infrastructure.

Unlike telcos, digital communication platforms do not face significant regulatory challenges. Using WhatsApp for cross-border communication does not incur additional charges nor does it require WhatsApp to develop any special infrastructure in each country.

Telcos face a different reality. Companies need to acquire a licence to operate in any country. They incur new licence and costs to operate different broadbands, spectrums and develop their infrastructure for each country they operate in.

For example, 4G broadband development enabled the rise of more efficient digital video and voice communication platforms. But the cost of a 4G licence, spectrum bids and the cost of building LTE infrastructure are on the high side.

5G, experts say, will herald an even faster internet. While desirable, 5G is expensive to build and could significantly alter the current voice revenue model of Nigerian telcos. GSMA Intelligence predicts that companies globally will spend around $1 trillion over the next five years to upgrade to 5G.

In Nigeria, mobile phone companies cover the cost of building these infrastructures without getting a slice of the digital profits of online platforms.

Airtel Africa’s capital expenditure has ballooned since 2017, rising from $395 million to $630 million in 2018. Ahead of its stock market listing in 2019, the company said it expects capital expenditure to increase as high as $700 annually for the short term.

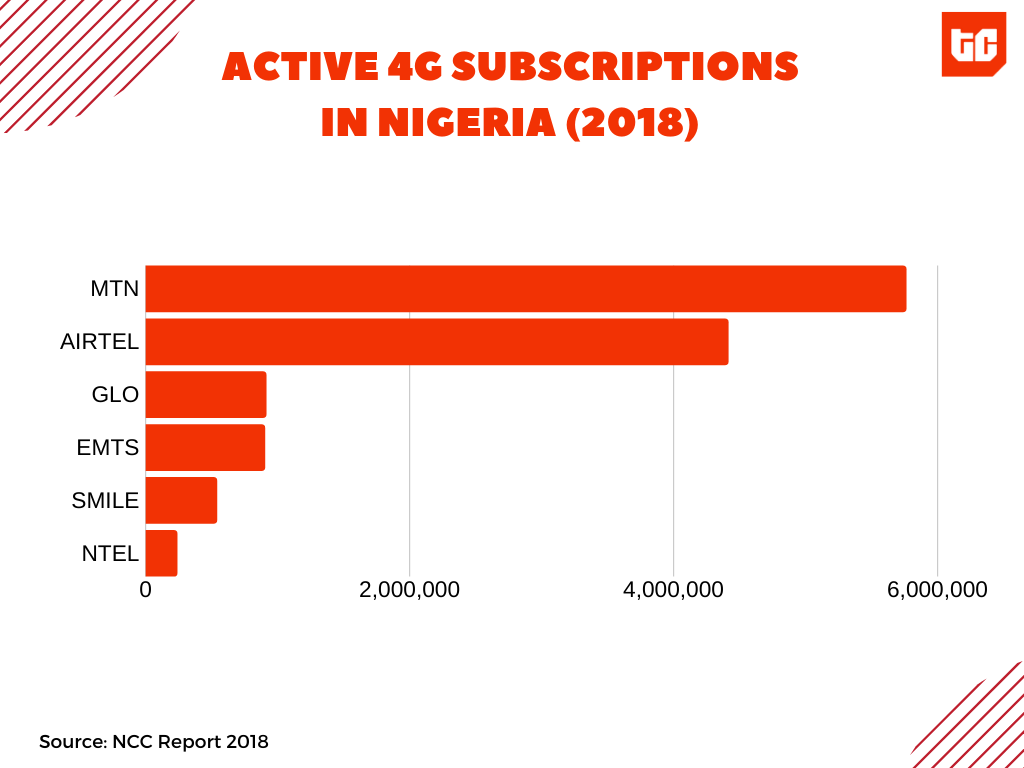

Yet as digital platforms grow, the pressure piles on to improve quality of service. It opens them up to greater competition from internet service providers like NTEL, Smile and Spectranet. NTEL and Smile are mobile broadband companies with voice and data services provided over 4G infrastructure.

In 2018, NTEL and Smile had 538,308 and 237,066 4G subscriptions respectively according to an NCC industry report [PDF]. These numbers look small, trailed two of Nigeria’s biggest mobile companies, Globacom and 9Mobile, that had 911,701 and 901,771 4G subscribers in 2018.

Pivot to data services

However, Nigerian telecom companies are diversifying quickly to offset the decline in voice revenue. Since 2016, every Nigerian telecom company has intensified their data services.

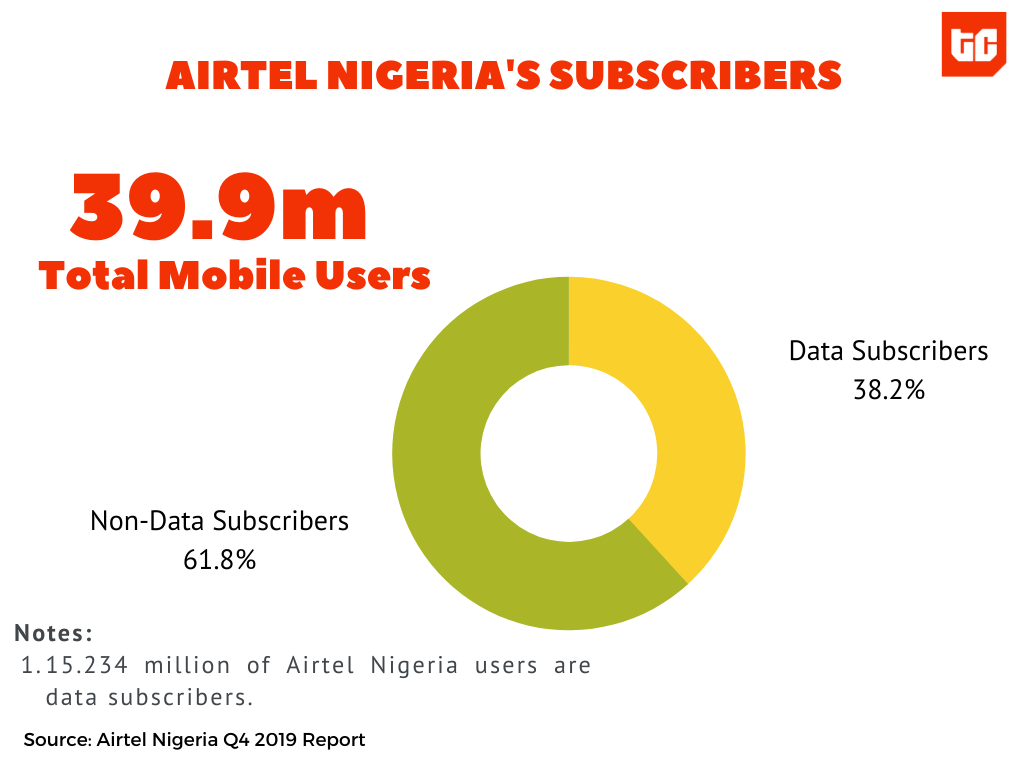

Broadband penetration is relatively low in the country. Only 38.5% of subscribers have 3G/4G broadband. This is small but represents a huge potential for telcos to deepen the penetration of data services and increase their data revenues.

Beginning with MTN, each now operates 4G services and are focused on scaling coverage across the country. MTN’s 4G service now covers 44% of Nigeria. Airtel 4G reached 100 cities by March 2019. Telcos predict that broadband penetration in Nigeria is going to double to 63% by 2023 thanks to a combination of affordable smartphones and improved 3G/4G efforts.

These efforts are beginning to have positive impacts on the outlook of operators. Mobile internet subscribers in Nigeria has increased from 64.1 million in January 2014 to 128.4 million in January 2020. MTN’s data revenue jumped from ₦45 billion in Q1 2019 to ₦86.1 billion in the same quarter in 2020.

Airtel is leading the pivot to data services in Nigeria. In addition to expanding LTE coverage, it has become the country’s second-biggest telco in terms of data subscribers. It added 24.5 million new data subscribers between 2014 and 2020; that’s higher than the 22 million new data users MTN onboarded during the same period.

Airtel has equally launched different digital offerings. One example is Airtel TV, a live TV and video streaming-demand app. The app is only available to its data subscribers. Airtel earns an average of $2.07 from each data subscriber annually.

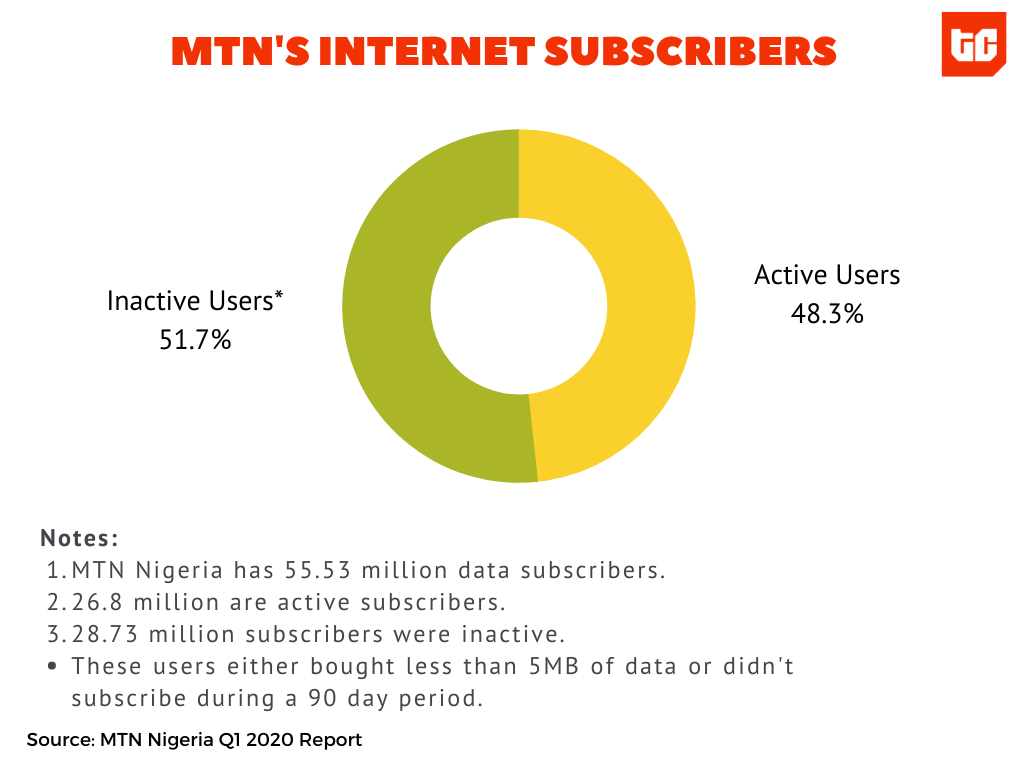

Despite these figures, active data subscribers for telcos are relatively small. Airtel has 39.9 million mobile subscribers, but its active data customers are 15.2 million. For MTN its data subscribers are 26.8 million, from a total pool of 68.5 million customers.

Telcos’ expansion to mobile money services

Beyond data services, telcos are expanding into financial services (fintech) like Safaricom’s exploits with M-Pesa.

In 2018, the Central Bank of Nigeria (CBN) announced the Payments Service Banking (PSB) licence, allowing non-finance companies to offer basic banking services.

The PSB is a limited banking license that wants to bring basic financial services to the unbanked population of Nigeria. It allows operators to issue bank accounts, debit cards, deploy ATMs, allows people to make payments, among a few other functions. However, operators will not be able to give loans or engage in foreign exchange operations.

Leveraging their network infrastructure and vast network of agents, telcos want to provide financial services to Nigeria’s rural and unbanked population. Two telcos, Globacom and 9Mobile, snapped up the PSB licence in 2019.

MTN, Nigeria’s biggest telco, secured a different licence, the Superagent licence in July 2019. With that licence, its agents can offer mobile money (MoMO) services like accepting deposits and sending money to users. With its 178,000 agents, MTN’s fintech revenue has grown to over ₦11 billion in Q1 2020.

Airtel and MTN already offer mobile money services in different countries. Airtel’s MoMo operation is live in its 13 other African markets and it is growing fast. Airtel Money revenue jumped from $103 million in 2017 to $234 million in 2019.

So while telcos come under pressure from online platforms, they are moving quickly to capture other revenue streams.