COVID-19 forces CBN to postpone plans to make the Microfinance Bank licence more expensive. Fintech insiders believe the revised licence could lead to mergers and acquisitions in the industry.

The Central Bank of Nigeria (CBN) has shifted the deadline for the implementation of the new regulations for Microfinance Banks (MFB). The new regulations were supposed to kick in on April 1 but will now be extended to April 1, 2021. CBN said the change is necessary as the coronavirus pandemic is having an impact on economic activities and threatening a global recession.

In a circular dated April 29, the regulator said: “in consideration of the impact of the coronavirus (COVID-19) pandemic on economic activities [CBN] has revised the deadlines for compliance with the minimum capital requirements for Microfinance Banks (MFBs) in Nigeria.”

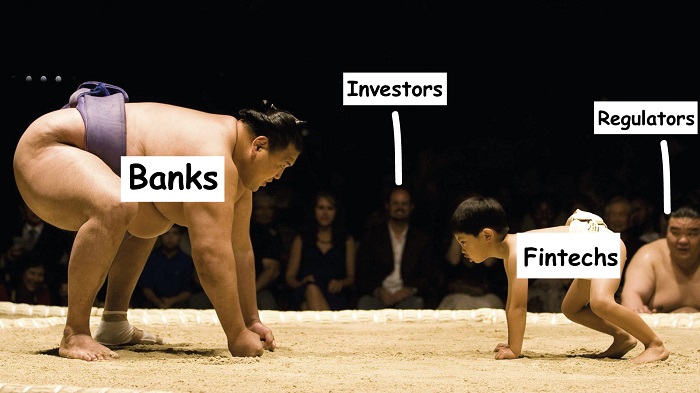

Fintechs and microfinance bank licence

Over the last two years, the CBN has been looking to tighten regulation for MFB licence holders. Nigeria has nearly 900 microfinance banks spread across different geopolitical zones, according to a February 2019 report.

Before the proposed 2020 change, MFBs were split into three categories: unit, state and national licence. Each category had its own capital requirements and geographical scope. The Unit licence had a ₦20 million ($51,696) capital requirement, but holders could operate only one office.

The state licence restricted holders to one state in Nigeria and carried a ₦100 million ($258,482) capital requirement. Meanwhile, the National MFBs could operate anywhere in the country but it did come with a steep ₦2 billion ($5.2 million) financial requirement.

A number of Nigerian fintechs have acquired MFB licences over the last few years. One explanation is Nigeria has no digital banking licence and there are no plans to develop one.

However, the MFB licence serves as a quick fix for fintechs looking to offer some banking services but are unable to raise the ₦25 billion ($59.5 million) required to secure a commercial bank licence.

Fintechs are snapping up the cheaper state and unit MFB licences. They are taking advantage of the location loophole thanks to their branchless nature and distribution over the internet.

Renmoney, one of Nigeria’s earliest fintechs of the last decade holds a State MFB licence. Meanwhile, a few years ago PiggyVest acquired Gold Microfinance Bank which owns a Unit licence.

VBank, the digital banking app, is operated by VFD Microfinance Bank, a Unit licence holder. Rubies Bank, another banking app, leverages the Unit licence owned by High Street MFB.

CBN increases the cost of the MFB licence

In 2018, CBN said it will raise the minimum capital requirements for each MFB licence category. It increased the capital requirement for the unit licence from ₦20 million ($51,696) to a whopping ₦200 million ($516,964). Meanwhile, the state licence was increased from ₦100 million ($258,482) to ₦1 billion ($2.6 million).

However, in March 2020, the CBN issued a revision. The unit licence was further divided into two: the rural and urban tiers. Each tier has strict location requirements and different capital requirements. The new rules were supposed to come into effect by April 2020.

The Rural Unit tier was pegged at ₦35 million ($90,468) and holders “shall operate only in the rural, unbanked or underbanked areas,” the CBN wrote

Meanwhile the Urban tier holders “shall operate in the banked and high-density [urban] areas,” the CBN wrote. But it requires ₦200 million ($516,964) minimum capital.

The Unit licences could be a problem for many startups operating with an MFB licence.

With their lean operations and finances, the original unit licence worked just fine for them. However, the new location rule is worrisome.

Operators have two choices. First, they may have to relocate their offices to rural locations. Although undesirable, it would qualify them for the less expensive Rural Tier licence.

The second option is to stay put in their current locations and pay the ₦200 million licence fee for the Urban Tier. Unfortunately, this sum is expensive for fintechs and could significantly constrain their finances.

Another challenge is, the CBN did not disclose what locations it considers “urban” or “rural”. So, for instance, it is unclear if a neighbourhood like Yaba in Lagos, with its agglomeration of tech startups, is defined as an urban area or a rural one.

Speaking to TechCabal, PiggyVest’s COO, Odunayo Eweniyi said while the location classification up to the CBN, there is already a rough idea of what areas could be classified urban.

“Ordinarily I think that fintech companies with HQs in Yaba will be classified as urban — just by the loose definition of what we classify as urban/rural in Nigeria.”

“[This] obviously raises the question of affordability,” she added.

But Eweniyi believes the challenge with the revised regulations is bigger.

“[S]hould we be lobbying for Yaba to be classified as rural, or should we be lobbying for the capital requirements to accommodate the needs of fintech companies?” she asked. “We’ll have to decide.”

That said, the postponement of the new MFB rules could be a good thing for fintechs. It should give MFB licence holders some time to resurge from the current economic challenges and possibly raise new funding to meet the new financial requirements of their licence.

Fintech insiders believe mergers and acquisitions could happen as more companies look to strengthen their positions. The coronavirus could also influence startups’ plans over the next year.

The pandemic has disrupted the global economy and is having an impact on investment decisions. While Nigerian startups are still getting funding despite the pandemic, investors are recommending they do their best to conserve cash to improve their runway.

For fintechs operating with an MFB licence, reducing costs is a route worth taking. While cost-cutting improves their operations, the revised capital requirement and division of the Unit licence creates a new headache.

“I think that due to the outsize effects of the coronavirus, and now these capital requirements, fintech companies will have to partner up and pool resources together,” Eweniyi suggests.