IN PARTNERSHIP WITH

Good morning ☀️ ️

Akwaaba Ghana! 🥳️

TechCabal is in Accra to meet key players and tell interesting stories in the tech ecosystem. We’d like to meet startup founders, investors, telecom executives, smartphone makers, policy makers, the whole nine yards. Who should we be talking to?

In today’s edition:

- Ghana Chronicles

- Fairmoney raises $42 million Series B

- Copia expands to Uganda

- TC Insights: Insufficient Funds

Ghana Chronicles

Yes, I’m in Accra.

I got into Ghana over the weekend. The airport had free Wifi and I could finally access Twitter without VPN. It sounds basic but the Lagos airport doesn’t offer free wifi and last time I passed through the airport in Cairo, I had to pay for the internet.

Fortunately Uber and Bolt work fine but there’s a twist. I’ll talk more about that later.

My first meal was Ghanian jollof rice – you know I had to. But what was more fascinating was that I bought it from a spot called Hi-Tech Fast Food. What are the odds? A tech journalist at a Hi-Tech… you get where I’m going with this.

There wasn’t anything techy about the shop but the pricing was interesting. The meals had only three price points: GH₵ 8, GH₵ 10 and GH₵ 15. It looked like that of a software as a service (SaaS) product, probably the inspiration the owner drew from tech.

A few hours into my stay, I ran out of my ‘complimentary’ Airbnb WiFi. It dawned on me that I had left ‘free unlimited internet’ at the airport and had entered the realm of ‘expensive capped’ internet.

You’ll be hearing from me during my stay here. See you tomorrow.

We’re looking for an experienced Product Marketing Leader to help Paystack acquire, engage, and retain Africa’s most ambitious businesses. Does this sound like you? Apply here →

FairMoney raises $42 million as it evolves into a digital bank

In Africa, are you really a lending app if your goal isn’t to become a digital bank?

Well, FairMoney definitely passes this test.

Last week, FairMoney announced a $42 million Series B round. The investment comes after FairMoney raised $11 million Series A two years ago and $16 million in total within its first four years.

Meet the Investors: The round was led by Tiger Global Management with existing investors like DST Partners, Flourish Ventures, Newfund, and Speedinvest participating.

Did you say Tiger Global?

Yes, the American investment firm has invested in 180 unicorns and added 81 companies to its portfolio this year.

This is its fourth investment in an African startup after iRoko (2013), Takealot (2014) and Flutterwave (2021). Notably, this is the first time the investment firm is investing in two African startups within a year. A sign of its renewed interest in the African continent after a long hiatus.

Back to FairMoney, how’s it doing?

From having a little over 100,000 users in its first year (2017) of operation, FairMoney has grown to have 1.3 million unique users who have made more than 6.5 million loan applications. Last year, the company disbursed a total loan volume of $93 million.

In less than a year of being in India, the company has processed more than 500,000 loan applications from over 100,000 unique users.

This year, FairMoney achieved one of its crucial goals by acquiring a microfinance bank license in Nigeria. The license allows FairMoney to operate as a financial service provider in Nigeria.

What’s next?

For FairMoney, it’s focusing on the Nigerian and Indian market where it faces stiff competition from other lending apps, digital banks and even traditional banks. Focus here means it’s building out more features to earn its digital bank status. It’s also working on a number of additional services including savings, stock trading, and crypto-trading products. These are subject to regulatory approvals.

In other related news. TeamApt raised an undisclosed Series B round.

Applications are now being accepted for Inclusive Fintech 50! IF50 provides key exposure for the most promising early-stage inclusive fintechs that have the potential to drive financial inclusion.

Learn more: https://bit.ly/IF50-2021

Copia expands to Uganda

![]()

Kenyan e-commerce startup, Copia Global has announced the expansion of its services to Uganda. It’s expanding after dominating the Kenyan market, where it claims to serve over one million customers.

The eight year old startup has raised $53 million in funding from investors, including LGT Lightstone, Endeavor Catalyst, and Goodwell Investments.

How it works: Copia Global operates a different model from most e-commerce platforms. Rather than depending on a website, it uses a network of agents spread across the country. When customers need an item, they visit an agent with a digital device to place their order.

After placing their order, the agent sends it to Copia Global, who processes and delivers it within two days when the customer returns to pick it up. By adopting this model, the company can serve people who do not own digital devices or cannot access the internet. Interestingly, it does all this using USSD technology.

While the startup has a website, it is mainly for customers who live in urban areas.

Big Picture: This model looks perfect for Uganda, where despite 47% of the population owning mobile subscriptions, only 12 million Ugandans use the internet. However, it’s not a new model, it’s been tried by Konga and Jumia already without much success.

Read more: Kenyan ECommerce Startup, Copia Global, Expands To Uganda

TC Insights: Insufficient funds

Nigeria is a country of contradictions. The super-rich live two steps away from those below the poverty line.

As Nigerian fintech startups are receiving millions of dollars in funding and the country boasts a booming e-commerce and payments industry, more than half of the country doesn’t have a bank account. The 2017 Global Financial Inclusion Database showed that only 39.7% of adult Nigerians have an account at a bank or financial institution.

While it’s a bit ironic, it’s not surprising. 33.3% of Nigerians are unemployed and many of those who work are paid irregularly or in cash. They don’t have enough money to keep in the bank or anywhere else.

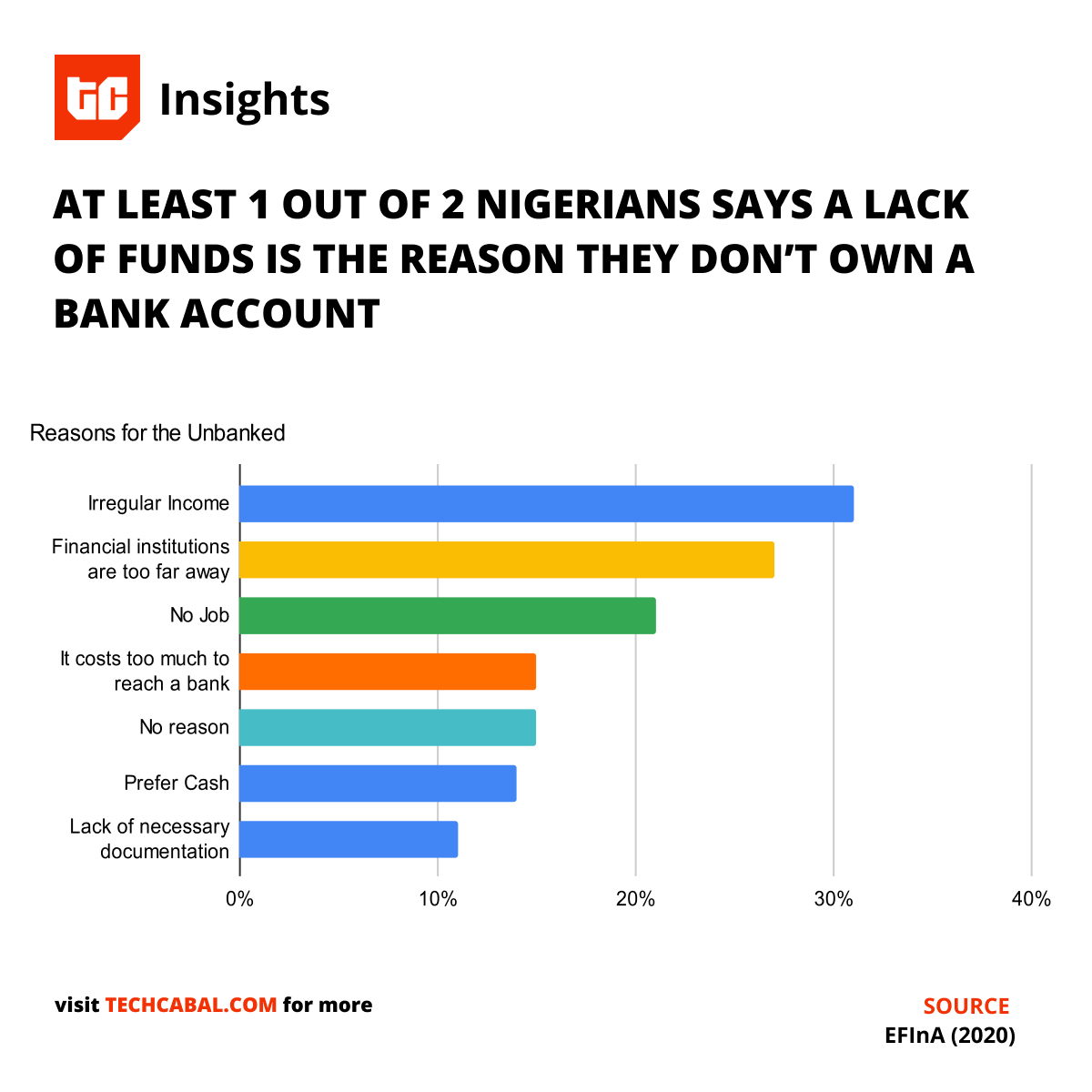

According to a report by EFInA, 3 out of 5 Nigerians say they don’t own a bank account because of insufficient funds. Some believed that banks were too far away. Nigeria has 4 bank branches and 17 ATMs per 100,000 adults, much lower than countries with high financial inclusion numbers.

There’s also the issue of identity. To open a bank account in Nigeria, a user would need to provide at minimum a government-issued ID card and proof of address, documentation that 73% of those without a bank account did not have.

A good number of the unbanked population don’t see any real need to get a bank account. For 15% of this group, a family member already had an account and 14% prefered using cash.

Over the last few years, Nigerian banks have begun to adjust to the needs of this population segment, for instance, by doing away with the minimum opening balance.

Still, the main barriers to financial inclusion – institutional exclusion, affordability, access, and low awareness – remain. Less traditional services like mobile money are quickly becoming the answer, as they circumvent some of the barriers to financial inclusion. Mobile money operators (MMOs) are more accessible, employing more than 260,000 mobile money agents across the country. It is no surprise that the number of mobile money users almost tripled from 2016 to 2019 and their number of transactions increased eightfold in that same time.

Although unconventional, mobile money operators seem better structured to fill the gap and serve the unbanked population.

Get all our reports here and watch videos from our events. Send your custom research requests here.

The Future of Commerce Conference

On the 30th of July, join us at the Future of Commerce where some of the world’s most influential leaders, entrepreneurs, and consumers will talk about the big changes coming to the world of commerce, from retail to payments to bitcoin, and more.

Confirmed speakers for the event include Ray Youssef – CEO, Paxful; Tracey Turner – Founder, Copia Global; Lauren Cochran – MD, Blue Haven Initiative and Asad Naqvi – MD, Apis Partners.

It will be a global media event with music, insightful conversations and an opportunity to network with some of the most brilliant minds in commerce.

Sign up now to get an invite.

JOB OPPORTUNITIES

Every week TechCabal shares job opportunities in the African tech ecosystem.

- Caret – Customer Success Associate

- TechCabal – Senior Editor (West Africa)

- SafeBoda – Country Manager

- Taeillo – Head of People & Culture