IN PARTNERSHIP WITH

Good morning ☀️ ️

After a decade, Microsoft announced that it’ll increase the prices of its office 365 subscriptions. The ~20% price increase doesn’t seem like much until you consider that there are over 300 million commercial Office 365 paid seats. I’ll leave you to do the maths. 🤯

In today’s edition:

- Softbank makes first African bet with OPay

- Nigerian Hacker offers disgruntled employees $1 million

- Julaya is digitizing payments in Ivory coast

- OnlyFans hits the reset button

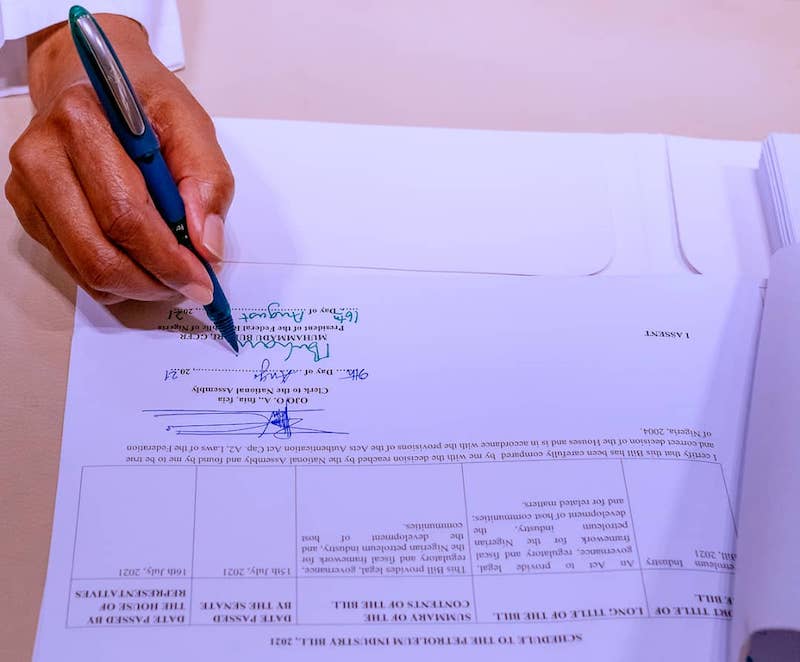

OPay raises $400m at $2bn valuation

Africa has a new unicorn! 🥳️

Yesterday, Opay announced a $400 million funding round valuing the Nigerian mobile-payments platform at $2 billion.

The round was led by SoftBank Vision Fund 2, marking SoftBank’s first investment in an African startup. Sequoia Capital China, DragonBall Capital, Redpoint China, Source Code Capital, SoftBank Ventures Asia, and 3W Capital also participated in the round.

This news comes three months after The Information reported that the company was in talks to raise “up to $400 million at a $1.5 billion valuation” from a group of Chinese investors. It’s also been two years since OPay announced two funding rounds in 2019 — $50 million in June and a $120 million Series B in November.

Backstory: In August 2018, when OPay launched it was processing about ₦20 million ($51,544) a month, and by the end of the year the fintech platform had processed ₦11 billion ($28.4 million). Now the company’s monthly transaction volumes exceed $3 billion per Bloomberg. In addition to expanding in other African countries, OPay is focused on the Middle East as well.

Zoom out: 2021 has been a great year for the African tech ecosystem, at this rate the continent is going to surpass its 2019 all-time high record of $2.1 billion raised in venture capital funding.

SoftBank joins a growing list of leading investors like Dragoneer, Sequoia, SVB Capital that have cut their first checks in African ventures this year.

Read more: Led by SoftBank, Nigeria’s OPay raises $400m at $2bn valuation

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

Nigerian Hacker offers disgruntled employees $1 million to help out

Would you help a hacker blackmail your employer (if you’re an employee) for a $1 million cut? I asked some of my colleagues this question and the responses were quite hilarious.

Well, this Nigerian Hacker who is also building a social network platform recently offered some employees this opportunity.

Backstory: According to cybersecurity firm Abnormal Security, on August 12, they intercepted a number of emails sent earlier in the month to some of their customers. The emails came with a $1 million offer, in bitcoin, to assist in a ransomware scheme. Over the course of five days, the team at Abnormal Security engaged with the hacker via Telegram pretending to be an employee that was willing to cooperate.

How Ransomware works: Ransomware is a form of malicious software (malware) that encrypts a victim’s files. It converts the information in the files into a secret code that hides the information’s true meaning.

Historically, ransomware has been delivered via email attachments or, more recently, using direct network access obtained through things like unsecure VPN accounts or software vulnerabilities.

Once the malware has been deployed, the victim loses access to their files and then the attacker demands a ransom from the victim to restore access to the data upon payment.

Victims of ransomware attacks are shown instructions for how to pay a fee to get the decryption key. The ransom in question can range from a few hundred dollars to millions, often paid to cybercriminals in Bitcoin.

Zoom out: In yesterday’s newsletter Timi expressed concern about hackers and the Nigerian government being able to gain access to messages. In this article, I share the details — backed with screenshots — of a hacker attempting to do so.

Join the Future Africa Collective – an exclusive community of investors who invest in startups building the future of Africa. With a $1,000 annual or a $300 quarterly subscription fee, you get access to invest a minimum of $2,500 in up to 20 fast-growing African startups each year. Learn More

JULAYA IS DIGITIZING PAYMENTS IN IVORY COAST

Grace Kouassi, an Ivorian construction retailer, goes through a lot of hassle when she has to pay employees their monthly salaries.

Her challenges are not due to a lack of cash; they stem from how best to disburse the funds. She has three options – use bank transfers, mobile money, or cash. In countries like Nigeria or South Africa, the first option, to an extent, is effective for business payments but not in Ivory Coast.

Charges on real-time gross settlement (RTGS) interbank transfers can be as high as CFA17,000 ($30) and most times, the transfers take longer than expected – up to three days instead of a few hours – while also being prone to transaction issues.

But these challenges are not limited to SMBs; they affect government institutions and even multilateral development organizations.

Enter, Julaya

Founded in 2018, Julaya is a startup that provides businesses in Ivory Coast with mobile-based digital accounts to make money transfers.

Julaya solves this pain point by helping businesses disburse money electronically to several mobile money and mobile banking wallets via a single platform, faster than wire transfers or cash transactions.

Before launching Julaya, co-founders Mathias Léopoldie and Charles Talbot worked on the expansion of LemonWay – a marketplace payment solution – into Burkina Faso and Mali.

It was during their time at the France-based fintech firm they were introduced to the world of mobile money in francophone Africa and realised how businesses in Ivory Coast could reach a huge unbanked population faster via mobile phones.

Fast Forward to July 2021, Julaya processed over $2 million monthly for 50 customers.

Unleash your summer passion with style! Whether you are being sun-kissed at a beach abroad, journeying with friends to explore the beauty of Nigeria or simply holidaying at home, we have you covered.

Please click here to find out how we can make your summer even more exciting.

OnlyFans hits the reset button

Sex sells but for how long?

This question has been on my mind since OnlyFans, a content subscription service that has amassed more than 130 million users, announced it would ban sexually explicit content starting from October 1.

The service is popular with and commonly associated with sex workers but it also hosts the work of other content creators, such as physical fitness experts, musicians, and other creators who post regularly online.

The reason? The first is related to a policy shift from credit card companies that might restrict payments related to sex content. On the other hand, according to Axios the company is struggling to raise money from investors who aren’t keen on being associated with X-rated content.

As per Axios, the company has paid out a whooping sum of $3.2 billion to its creators since its inception and recorded a $375m revenue in 2020.

Other notable stats:

More than 300 creators earn at least $1 million annually.

Around 16,000 creators earn at least $50,000 annually.

More than seven million “fans” spend on OnlyFans each month.

And what do the Creators/Fans think?

Hmmm. Several OnlyFans creators are frustrated and angry at OnlyFans’ announcement, stating that the decision will cost the creators their livelihoods and networks. Some of them lost their jobs during the pandemic and turned to sharing explicit videos of themselves on OnlyFans to help pay the bills.

For the fans, they’re predicting it’ll lead to the end of the platform. I guess OnlyTime will tell.

KB4-CON EMEA is a free, highly engaging, cybersecurity-focused virtual event designed for CISOs, security awareness and cybersecurity professionals in Europe, the Middle East and Africa.

The event will be on Thursday, September 23rd and features keynotes from two of the most well known figures in cybersecurity. Mikko Hyppönen will cover how our global networks are being threatened by surveillance and crime, and how we can fix our technical, and human, problems. Kevin Mitnick will reveal social engineering tradecraft and insights and wow you with a live hacking demonstration.

You can register here.