In Nigeria, fintech startups are increasingly taking on incumbent banks by offering people and businesses a mobile-first, personalised, and often cheaper set of banking services. Lagos-based Kredimoney, founded by Afolabi Abimbola and Samuel Orji, is one of such startups.

Over the past few months, the Kredi team has been building a fully-digitised bank (Kredi Bank) in stealth, with a microfinance license from the Central Bank of Nigeria (CBN). After executing a pilot phase that saw the platform gain over 8,000 users across the country, the startup is now poised for a full launch.

Kredi Bank is yet another digital-first bank to operate in Nigeria, where the neobank wave is taking shape. The likes of Kuda, Fairmoney, Sparkle, and Brass already ply their trade in the country as they seek to take advantage of the distrust between traditional banks and Nigerians.

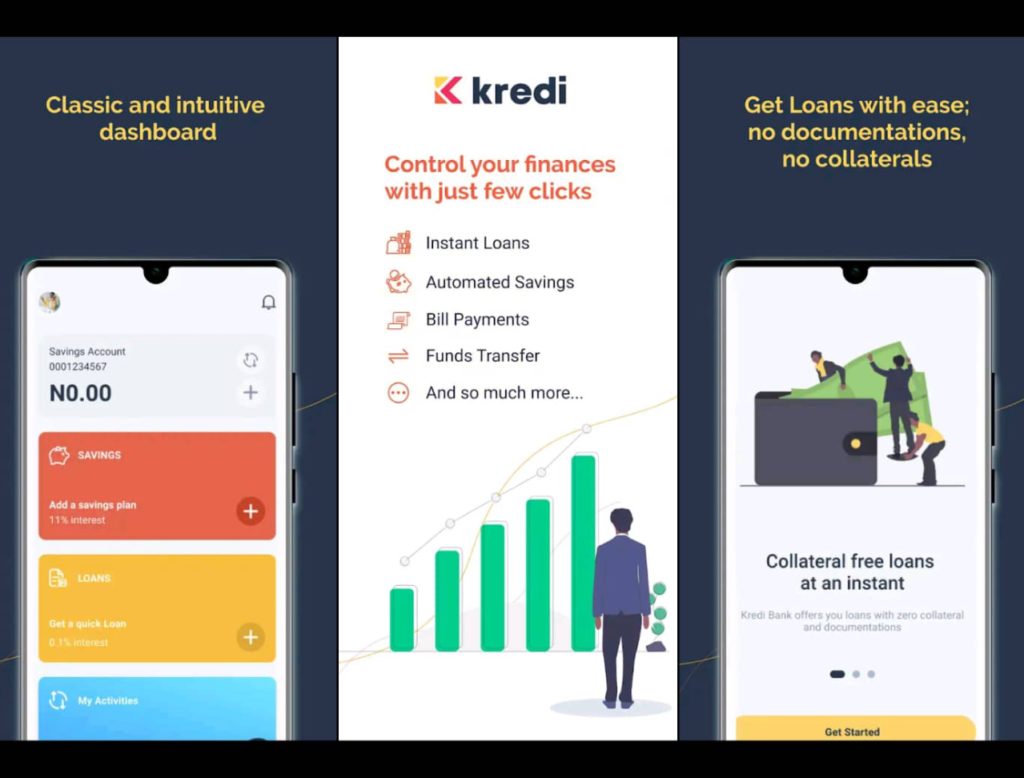

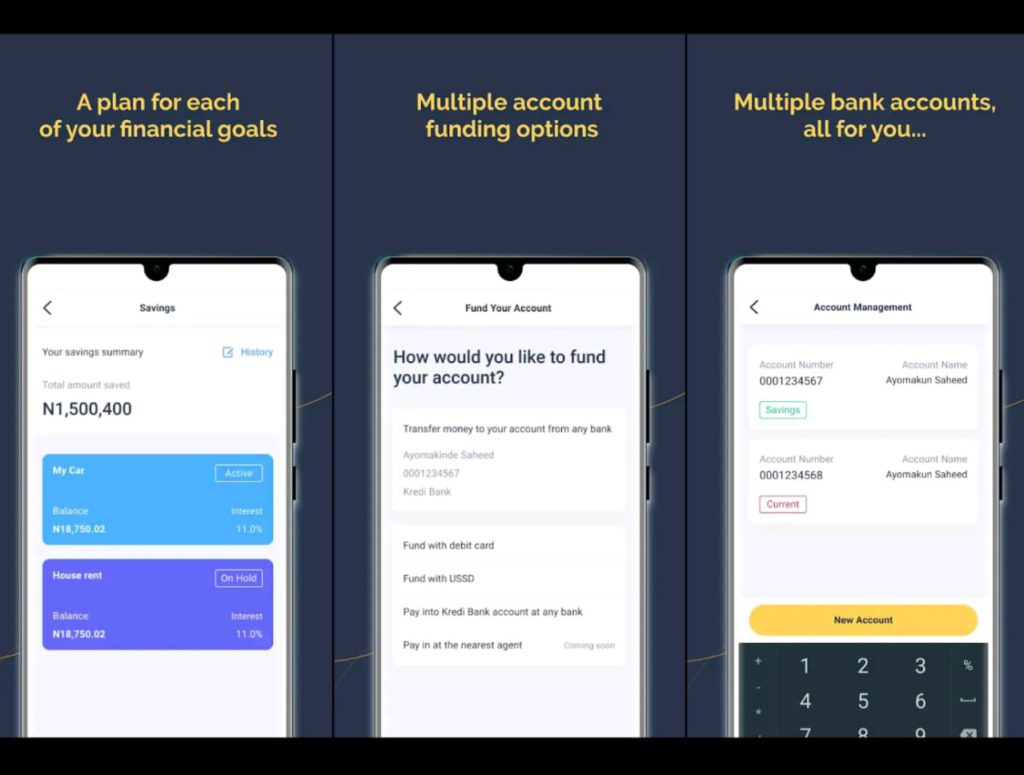

Like its counterparts, Kredi Bank offers services such as account opening, savings (with a 20% interest rate per annum), loans, bill payments, top-ups, spending breakdown, and requesting or sending funds, as it looks to attract customers in the mass market. In addition to these features, Kredi’s investment product, Trickle, allows users to invest while they spend.

Abimbola further explains that the startup is built to serve as a “one-stop-shop” bank that meets the financial needs of not just individuals, but also corporates and small and medium enterprises (SMEs).

For SMEs, Kredimoney is creating a platform that provides cash management services, invoice discounting, as well as asset financing and credit facilities at competitive interest rates, after having profiled and pre-qualified them.

“We’re focused on smoothly ushering Nigerians into the future of banking with innovative products and convenience,” the founder and CEO told TechCabal. “But unlike others that specialise, we aim to be a one-stop-shop bank for both people and businesses.”

Another marked difference that separates Kredi Bank from its peers, or competitors, is its offline customer acquisition strategy. Knowing well that not all the millions of bank account holders have smartphones, the startup has partnered with two mobile payment companies, which gives it access to over 20,000 agents.

These agents are equipped with Kredi Bank point-of-sale (POS) devices via which they can onboard users and access the same set of services available on the mobile application. In addition, Kredi Bank provides funding to support the agents’ existing businesses with the mobile payment companies acting as guarantors.

Payment infrastructure for other fintechs

The business-to-business (B2B) side of Kredi’s operations also includes providing API-based payment infrastructure services to fellow fintech startups that are either not fully licensed or don’t have the technology to carry out mass payments.

“There are several fintech companies without the capacity or access to the NIBSS Instant Payments (NIP) to process payments on behalf of customers,” Abimbola said. “So through our API, we provide them the platform to carry out their transactions seamlessly for a fee.”

The startup has an array of partners that include Interswitch, Stanbic IBTC Bank, AXA Mansard, Chipper Cash, and Crowdyvest. There is also a decent list of fintechs using Kredi’s payment infrastructure services.

“Being fully licenced allows us to offer as many products and services,” Abimbola said. “Our partnership with AXA Mansard enables us to give out free HMO to our customers as well as microinsurance products.”

Abimbola’s 15-year career—spanning the telecom, mobile payment, consumer lending, and digital banking industries—has been key to building a fintech startup with a multifaceted business model.

He spent part of his early years at Funds and Electronic Transfer Solutions (FETS) Limited, a pioneer of mobile payments in Nigeria.

“It was a great opportunity for me to be part of a pioneer of mobile payments in Nigeria,” Abimbola recalled. “I could see how to open a financial account in a different way that served those at the base of the pyramid.”

His professional experience includes management-level positions at Renmoney and he also held director-level positions at Kuda Bank and OPay.

Kredimoney co-founder, Orji, is a finance and investment professional with a legal background. His experience includes time in an international law firm, investment banking, and private equity. His most recent position is with a US-based emerging markets-focused VC investor, where he has been responsible for leading fintech investments across sub-Saharan Africa.

By this time next year, Abimbola expects Kredi Bank to have onboarded around one million individual users and 30,000 SMEs.

An expansion into three other African countries is also on the cards for 2022, a vision that will be bankrolled by a series of planned funding rounds after having bootstrapped the startup so far.

According to the duo, Kredi has grown faster than anticipated and the team is looking to scale quickly. “We got to 8,000 users without any marketing spend,” Orji said. “Customers clearly like our product. And we have big-name players looking to partner with us.”

Abimbola adds that Kredi is at “an inflection point” in its growth journey. “We’re on the verge of opening up our pre-seed round and already have strong interest from investors who are amazed by the traction we have built without external funding.”

There’s a lot of neobank activity going on in Nigeria as several fintech companies build services to serve a rapidly-expanding market. But the Kredi team isn’t fazed by the competition, with Orji holding that market fundamentals support additional players.

“The Nigerian market is big and there are parts that are still not being served,” he said. “It’s a question of simply targeting those parts and designing products that are unique. This is what Kredi is doing.”