The collapse of DealDey, a Nigeria-based online deals aggregator, three years ago, laid bare the difficulty of operating an internet-based commerce business in the country, especially with the similar failures of Efritin and OLX at the time.

Much like Groupon, DealDey connected customers with merchants that offered goods and services at slashed prices, a proposition that appealed to a largely low-income population. In some cases, consumers could purchase items at discounts of more than 90%.

Founded in 2011 by Sim Shagaya, DealDey was a precursor for many e-commerce platforms in the country. And at its peak, the startup could claim to be sub-Saharan Africa’s largest online deals platform.

It had more than 400 employees, over one million users, 15,000 active merchants, and 20,000 verified listed businesses, raised millions in equity funding, and looked set to play a big role in the Nigerian e-commerce space for decades to come.

That was before things went south. As Nigeria’s 2016 economic recession bit hard, DealDey cut over 60% of its staff and reportedly owed merchants for months. In less than a year, the platform was sold to Ringier Africa Deals Group reportedly for $5 million, rather than the $75 million at which it valued itself, before eventually shutting down in late 2018.

So much has changed in the country since then. For one, more Nigerians now shop online, and arguably, younger populations in urban areas have more spending power. Interestingly, some of DealDey’s former managers—including Mohammed Abubakar, Juwon Ajao, and Joy Amadi—now have an opportunity to take another shot at building the continent’s largest online deals platform, but this time under the ThankUCash brand.

A multi-merchant rewards platform

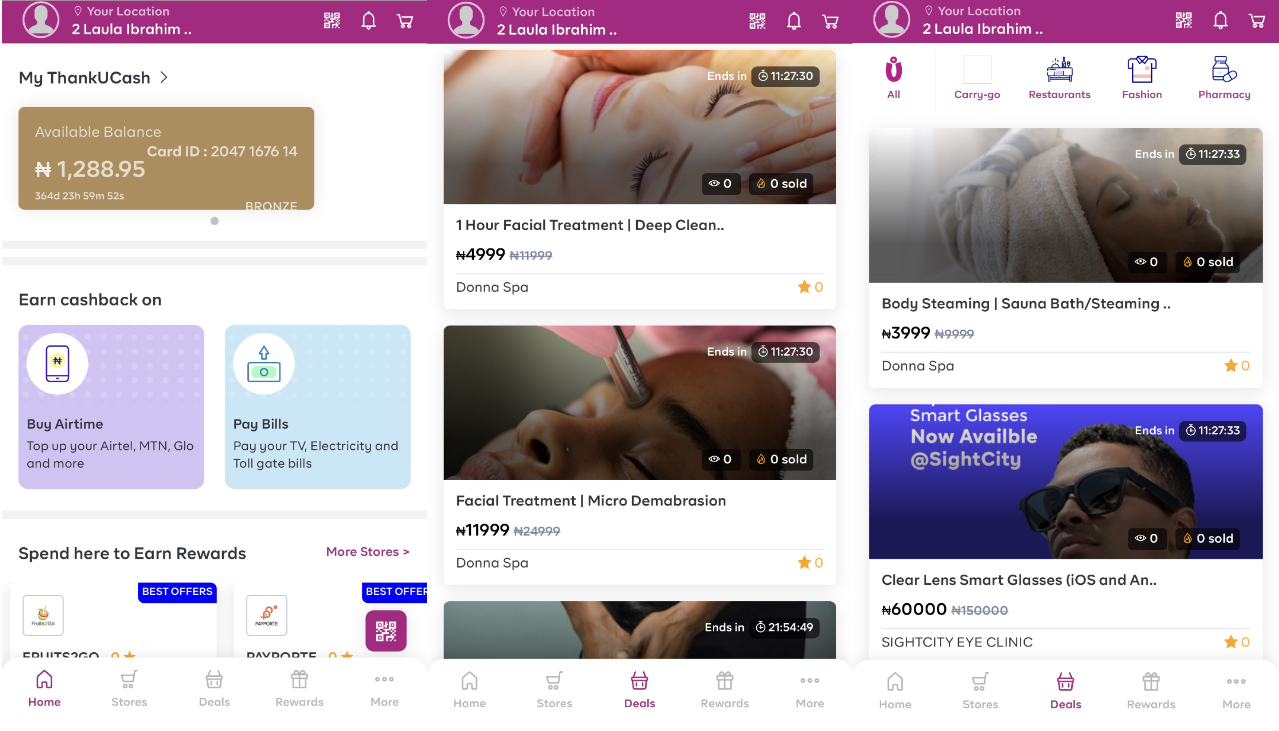

Since its founding in 2018, ThankUCash—a service that helps companies grow customer loyalty and increase revenue with data analytics and customer rewards—has become a household name among bargain hunters.

The platform is the brainchild of Connected Analytics, a company founded by Simeon Ononobi (CEO), Suraj Supekar (CTO), Madonna Ononobi (COO), and Harshal Gandole (Senior VP). The founding members of ThankUCash, a kind of rewards platform hardly seen in African markets, were inspired by the need to address a significant market gap Simeon Ononobi and his team observed: the lack of consumer data and loyalty among businesses.

“We saw that there were no records on buyers, which affected customer retention as people only bought what they needed and never came back. So we moved to solve this problem, and that’s what brought about ThankUCash,” he told TechCabal. “We also realised the need to make consumers happy and excited about spending.”

ThankUCash enables merchants to give rewards (in the form of cashback, discounts, and points) seamlessly to their customers via a data analytics-powered reward system. Within the ThankUCash app, customers can use the rewards to buy deals, airtime, pay for utility bills, and cable TV subscriptions.

By giving such rewards, the startup hopes to help build customer loyalty and increase revenue for merchants while also collecting customer data for analytics, targeting, and decision-making purposes.

In this sense, Connected Analytics generates revenue by using one of the most common business models available: being a middleman. It charges a 30% commission on customer rewards, a monthly SaaS fee from merchants using its predictive analytics platform, and an upfront partnership fee for partners looking to use the platform, and commissions on future transactions.

As of March this year, ThankUCash had over 500 merchants it was helping to grow their businesses. These include Trebet, Dana Airlines, Gleeword, ENYO Retail, MedMart, PriceRite, Choplife, and CET Energy, among others. The startup claims to have also secured strategic partnerships with major banks and financial institutions in the country, such as UBA, Sterling Bank, First City Monument Bank (FCMB), and Wema Bank.

With 734,000 users, 90,000 of which are active monthly, the multi-merchant rewards platform has clearly gained significant traction across key indicators so far. But Connected Analytics is not resting on its laurels as it plans to add a new segment to its business offerings: Groupon-like deals.

Succeeding where DealDey struggled

By expanding its service to include daily deals, Connected Analytics is stepping into a territory where very few Nigerian companies play, ever since the collapse of DealDey three years ago. Some platforms currently offer deals but not on the same scale as the pioneering startup did.

The decision to re-assemble the DealDey team, according to Simeon Ononobi, was necessitated by the need to tap their experience in achieving the startup’s goals. “We realised we couldn’t do this on our own and resorted to bringing on the team that had done it in the past,” the CEO said.

But how does the company plan to avoid the pitfalls that brought down DealDey after seven years of operations?

DealDey’s collapse was based largely on the economic downturn of 2018 when the country’s budget was approved late and consumers’ buying power was affected. Customers wanted to get the same price points and same value. “With thin margins, we needed to sell more to cover overhead, and at that particular time, it was a tall order,” Abubakar said.

ThankUCash intends to leverage its existing analytics capabilities in order to do things better now, according to Simeon Ononobi.

Abubakar, who was the city manager at DealDey, and now serves as ThankUCash’s deals manager, believes the surge in online commerce activity among Nigerians bodes well for the foray into daily deals by Connected Analytics.

“Things are different now compared to when DealDey shut down. More people are inclined to shop online and e-commerce numbers are increasing,” he said. “Also, there are many online platforms doing food delivery, event ticketing, hotel bookings, and other professional services that were not there three or four years ago.”

Connected Analytics plans to hire even more ex-DealDey staff and has also poached top employees from companies like KPMG, Jumia, and Econet Media.

According to Simeon Ononobi, some failed businesses could have had better chances of survival if they had a better knowledge of their customers and leveraged that data to make decisions. ThankUCash’s analytics platform solves this problem, and with the addition of the daily deals vertical, it can help businesses, from banks to airlines and hotels, boost sales.

Take a hotel with a 70% occupancy rate during holidays, for instance. Instead of having vacant rooms while overhead costs remain constant, the company could salvage some revenue by offering discounts on bookings via ThankUCash.

Simeon Ononobi is bullish on ThankUCash’s chances of becoming a super aggregator of such deals, helping businesses grow and consumers access bargains. “It’s huge,” the CEO said of his company’s ambitions in the online deals space. “We’re planning a lot of things and intend to cover a wide range of product categories like DealDey did.”

For Abubakar, he and his former (and now current) colleagues have a chance to “find our mistakes, fix them, and then innovate more” at ThankUCash.

If you enjoyed reading this article, please share it in your WhatsApp groups and Telegram channels.