Hey, it’s Michael, and I have a question for you.

What do Alaba International and Onitsha Main Market in Nigeria, Karatina Open Air Market in Kenya, and Jemaa el-Fnaa in Morocco have in common, apart from being some of Africa’s largest markets?

No need to spend time guessing. I’ll tell you. They are home to thousands of merchants that run day-to-day brick-and-mortar operations and transact in huge volumes of cash, with billions of dollars in turnover yearly.

These businesses have stayed offline for the most part of their existence, largely relying on pen and paper or ledgers for bookkeeping and recording important trade data. Some of the traders even rely on just their brains to keep track of things.

You don’t need to be a genius to tell that this way of running a business can be time-consuming, error-prone, affect cash flow, business growth and limit chances of a small business securing bank loans or other SME financing.

Assessing the opportunity, and challenges

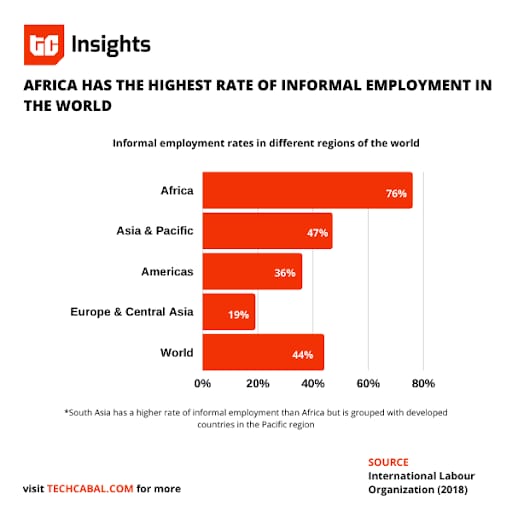

Markets like the aforementioned exist all over Africa and account for up to 90% of businesses on the continent.

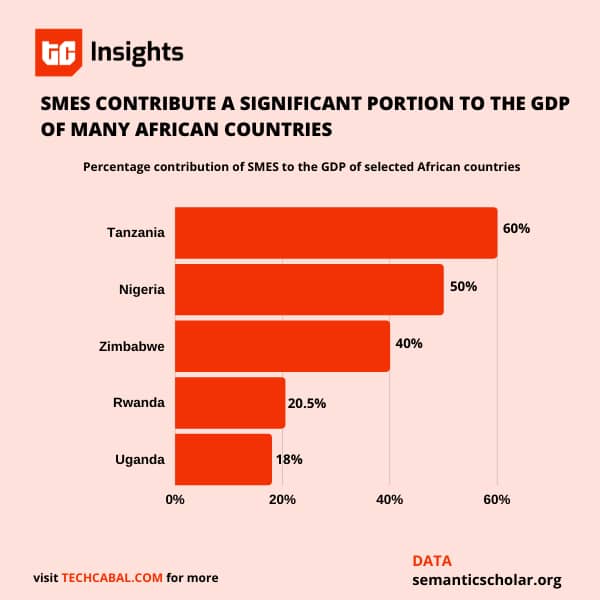

As such, there’s a significantly large market of non-digital, small and medium enterprises (SMEs) waiting to be tapped by Africa’s budding technology startups.

And they’re already moving fast to close this gap.

Doroki, Sabi, Alerzo, TradeDepot, OmniBiz, and Sokowatch are some of the players creating digital products for the different segments of SME operation in Africa’s large offline markets.

Venture capitalists are also happily backing startups playing in this space. This year, millions of dollars in VC funding have been poured into such startups: Kippa’s $3.2 million and Bumpa’s $200,000 pre-seed rounds, Sendbox’s $1.8 million, and Morocco-based Chari’s $5 million seed round are just some examples.

Layering digital solutions on offline SME activity—from payment collection and bookkeeping to inventory management and order fulfilment—can create more efficiency and scale in merchant operations, and generate returns for the startups and venture backers while positively contributing to the African economy.

On paper, it’s a clear win-win for all parties. But the path to winning is anything but direct.

Without industry data available, it’s near impossible to measure the uptake of these digital solutions among SMEs but, unsurprisingly, driving adoption is a key roadblock for players.

At least eight out of 10 merchants I spoke to before writing this piece confirmed that skepticism exists about digitisation among SME owners.

“I’m doing this business just to survive and don’t care about all that (digital tools),” one entrepreneur said. “I don’t think I can afford to pay some fee every month for recording something that I can write in a book,” another quipped.

How do you get an SME owner who set up their business to survive, and is just getting by in a harsh economy, to pay for a digital tool they’d have to use for long before seeing returns?

These issues are in addition to well-documented, continent-wide challenges—such as the lack of access to credit and broadband—that have prevented many SMEs from making the digital transition.

PARTNER MESSAGE

|

| Welcome millions of new customers from across the world by accepting payments for your business by accepting Discover Global Network cards on Flutterwave. Create a Flutterwave account for FREE, here. |

How can startups approach SME digitisation?

In spite of the challenges, huge strides have been recorded in efforts to deepen the use of digital tools among informal SMEs in Africa.

Startups like Sabi and Sokowatch have been able to sign on thousands of merchants on their respective platforms.

But for every thousand merchants onboarded, millions more remain offline, with many skeptical.

A startup founder in the space, who chose to be anonymous, confirmed that it can take a lot of effort and time to convince a small business owner about the benefits of digitisation.

And due to the high rate of digital illiteracy among SME owners, resources are sometimes expended on training programmes to teach skills necessary for digital adoption.

Finding the right path to the mass market is crucial for startups. This, they can achieve, by taking time to study the behaviour patterns of the business owners they already or wish to serve.

Even with that, startups are bound to hit some rough spots as it would likely take many years to generate enough revenue from merchants or see meaningful returns on customer acquisition costs.

But that’s what venture business is about: betting on potential. And startups, with their nimble approach to product development, remain the best bet to digitise the offline opportunities among SMEs in Africa.

PARTNER MESSAGE

|

| Are you a whiz? Apply for the Adamantine Energy LNG Fuel Stove Hackathon, create the most innovative solution for a portable and safe LNG stove. The winner will receive a monetary award of 1,000,000 naira as well as the opportunity to design the product. Register for free |

Have a great week

Thank you for reading the Next Wave. Please share today’s edition with your network on WhatsApp, Telegram, and other platforms, and reply to this email to let us know what we can be better at.

Subscribe to our TC Daily Newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.