November 29th 2021

The Next Wave provides a futuristic analysis of BizTech and innovation in Africa. Subscribe here to get it directly in your inbox on Sundays at 3 PM (WAT).

Hey everyone, it’s Koromone. I hope this newsletter edition finds you avoiding the Omicron variant like the way US billionaires avoid paying taxes.

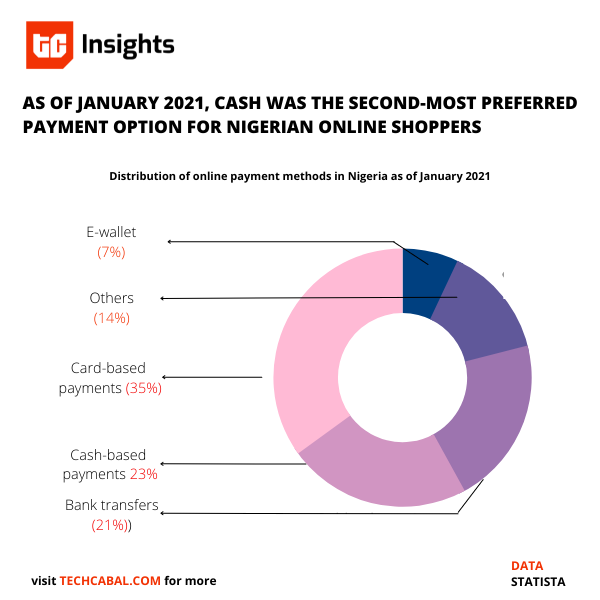

Until the much-anticipated launch of the eNaira, Nigerians dealt with Naira in one form: paper. And try as the CBN did to enforce a cashless policy in the country, Nigerians were not having it.

Primarily because Nigeria is a low-trust society, which means we prefer to exchange currency in a tangible way. And also, cash is still king in Africa. The cashless policy was introduced in 2011 and piloted in Lagos a year later. Since 2012, commercial banks and a few financial institutions, like Paga and TeamApt, have set up thriving agency banking businesses and POS shops across the country.

Agency banking and POS shops are driving a cash-friendly economy, the total opposite of what CBN set out to do when they introduced it more than a decade ago.

“Our economy uses too much cash for transactions for goods and services, especially for buying and selling. This is not how it is done in other progressive countries of the world where there are other payment options like; Debit and Credit Cards, Bank Transfers, Bank Direct Debits, Automated Teller Machines (ATMs), and even Mobile Phone Money.” – The Central Bank of Nigeria.

Since the cashless policy was introduced to reduce, and not eliminate, cash usage, agency banks can drive financial inclusion using grassroots methods.

Despite the CBN-imposed fees and limits designed to control how frequently Nigerians deposited and withdrew cash, Nigerians remain undeterred. They refuse to change their relationship with paper money.

I’d like to give a special thanks to Adebiyi Aromolaran for bringing some guidance and insights into today’s edition. Adebiyi is currently Head of Africa Expansion at Dlocal, a payments company building solutions for emerging markets. He also oversaw expansion and compliance at Flutterwave a few years ago.

Let’s talk about the potential of the eNaira.

Partner Message

Welcome millions of new customers from across the world by accepting payments for your business by accepting Discover Global Network cards on Flutterwave.

Create a Flutterwave account for FREE today.

Why eNaira? Why not eNaira?

“The eNaira is a gamechanger, but its impact won’t be felt immediately. The CBN still has time to think through several aspects of the currency’s unique selling point (USP) and present its value in a clearer way. Where remittances inflow is concerned, one way the CBN can drive innovation in that sector is to replace cash pick-up with eNaira wallet credit.” – Adebiyi Aromolaran

ICYMI: Two weeks ago, Davido, a widely popular and influential Afrobeat singer and entertainer, tweeted his Wema Bank account details and asked his friends to donate 1 million naira ($1,720) to his birthday fund. It was an audacious tweet, considering Davido’s wealth status and fame; but in true social media fashion, the tweet went viral and set off an unconventional chain of events:

- Davido received over ₦150,000,000 (~346,000) in 24 hours.

- Wema Bank sent a few of its team members to visit Davido, who was in Dubai when he sent out the tweet.

- ALAT, a digital bank powered by Wema Bank, tweeted for the first time since Twitter was banned in Nigeria.

- Davido released a statement revealing plans to donate 100% of the fund to orphanages across Nigeria.

As with everything that involves money and Nigerian Twitter, responses to Davido’s demand were peppered with astute commentaries about ethics and wealth, and witty jokes. Like this one from Fisayo Fosudo, a Nigerian visual storyteller and video creator:

In a perfect financial situation, Davido should have used his eNaira wallet. But there are still several growing concerns around the validity of the eNaira and why the CBN is the custodian of the electronic currency.

Partner Message

The SCIP Africa team will host a physical Boot Camp for the selected startups in Kigali, Rwanda on the 22nd of November to 26th of November, 2021. Find more information about #SPICAfrica here.

‘Same Naira. More possibilities’

“Same Naira. More possibilities” – this tagline can be found on the eNaira website. Trite as it is, I wonder how many Nigerians would agree that the eNaira comes with many possibilities.

Has the CBN done an excellent job of explaining the value of the digital currency? Or how important it is for a large chunk of Nigeria’s financially literate population to loosen their grip on the paper naira and adopt its digital equivalent instead?

In order for us to fully appreciate the value of the eNaira, we need a better understanding of how the digital currency works and why it matters to individuals, merchants, vendors, and financial institutions.

“What CBN has done with the eNaira is that they’ve closely mirrored how commercial banks manage KYC requirements for new customers. Opening an eNaira wallet for individuals comes with a three-tier process; the same rules still apply, regardless of the naira’s form,” said Aromolaran on a call with TechCabal.

“Let’s not forget the currency is still naira, paper or electronic. And the only way to purchase any amount of eNaira requires you to get it through your bank. At any point of the exchange, eNaira customers are swapping one form of naira for another. The truth is, the CBN hasn’t clearly defined its own role within the digital currency ecosystem. They are delving into waters they aren’t familiar with and have to work within their internal limitations and capabilities as regulators.”

Setting sentiments aside, there are intelligent and innovative people who have been employed by the CBN. And contrary to unpopular opinion, some CBN regulators and operators aren’t at war with technology’s growing popularity within Nigeria’s fintech ecosystem. But the apex bank is also responsible for creating and awarding licenses to emerging and established financial institutions in the country. Banking with regulators is a complicated marriage for many Nigerians.

Have a great week

Thank you for reading the Next Wave. Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and reply to this email to let us know what we can be better at.

Subscribe to our TC Daily Newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Koromone Koroye, Managing Editor, TechCabal

newsletter