IN PARTNERSHIP WITH

Bonjour! ☀️ ️

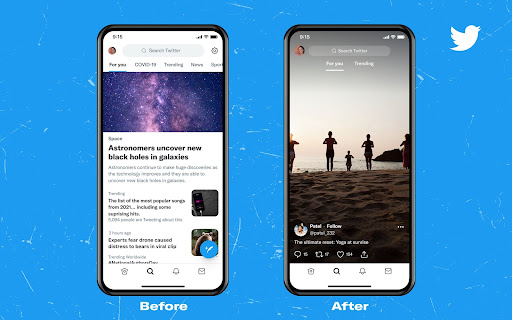

Twitter is testing TikTok style videos for its platform. 😒

According to a tweet from the official Twitter Support account, the Explore page is getting a downgrade an upgrade, a simplified interface that emphasizes one tweet or video at a time instead of showing a crowded newsfeed.

Seems like they’re trying out the less is more mantra.

In today’s edition

- eNaira is breaking ground for crypto innovation in Africa

- Kwara is building Africa’s first credit union-powered neobank

- Unifying Africa’s communication industry

- TC Insights: Agritechs need funding

BREAKING GROUND FOR CRYPTO INNOVATION IN AFRICA

Central banks in Africa are looking to draw lessons from Nigeria’s turbulent but ground-breaking launch of the continent’s first state-backed digital currency, the eNaira.

Tanzania announced last week that it plans to unveil its own digital cash to slash transaction costs and boost citizens’ participation in the formal financial system.

In September, the central bank of South Africa partnered with the Singaporean, Malaysian, and Australian central banks to test the interoperability of cryptocurrencies in cross-border payments, in a major push to mainstream digital currencies in Africa as legal tender.

It is not clear when or whether South Africa will formally introduce a digital currency, but there are signs the government is taking it seriously, especially after the Nigerian launch.

Last month, Kenya’s central bank governor, Patrick Njoroge, revealed that the regulator is also exploring the use of a Central Bank Digital Currency (CBDC) to settle cross-border payments.

“We see the benefits would be more cross border…” said the Njoroge. “The issue is not to do it first, the issue is to do it right,” he said on the sidelines of a virtual Afro-Asia Fintech festival.

Blockchain data provider, Chainalysis, projects more states in Africa are likely to develop digital currencies, even if just to avoid being “left out”.

In fact, Tanzania has cited not being left out as one of the reasons for the planned introduction of a CBDC.

“To ensure that our country is not left behind the adoption of central bank digital currencies, the Bank of Tanzania has already begun preparations to have its own CBDC,” central bank Governor Florens Luoga told a finance conference in the capital, Dodoma.

According to Chainalysis, CBDCs are both similar to and distinct from existing cryptocurrencies. “They are paperless, like bitcoin, and backed, like stablecoins. But unlike bitcoin, they’re centralised; and unlike stable coins, they’re government-issued.”

There’s more in Nigeria’s eNaira is a ground-breaking litmus test for crypto innovation in Africa.

KWARA IS BUILDING AFRICA’S FIRST CREDIT UNION-POWERED NEOBANK

One of the beauties of fintech is its ability to either unbundle or seamlessly bundle fragmented and broken banking services. While some startups focus on building digital consumer banks, others focus on building banks for businesses, or for both.

One startup building for both is Kenya-based Kwara, a one-stop-shop, core digital banking infrastructure for Savings and Credit Co-operatives (SACCOs) to manage all their activities, and it has raised $4 million seed funding.

The new investment will be used to facilitate the launching of its neobank; further develop its existing app in order to enable credit unions in emerging markets to digitise and bring financial services to millions of people; double down on its marketing efforts; and increase its talent pool.

The investment was led by Breega, with participation from SoftBank Vision Fund, Emerge, FINCA Ventures, New General Market Partners, Globivest, Do Good Invest, Raba Capital, Launch Africa, Norrsken Impact Accelerator, Future Africa, Samurai Incubate, DOB Equity, and fintech angels.

While many people think that SACCOs are a slow, vulnerable, and outdated way of saving and accessing credit, and that the market needs new agile products that could displace this model, Kwara, founded by Cynthis Wandia (CEO) and David Hwan (CTO), wants to keep it going by enhancing its efficiency through digitising all its core functionalities.

Damilare Dosunmu has more in Kwara raises a $4m seed to build Africa’s first credit union-powered neobank.

In Ep. 4 of Artwork, learn how you can grow from a freelance designer to a world-class brand design studio.

👉🏾 Watch now

This is partner content.

UNIFYING AFRICA’S COMMUNICATION INDUSTRY

Businesses in Africa encounter many problems when communicating with their customers because communication channels are mostly single-channel platforms. What this means is that businesses have to get a tool for every channel on which they communicate with their customers, be it voice, WhatsApp, email, or text. But this leads to fragmentation in communication, which makes this sort of communication ineffective.

This problem has led to the rise of unified communication (UC) tools, which integrate various communication tools into a single platform. UC solutions help businesses reduce operating expenses, increase revenue, and strengthen customer relationships; it is no wonder businesses are transitioning from single-channel to UCs.

The global unified communications market, led by the likes of Verizon, IBM Corporation Cisco Systems Inc, Microsoft Corporation, Avaya Inc, and Alcatel-Lucent is estimated to be worth $93.52.billion in 2021, with a compound annual growth rate (CAGR) of 20.5% from 2021 to 2028.

While data on Africa’s market is largely unavailable, Africa-focused unified communication startup, Sendchamp, estimates the market’s value at $4.7 billion, at a 27% YoY growth rate.

Overall, the market in Africa is relatively untapped, which is why Sendchamp raised an angel round of $100,000 to help businesses integrate the entire customer journey in a single app.

Read more about their raise in Sendchamp raises angel funding to tap into the unified communication industry.

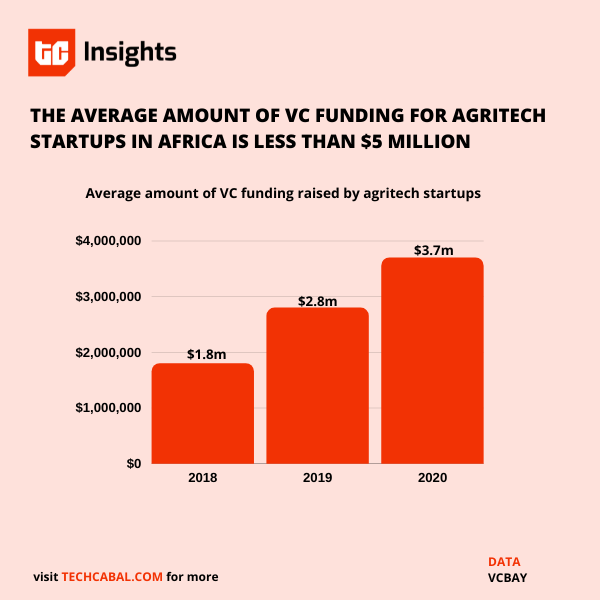

TC INSIGHTS: AGRITECHS NEED FUNDING

Agriculture is an integral part of Africa’s economy, contributing 15% to the continent’s GDP and employing 54% of the population. However, with 60% of the world’s arable land unused, the potential of the sector remains largely untapped.

Africa’s agricultural sector is plagued with unpredictable weather conditions and drawn-back farming practices, resulting in low crop yield. Yet, agritech startups are leveraging artificial intelligence, drones, and mobile platforms to increase productivity.

In 2018, the market for the digitalisation of agricultural services was estimated to be $143 million out of an addressable market of $2.6 billion. Although agritech startups are rising up to the challenge, VC funding into the sector is low compared to other sectors. While early-stage funding is available, big-ticket investments are difficult to secure.

One major reason for this is the high risk involved with investments within the sector. Another reason is the fast-paced nature of startups, a direct contradiction of the patience involved with agriculture-based businesses. For instance, there’s a long time between planting season and harvest. In the same vein, livestock takes a while before they mature.

One way startups can solve this is by seeking long-term engagement with investors to educate them about their business models and the benefits digital solutions could bring to farmers, and how investors might benefit from working with them. Also, government policies aimed at improving the business environment can encourage investment in agritech startups and increase the risk appetite of investors. An example of such a policy would be an improvement in physical and financial infrastructure to support the agricultural ecosystem.

The agritech sector stands to benefit greatly from increased investment as it will lead to more employment opportunities, an improved value chain, and a significant increase in output across the continent.

You can download all our reports here and watch videos from our events. Send your custom research requests here.

Quidax is an African-founded cryptocurrency exchange that makes it easy for you to access Bitcoin and other cryptocurrencies. They also make it possible for Fintech companies to offer cryptocurrency services to their customers.

This is partner content.

JOB OPPORTUNITIES

Every week, we share job opportunities in the African ecosystem.

- Big Cabal Media – Software Developer – Lagos, Nigeria

- Fuzu – Junior Financial Analyst – Nairobi, Kenya

- TeamApt – Growth Associate, Flutter Developer, UX Product Designer – Lagos, Nigeria

- Tix.Africa – Backend Engineer, Frontend Engineer – Nigeria (Remote)

There are more opportunities here. If you’d like to share a job opening or an opportunity, please fill this form.

What else we’re reading

- Europe sent Nigeria up to 1 million near-expired doses of the COVID vaccine.

- Here’s how you can delete your Twitter posts in bulk.

- Ethiopian launches car hire and transfer service in partnership with CarTrawler.

- Chinese property giant Evergrande defaults on debt.