Pan-African fintech firm Flutterwave on Friday announced a rebrand of its logo and dashboard as well as the addition of small business lending, fintech-as-a-service (FaaS), and more to its suite of offerings.

The announcement comes 2 days after Flutterwave confirmed it had raised $250 million in a Series D round that tripled the company’s valuation to over $3 billion. Led by founder and CEO Olugbenga Agboola, the company facilitates cross-border payments transactions of small-to-large businesses in Africa via one API.

In a virtual event themed “Flutterwave 3.0”, Africa’s most valuable startup and payments giant rolled out a series of products and services including FaaS services for embedded finance, SME loans for its users, card issuance for a wide array of clients while announcing the addition of Apple Pay and Google Pay to its payment options.

Flutterwave Capital, the new SME loans product, is offered in partnership with the company’s lending partners—CashConnect Microfinance Bank, MoneyWise Microfinance Bank, Wema Bank, Zenith Bank, Stanbic IBTC Bank, and Sterling Bank.

The new product will enable businesses “easily access loans without collateral, cumbersome documentation, and other stringent terms and conditions,” a blog post on Flutterwave’s website reads, adding that eligible applicants can access the funds they need in less than 2 business days.

“With Flutterwave Capital, we’re making it easier for business owners to access the funds they require to grow their businesses. Business owners can expand, increase inventory, hire more labour, pay bills, run marketing campaigns, and ultimately grow revenue with these funds,” the company said.

Currently, only Flutterwave businesses in Nigeria can access loans but the company says it is working to make it available to its businesses in South Africa, Kenya, and other markets where it operates.

As regards the fintech-as-a-service solution, Flutterwave is opening up its infrastructure to allow other companies to use its APIs to embed financial capabilities into their existing applications, products, and services.

Flutterwave’s FaaS service provides a unified tech stack that includes KYC, account opening, debit card issuance, payments, and real-time transfers through a single endpoint, account servicing, and compliance.

The solution helps companies bypass the often gruelling work of building the infrastructure, integrating multiple, disparate financial systems, licensing, and compliance required in building and offering consumers digital financial services.

Flutterwave also helps businesses outside Africa expand their operations on the continent with an international clientele that includes Booking.com, Flywire, and Uber.

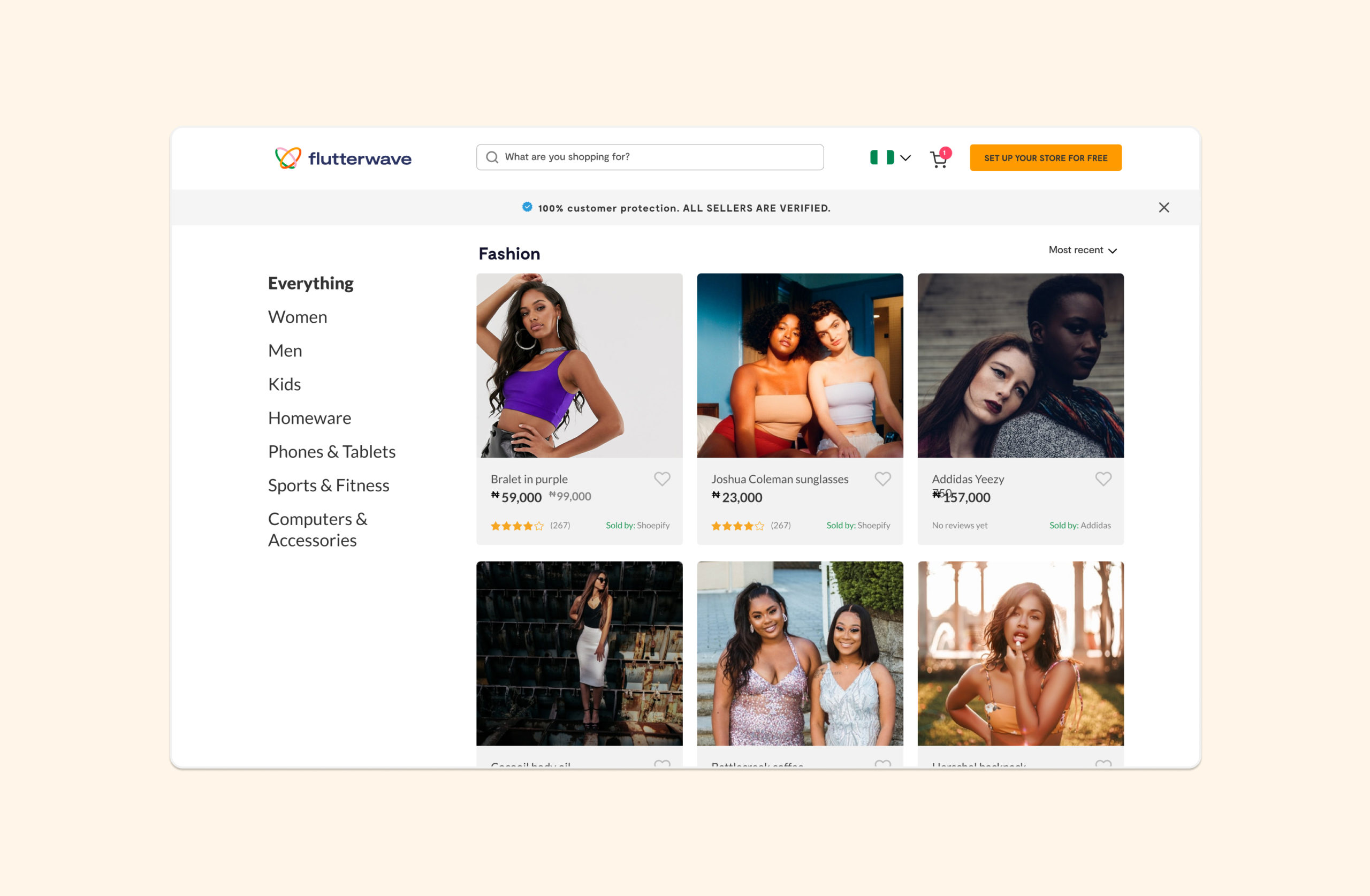

The new set of offerings and features is in line with Flutterwave’s ambitious product expansion drive. Last year, the company launched Flutterwave Market for merchants to sell their goods via an online marketplace and, most recently, Send, a remittance service that empowers customers to seamlessly send money to recipients to and from Africa.

In March 2021, the San Francisco-headquartered and Lagos-based startup raised $170 million in a Series C round at a valuation of $1 billion. The latest financing thus brings its total investments secured since launched in 2016 to $475 million (plus a $35 million Series B in 2020 and a $20 million Series A in 2018).

The $3 billion valuation sees Flutterwave surpass the $2 billion mark set by SoftBank-backed fintech OPay and FTX-backed cross-border payments platform Chipper Cash last year.

Currently, Flutterwave has an infrastructure reach across 34 countries on the continent and processes 200 million transactions worth more than $16 billion. More than 900,000 businesses globally use its solution to process payments in 150 currencies and across different payment modes: local and international cards, mobile wallets, bank transfers, and its consumer product Barter, which now allows for multicurrency wallets.

If you enjoyed reading this article, please share it in your WhatsApp groups and Telegram channels.