IN PARTNERSHIP WITH

Good morning 🌞

Welcome to Q2, I hope your Q1 KPIs didn’t follow you into April the same way mine did.

Before you launch yourself into this week, you might want to catch up with Friday’s edition where we recapped the biggest moves made in the ecosystem in March.

The highlights? Well, the ecosystem raised ~$510 million across 35 deals. Fintech led, but the biggest individual raises weren’t from fintech companies; e-commerce and mobility startups took March’s spotlight.

In today’s edition

- MTN is Nigeria’s most tax compliant organisation

- Zambia disconnects 2 million sim cards

- daba wants to help everyone invest with $50

- TC Insights: E-voting in Africa

- Job opportunities

MTN IS NIGERIA’S MOST TAX COMPLIANT ORGANISATION

MTN has made some big moves this year.

It rebranded from a telecoms company into a tech company, a move that involved changing its 20-year logo. It also became the first African company to move into the metaverse by buying 144 plots of land in Ubuntuland.

In Nigeria, it’s receiving some accolades.

Last week, Nigeria’s tax collection agency, the Federal Inland Revenue Service (FIRS) named the company Nigeria’s most tax compliant organisation. It’s also named the company as one of the top 20 taxpayers in Nigeria for 2021.

According to the FIRS, MTN remitted ₦618.7 billion ($1.5 billion), about 13.4% of FIRS’ ₦6.4 trillion ($15 billion) total revenue for 2021. FIRS’ 2021 revenue is its highest ever, surpassing its 2019 record of ₦5.3 trillion ($12 .7 billion).

What does this mean for MTN?

Last year, MTN Nigeria generated ₦1.65 trillion in revenue, a 24% increase from 2020.

With its planned expansions, there could be more growth for MTN down the line, especially considering how it’s aiming to “lead digital platforms for Africa’s progress”.

For Nigerians who bought MTN’s shares, this could mean a timely investment if the company can hack tech the same way it occasionally hacks telecommunications in the country.

For MTN, the next stage is investing in underserved communities in Nigeria. “We will continue to invest heavily in network expansion with a focus on expanding access to under-served communities. We also plan to connect an additional 2,000 rural communities in 2022,” said Modupe Kadri, MTN Nigeria’s chief financial officer.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

ZAMBIA DISCONNECTS 2 MILLION SIM CARDS

Zambia is cracking down on scams.

Last week, the Zambia Information and Communications Technology Authority (ZICTA) announced that it had disconnected over 2 million sim cards across the country.

Why?

Similar to other countries in sub-Saharan Africa, money transactions are on the rise in Zambia.

In 2020, the sector saw a rise with ZMW105.6 billion ($5.8 billion) processed in mobile money transactions, a 112% increase from 2019’s ZMW49.6 billion ($2.7 billion). In 2021, that number jumped by 60% to ZMW169.4 billion ($9.4 billion).

As mobile money transactions increased, so did criminal opportunities. Several Zambians have fallen victim to scams that involve sharing their pins with scammers pretending to be call centre agents. Others had been told to share their pins as part of registration processes for free internet, lotteries, or even gift vouchers.

In response, Zambian agencies have taken strong steps including sensitisation campaigns by telecoms, as well as plans for the establishment of a fast track court to deal swift judgement to scammers.

Last month, ZICTA announced plans to deactivate half a million sim cards. Last week though, it announced that over 2 million sim cards—across service providers MTN, Airtel and Zamtel—had been deactivated so far.

According to ZICTA, the cards belonged to people who had more than 10 sim cards registered in their name, an offence under a 2011 legislation. In Zambia, it is reportedly illegal for any person to own more than 10 sim cards without justification.

Zoom out: There are over 17 million mobile sims registered in Zambia and it’s unfathomable that all 2 million of these are involved in scams. This is also not the first time ZICTA is deactivating sims. In 2019, the agency deactivated over 500 sim cards that had been identified to belong to scammers. Its recent deactivation appears to be a blanket action that will affect both scammers and legitimate users.

DABA WANTS TO HELP EVERYONE INVEST WITH $50

African companies still endure a difficult time raising capital from external investors and, for many founders, the idea of bootstrapping is the only viable option. “At Afrika Startup Lab, we’ve worked with more than 800 entrepreneurs and realised that a lot of young African startups, despite being investable, lack access to much-needed capital to build,” said US-based entrepreneur Boum III Jnr.

That doesn’t necessarily mean a lack of investor appetite for the continent. Africa’s startup funding landscape hit a record ∼$5 billion in 2021—a figure that’s on track to hit $7 billion this year as global VC giants like Tiger Global and SoftBank increasingly back African founders. But only a fraction of startups are able to attract funding from venture capital and private equity investors.

Angel investors have been crucial in filling the funding gap, especially for startups just starting out. They are mostly upwardly-mobile professionals and high net worth individuals (HNWIs) from across the world who often back startups through angel networks or syndicates.

But what if there was a way to broaden the pool of investors to include less affluent individuals (from across the world) but with disposable income and willingness to invest in investable opportunities in Africa?

This was the question on the minds of Boum and his partner, Anthony Miclet, as they sought to address the financing challenge for African startups. Their efforts to address these bottlenecks led to the creation of daba—a platform that allows individual investors across the world to discover and invest in some of Africa’s most promising companies, through an app, and with as little as $50.

Read more in daba wants to enable foreign retail investing in African startups and stock exchanges.

Fincra provides reliable payments solutions for fintechs, online platforms and global businesses. Their solutions make it super easy for businesses to send and receive local and international payments in EUR, GBP and NGN from/to customers, suppliers and partners seamlessly without the headaches associated with traditional payment methods. You can gain access to Fincra’s platform through a merchant portal or simply integrate their payment API keys into your platform.

Sign up for a quick demo in less than 5 minutes here.

This is partner content.

TC INSIGHTS: E-VOTING IN AFRICA

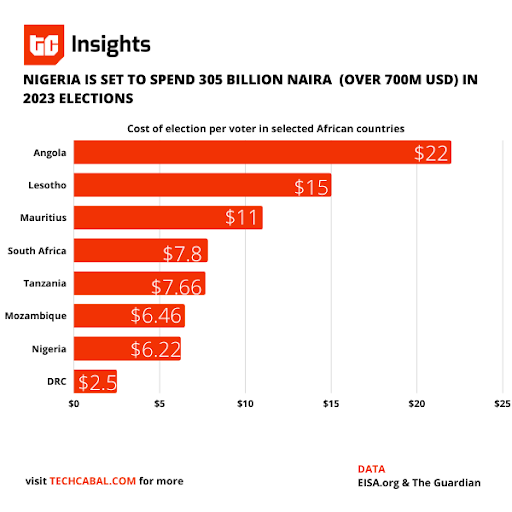

Elections can be an all-day affair across different countries in Africa. It is not uncommon to have whole days taken off to fulfil this basic civil obligation. For instance, registration for voter’s cards, thumb printing and manual voting take a long time to be completed thereby contributing to increased voter apathy and poor electoral outcomes.

However, electoral systems and rapid upscale in technological innovations are almost inseparable in today’s world. This trend could become more beneficial to the African continent especially now that people are leveraging technological innovation to solve everyday societal challenges. Mobile technologies alone have created 1.7 million jobs and contributed $144 billion to the continent’s economy, representing roughly 8.5% of GDP.

Interestingly, opportunities exist to infuse technology into Africa’s voting process to reduce the cost of conducting elections in the continent, strengthen the integrity of the election results and promote political transparency which has become a near-impossible task to achieve. Areas, where technology could prove a game-changer in Africa’s electoral process, include vote counting using optical scanners, digital mapping for electoral boundary administration e.t.c.

The e-voting system could be one the most effective ways to adopt technology in Africa’s electoral process. However, the issue of internet accessibility and poor digital literacy amongst Africans could jeopardize the initiative. This can be circumvented by rolling out the e-voting system in phases i.e. in areas with sufficient evidence to support the process.

Essentially, electoral commissions across African countries need to open up all stages of the electoral process (especially the verification stage) to knowledgeable observers. This is where subtle algorithmic adjustments can be inserted to preserve close parity between voting patterns on the ground and “verified” results that “just” deliver very narrow victories to a ruling party.

Still, Africa has come almost of age in electronic and digital voting. The West’s elections look like Sony’s Walkmans in the age of the smartphone. Africa’s new leaders and technocrats will make the generational jump more smoothly in the future, and keep showing the way.

Check out our funding dashboard, DealFlow to track every deal that’s happening on the continent in real-time. Also, follow us on Twitter, Instagram, and LinkedIn for more updates.

JOB OPPORTUNITIES

- Big Cabal Media – Sales Associate (TC Insights) – Lagos, Nigeria

- Flutterwave – Product Compliance Officer (Nigeria), Product Compliance Officer (Egypt), Product Compliance Officer (Cameroon) – Various countries

- Renmoney – Senior Fullstack Engineer, Content Manager – Lagos, Nigeria

- Nestcoin – Senior Frontend Engineer, Social Media/Community Specialist, Product Manager – Africa (Remote)

- Helicarrier – Senior Product Marketing Manager, Treasury Currency Dealer – Africa (Remote)

What else we’re reading

- Peace Itimi: From Nigeria to the UK in search of peace.

- Two years on, what has #YouTubeBlack Voices done for African creators?

- Will B2B e-commerce capture Africa’s informal markets?

- What does a product manager’s role look like in 2022?

- Nigeria’s Central Bank may move ahead with plans to stop FX sale to banks.

DON’T JUST READ THE BRAND, WEAR IT TOO

Visit techcabal.com/shop and associate yourself with greatness.