There has been a significant increase in investment going into African startups over the past couple of years. However, when compared to the figures for other places, it is obvious that Africa still falls short in terms of volume.

It is reported that the average seed round among African Startups is $1.5 million compared to $5.7 million in Latin America or $4.6 million in India. So despite the increased investment, most African founders still struggle to get funding, especially for early-stage deals and tend to resort to bootstrapping.

However, the world has caught on to the opportunities that are available in the African startup space with a growing amount of Startups springing out of Africa.

This provides VCs and Angels ample opportunity to invest. However, to benefit from this, they have to understand that startup investing in Africa is different for several reasons and to determine if a startup is worth investing in, you’ll have to consider the following:

Government Policy: The policies guiding startups in Africa are not fully developed compared to those in Europe as such prospective investors (angels or VCs) need to understand the policies around the industry a startup operates in before going in.

Market fit: No matter how innovative a Startup’s solution is, you must know for sure if its solution is right for the market and also if the market realizes that the solution is what it needs.

The African market is relatively underdeveloped and it is important for the Startup’s solution to be accepted by the market. If it is earlier than the market is ready for, adoption might likely not happen and the startup may fail with investors losing their money.

Due diligence: It is important that investors (VC and angel investors) carry out their due diligence to ensure that every detail a founder gives is accurate, this is because some founders might take advantage of the investor’s lack of knowledge on the Africa startup space to make deceiving claims that will make prospective investors to commit to investing.

This is why it is important for venture capitalists or foreign angel investors who want to take advantage of the massive opportunities in the African startup space to align with existing systems within the African startup setting who have an in-depth knowledge of how things are to profit from it or they run the risk of being taken advantage of. They could join an angel investing group or take advantage of independent startup investing platforms like GetEquity.

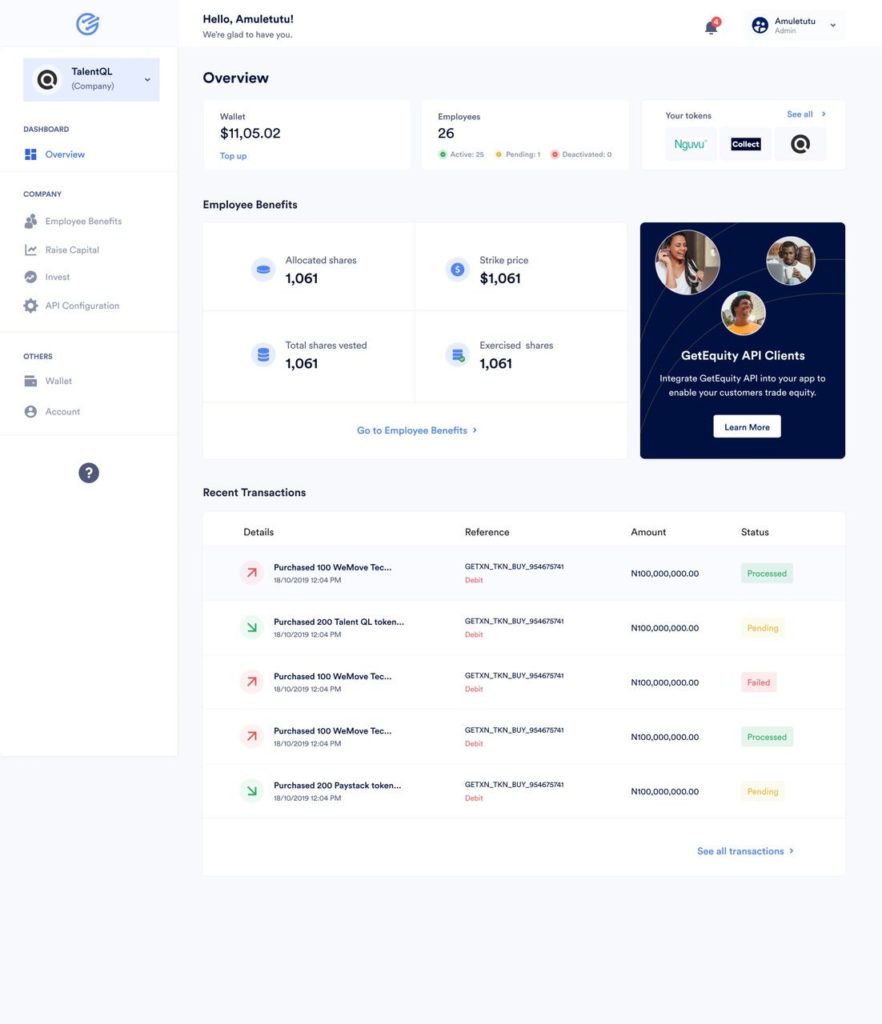

GetEquity, a democratized startup investing platform, offers angel investors, Venture capitalists, or syndicates (group of angel investors), through their dealroom, the opportunity to invest in African startups, using its already existing structure, network, knowledge, tools, and infrastructure and understanding of the African startup space while giving them the freedom to invest as they see fit.

With the GetEquity Dealroom companies and Venture, capitalists won’t need to go through all through the documentation and legal processes to ensure requirements and compliances are met every time you want to invest in a startup. You only need to set up a Dealroom once and the rest is automated forever and you can go about investing without the time delay that comes with getting paperwork and compliances sorted in Africa.

With the GetEquity Dealroom you’re able to create a members-only community where you can raise or fund a high-growth startup within your community, trade secondaries with ease with members, automate carried interest, or even onboard new members with invite-only links.

Making use of an already existing structure in the African startup space puts you at an advantage as you don’t have to figure it out all on your own but can get insight by being part of an already working system.

You can schedule a demo of the Dealroom by sending an email to support@getequity.io or book a meeting with us here