IN PARTNERSHIP WITH

Monday. Again. 🥲

Have you ever tried to copy and paste files in Google Drive using the shortcut Control/Command + X, and Control/Command + V?

If you have, you should have noticed that these basic shortcuts don’t work on Drive, and you have to either drag and drop the files you want to move, or move them using the Menu buttons.

Not anymore though! Last week, Google announced that the copy/paste shortcut is finally coming to Google Drive. Now, you’ll be able to use Control/Command + X to move all those files that people remember only when it’s time for appraisals. 🌚

In today’s edition

- Starlink is coming to Nigeria and Mozambique

- ANC wants to end DStv’s exclusive sports rights

- TC Insights: B2B to the rescue

- Job opportunities

STARLINK IS COMING TO NIGERIA AND MOZAMBIQUE

Elon Musk’s satellite internet service, Starlink, has received license to operate in Nigeria and Mozambique.

Starlink, an internet service provider/operator (ISP) similar to Spectranet or VSAT, delivers super-fast internet via satellites to rural areas. Unlike telecoms like Airtel, MTN or Orange which offer both voice and internet services, operators like Starlink and Spectranet only offer internet services, meaning you can’t make direct phone calls with them.

Starlink is theoretically capable of delivering 150 Mbps internet speeds to any place on the planet. All the customer needs is a clear view of the sky. It basically helps connect people to the internet beamed from space onto a dish antenna, much like satellite TV.

Presently, Starlink operates in 36 countries around the world and has over 400,000 subscribers. Mozambique and Nigeria will mark the service’s entry into Africa.

But is Stalink shooting too high?

One hundred and fifty megabytes per second (Mbps) is impressive internet speed, especially in countries like Mozambique and Nigeria where internet speeds don’t exceed 18.5 Mbps—and that’s being very generous.

While Starlink does promise 150 Mbps for these 2 countries, its prices aren’t so promising. Starlink’s Standard kit costs $599 to set up and a monthly subscription fee of $110 dollars. Its premium service—which has internet speeds of up to 500 Mbps—costs $2,500 to set up and a monthly subscription fee of $500. That’s 10x the $50 subscription fee Nigerians pay for unlimited internet services from providers like Spectranet or SMILE.

And very few Nigerians can afford Spectranet’s prices, talk less of Starlink’s. At 249,000 subscribers, Spectranet has the highest subscribers of any internet service operator in Nigeria; the rest have less than 15,000. Many more stick with telecoms which have affordable data plans that cost less than $10.

Since the announcement, many people have been concerned about Starlink’s prices, especially as it plans to provide high-speed internet to rural areas.

At these prices, it appears Starlink will shine brighter with corporations and large businesses than it will with individuals and MSMEs…and villages. 😑

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

ANC WANTS TO END DSTV’S EXCLUSIVE SPORTS RIGHTS

South Africa is looking to end DStv’s monopoly over South African sports broadcasting.

Last week, the African National Congress (ANC) shared a policy that prevents national sporting teams and associations from offering exclusive broadcasting rights.

DStv has a few good selling points, one of which is it’s exclusive sports broadcasting rights which gives it access to the SuperSports channels, where high-profile global sports events like the English Premier League are broadcasted. In fact, the SuperSports channels are the biggest offerings for DStv’s most expensive bouquet, DStv Premium.

Side-bar: Exclusive rights or assignments mean that only one party can perform a certain action. Here, it means that DStv has entered into an exclusive streaming partnership with SuperSports, so SuperSports cannot enter into the same agreement with other television networks, or allow them to stream SuperSports channels.

In the past few years though, DStv has come under heat for this exclusive right which has given it monopoly over broadcasting on the continent. Many other broadcasters are struggling as they can’t stream high-profile sports events.

In 2020, Nigeria ordered Multichoice—DStv’s parent company—to share its streaming access with other broadcasting networks in the country, but the network is yet to comply.

South Africa has also taken a couple of steps to curb DStv’s monopoly. Last year, the Independent Communications Authority of South Africa’s (Icasa) Inquiry recommended that DStv’s exclusive rights be nullified.

Now, the ANC also wants to make it impossible for sports teams in South Africa to sell their rights exclusively to DStv or any other broadcasting company

Zoom out: DStv now has 2 South African regulators on its tail, and both want to extinguish its exclusive rights. Icasa has relaunched its inquiry and will be checking if DStv’s wings should be clipped, and ANC will decide if it’s time to limit DStv’s exclusivity to South African sports.

Payment collection just got easier on Fincra!

Receive payments from your customers via debit/credit cards or bank transfers and settle these payments to your Fincra wallet or your bank account.

Create an account in less than 2 mins and Try the Fincra checkout here.

This is partner content.

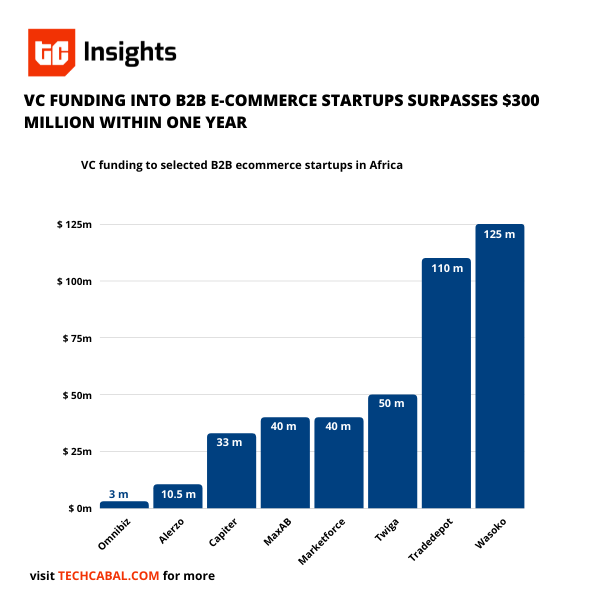

TC INSIGHTS: B2B ON THE RISE

In the early days of e-commerce in Africa, startups focused on the business-to-consumer (B2C) model, driven primarily by a rising middle class and a young population across the continent. The thinking behind this was that as they acquired more users and multiplied, the unit economics will be sorted.

Those thoughts didn’t materialise. Dwindling purchasing power across the continent, rising inflation, and a poor street naming system that made the delivery to customers difficult and inefficient ensured unit economics wasn’t attained.

To turn the business tide around, players/operators in the e-commerce sector turned to a business-to-business (B2B) model. Globally, the size of B2B e-commerce is worth 5 times more than B2C e-commerce. With informal channels like kiosks and markets accounting for 90% of sales in Africa, e-commerce companies have since begun to focus on aggregating consumers’ demands by reaching these stores rather than the end-user directly. This has resulted in improved fortunes for these companies.

Investors are also jumping on the buzz. Between 2021 and 2022, e-commerce companies like Tradedepot, Wasoko, Twiga, MaxAB, and Marketforce received a combined $365 million in VC funding. These startups tend to have good revenues and low operating costs that help them attain unit economics and a low burn rate.

“The cost of acquiring a B2B client is lower than B2C, you invest in marketing, communication, and training customers on how to use your product. In B2B, you know your client, and you can send a sales rep to meet the clients,” Ismail Belkhayat, CEO of Moroccan B2B startup Chari, told TechCabal in a chat.

“The operating costs are lower due to the return rate i.e., the percentage of delivery that comes back to the warehouse. Cash on delivery means clients are not always available, This results in a higher cost of logistics. B2B clients are mostly shop owners, always open and have low return rates. “ he further shared.

Retailers will decide if these shiny new startups are better allies compared to the middlemen. One thing is sure: the informal retail sector in Africa will not remain the same if both partners forge ahead.

Europe’s biggest start-up and tech event is back! Viva Technology brings together start-ups, CEOs, investors, global tech actors, and well-pronounced speakers. It will take place on June 15-18, in Paris.

This is partner content.

THE STATE OF INTERNATIONAL E-COMMERCE IN AFRICA

Over the years, e-commerce has evolved into a significant force pushing global economic transformation. Africa is no exception as entrepreneurs are developing solutions that tackle issues like low consumer trust and limited access to formal banking.

Funding is also increasing for e-commerce platforms. In 2020, e-commerce startups raised $388 million, second only to fintech.

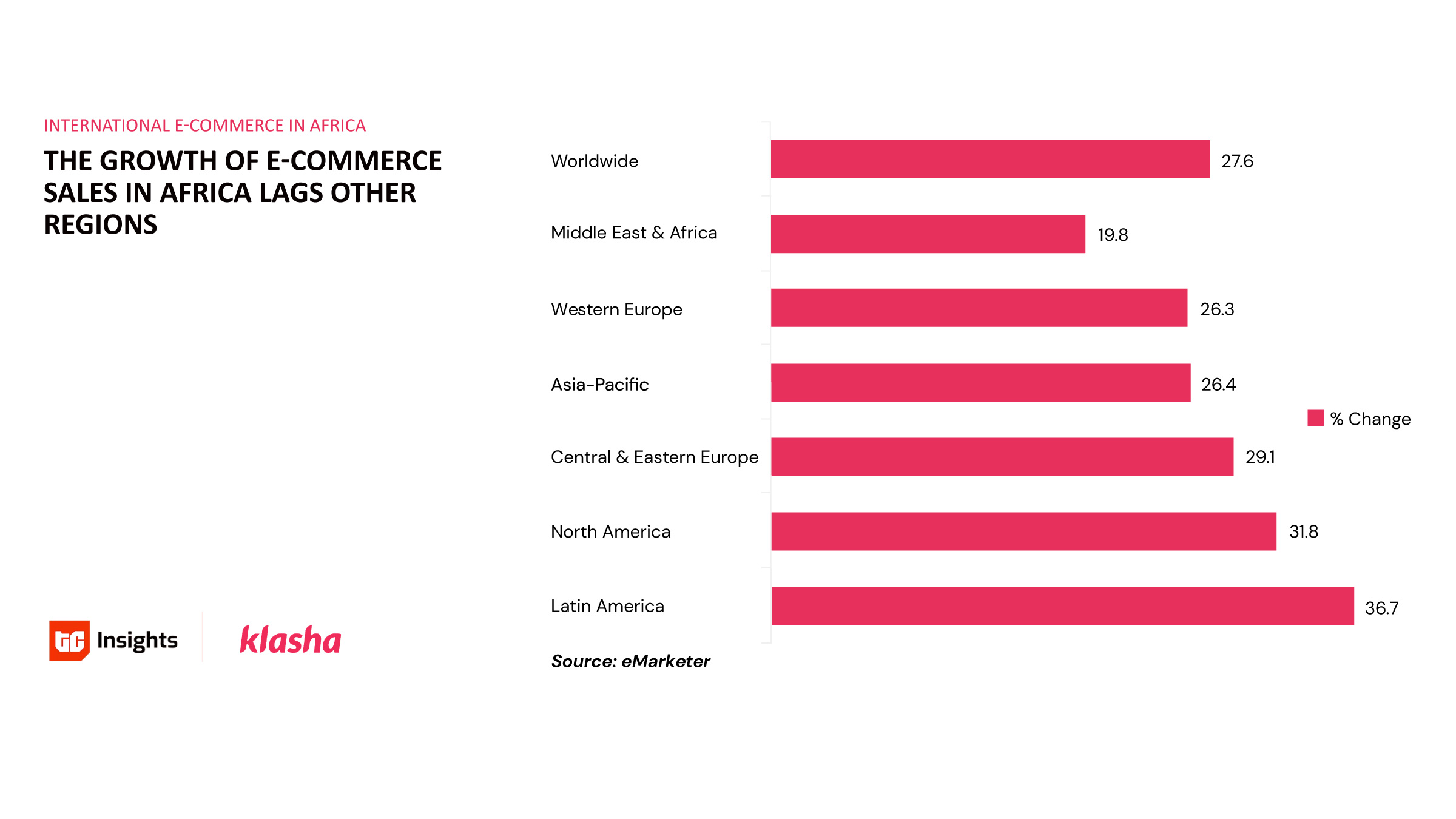

There are, however, a number of barriers causing the growth of e-commerce in Africa to lag that of other regions.

In our latest whitepaper with Klasha, TechCabal examines the state of international e-commerce in Africa, with a focus on the key players contributing to the sector’s development and barriers hampering its growth.

Get your free copy here.

JOB OPPORTUNITIES

- TechCabal – Editor-in-Chief – Lagos, Nigeria

- Big Cabal Media – Head of Events, Associate Art Director, Associate Video Editor – Lagos, Nigeria

- Flutterwave – Product Compliance Officer, Retail Sales Lead, User Policy Strategist – Various Locations

- Seamfix – Lead Product Manager, Product Designer – Lagos, Nigeria

There are more opportunities here. If you’d like to share a job opening or an opportunity, please fill this form.

What else we’re reading

- Melior is building a distribution and financing powerhouse for Nigerian indie artists.

- How strategic partnerships helped Kay Akinwunmi build Zazuu.

- How bank and fintech partnerships can build a stronger African financial ecosystem.

- Why is Google laying a subsea internet cable in Africa?