IN PARTNERSHIP WITH

Good morning 🎊

Instagram is testing reposts, eight months after TikTok launched the retweet-like feature.

Much like the retweet feature, Instagram’s repost feature will allow users bring posts from other people onto their own timelines. Previously, users could only share others’ posts on their Stories or via DMs.

CRYPTO MARKET

|

|

|

|---|---|---|

|

Bitcoin

|

$22,380 |

+ 2.81% |

|

Ether

|

$1,718 |

– 0.70% |

|

BNB

|

$292 |

– 0.23% |

|

Solana

|

$38.50 |

+ 10.44% |

|

Cardano

|

$0.50 |

– 1.21% |

|

|

Source: CoinMarketCap

|

|

* Data as of 06:00 AM WAT, September 13, 2022.

WHAT DOESN’T WORK ON IOS 16?

iOS 16 came, as promised, yesterday and we took a bite of Apple’s 3.03GB update.

As we mentioned in yesterday’s edition, the latest iOS contains customisable lock screens, Apple Pay Later, an edit button for messages, and background remover for Photos.

And like all things that involve a climax, there was a post-spot clarity after the deed had been done. Here’s what we’ve noticed so far:

- The background remover is super easy to access; all you have to do is long-click on images and iOS 16 will select the most prominent objects in the photo. But it’s not quite there yet: there are still strokes from the original images in the background, and if an image has many people or objects in it, the background remover selects all so there’s no way to choose. Here’s an example, editing a photo of TechCabal treasure Sultan Quadri wearing TC Merch:

There’s also no easy way to paste or create something new with the image you copied. Unless you plan on sending the rendered image to someone on WhatsApp, iMessage or any other messaging app, you’ll have to use external tools like Canva or iMovie to create a new photo.

There’s also no easy way to paste or create something new with the image you copied. Unless you plan on sending the rendered image to someone on WhatsApp, iMessage or any other messaging app, you’ll have to use external tools like Canva or iMovie to create a new photo.

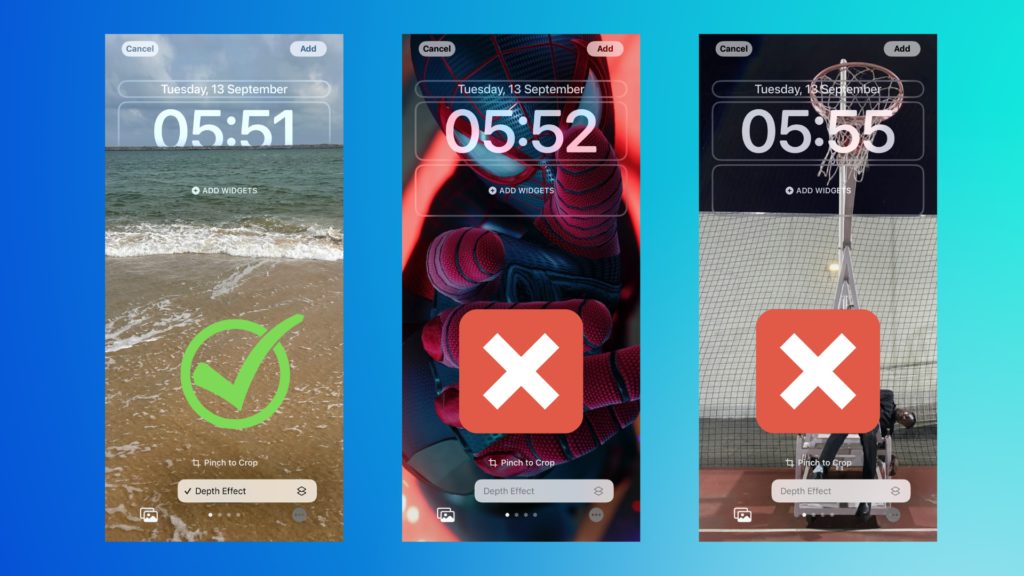

- The customisable home screens are as exciting, the home screen is easily customisable but the depth effect we were all looking forward to doesn’t work for all photos, only a select few.

Have you gotten the update yet? What have you noticed? Share with us on Twitter.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

MULTICHOICE SUBSIDIARY LAUNCHES TECH TO LIMIT PASSWORD SHARING

There are a thousand ways people come through for their friends and family.

One of them is sharing the passwords of their video streaming platforms. Multichoice, the parent company of DStv, GOtv, and Showmax, is not finding this trend business-friendly, and they’ve turned to technology to save the day.

Its subsidiary, Irdeto, has launched a tech product that will help pay-TV operators limit streaming to one account. An all-man-for-himself situation.

Multichoice launched a tech product?

Yup. They did, but it was through Irdeto, a subsidiary company they’ve had since 1997. The company develops security software solutions for players in the gaming and video streaming industries.

Irdeto updated its digital rights management solution to enable operators to control how many users can simultaneously stream from one account and how many of each device type can connect to the account. These factors will then determine the pricing models users can opt for. Actually, this is pretty much how Netflix works.

Why is Multichoice doing this?

They don’t want multiple people streaming DStv from one account, except if paying for the account is costlier. They’re typically saying that only one person can stream at a time with a shared DStv password.

The good news for password sharers is that Showmax is unaffected by all this, at least for now.

Zoom Out: Multichoice seems to be closely following the footsteps of Netflix in this password-sharing crackdown saga. In some countries, Netflix is already making users select a location as home, outside of which they’d have to pay extra money to use the service. For these companies, the logic is simple: we’d stop losing billions in revenue if more people opened personal accounts. But will the market follow such predictions? That’s really up to the password collectors!

KIPPA SECURES $8.4 MILLION

Kippa, a platform for financial management and payments, has received $8.4 million in seed funding from Goodwater Capital, TEN 13VC, Rocketship VC, Saison Capital, Crestone VC, VentureSouq, Horizon Partners, and Vibe Capital.

Last November, Kippa raised $3.2 million in its pre-seed round from Target Global and others. In this new round. This new round brings Kippa’s funding to a sum of $11.6 million.

What will Kippa use the money for?

Kippa says it has spent time understanding the most significant needs of small and medium enterprises, so it will use the money to keep updating its suite of products to cater to the needs of such businesses. Its app enables businesses to perform simple bookkeeping, send invoices and receipts, get an e-commerce website, and get registered in three days.

It has also taken a long stride further by obtaining a Super-Agent licence from the Central Bank of Nigeria. The license will allow merchants using the Kippa platform to also provide financial services like cash withdrawals and deposits, bank account opening, bill payment, and insurance to their walk-in customers.

With over 500,000 users and $3 billion in annualized transactions, Kippa appears to be on the right track.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

👉🏾 Learn more at paystack.com/storefront.

This is partner content.

M-KOPA HAS GIVEN OUT $600 MILLION IN CREDIT

Asset financing platform M-KOPA reports that it has provided over $600 million in credit to 2.3 million people across Kenya, Uganda, and Nigeria. According to the fintech startup, these credit lines have given its customers access to products that have changed their lives.

Which life-changing products?

M-KOPA believes that every African deserves quality products, no matter how little they earn. It has a pay-as-you-go payment model for solar products, energy-efficient televisions and fridges, and smartphones. Additionally, it provides its clients with microinsurance and cash loans. In more than ten years, M-KOPA has discovered that its goods and services have impacted 4.5 million people in terms of their economic, social, and environmental well-being.

What are these impacts?

M-KOPA has sold over 1 million solar home systems, preventing 2 million tonnes of CO2 emissions from entering the atmosphere. One million Africans have purchased high-quality smartphones using its micropayment model, opening up online information and employment opportunities. Two hundred and twenty-two thousand of these one million people had never used the internet before.

Eighty-six percent of M-KOPA’s clients reported that the goods and services had raised their standard of living. Furthermore, the business employed 944 more people in full-time positions between 2019 and 2021. In the same time frame, the number of M-KOPA sales agents—who actively engage locals in the business’s core markets—quadruped to 10,000.

Now, M-KOPA has a bigger goal in mind: to give 20 million customers access to more than $7 billion in capital to help them advance.

PUZZLE: UNSCRAMBLE “BILLIONS”

How many billions do you need? How many words can you create from “billions”? Find out.

IN OTHER NEWS FROM TECHCABAL

The Next Wave: There was nothing special about raising $5 billion.

Is Capiter the latest casualty of the venture funding downturn in Africa?

How to easily understand blockchain and key into it.

Start cashing out your bitcoin for naira today. With Cashout, you can own a bitcoin exchange and start receiving payments with bitcoin. Cashout makes it easy to exchange bitcoin for naira.

Get started today! Cash out with Cashout.

This is partner content.

OPPORTUNITIES

- The AYuTe Africa Challenge Nigeria 2022 is now open to early and growth-stage agritech businesses in Nigeria. Young Nigerians using technological innovation to address smallholder farmer challenges can apply to get up to $10,000 in prizes. Apply by September 16.

- The Ecobank Fintech Challenge 2022 is now open to Africa-focused fintechs addressing specific problems including financial inclusion, credit scoring, and customer experience. One winner will be awarded a grand prize of $50,000. Apply by September 16.

- Fintechs focusing on financial inclusion in Africa can now apply for the CATAPULT: Inclusion Africa Programme 2022. Ten selected fintechs will participate in a one-week all-expenses-paid bootcamp, and participate in the Arch Summit event. Apply by September 15.

What else is happening in tech?

- Ghana-based solar energy provider PEG Africa acquired by Bboxx.

- British International Investment plans to invest $100 million in Egyptian startups.

- Cellulant partners with Orange Money to power card-to-wallet transfers for eight banks in Botswana.

- Elon Musk sends yet another notice trying to terminate the Twitter deal.