Nigerian fintech startup Kippa announced today that it has received a Super-Agent banking license from the Central Bank of Nigeria, fostering its ambition to make it easy for anyone to start and run profitable small businesses in Africa.

A Super-Agent is a corporately licensed entity empowered to conduct certain banking activities within the community such as cash deposit and withdrawal, bills payment (utilities, taxes, tenement rates, subscription etc.), cash disbursement and cash repayment of loans, etc. The Nigerian regulator created this licence to allow more entities that aren’t financial institutions provide services that promote financial inclusion.

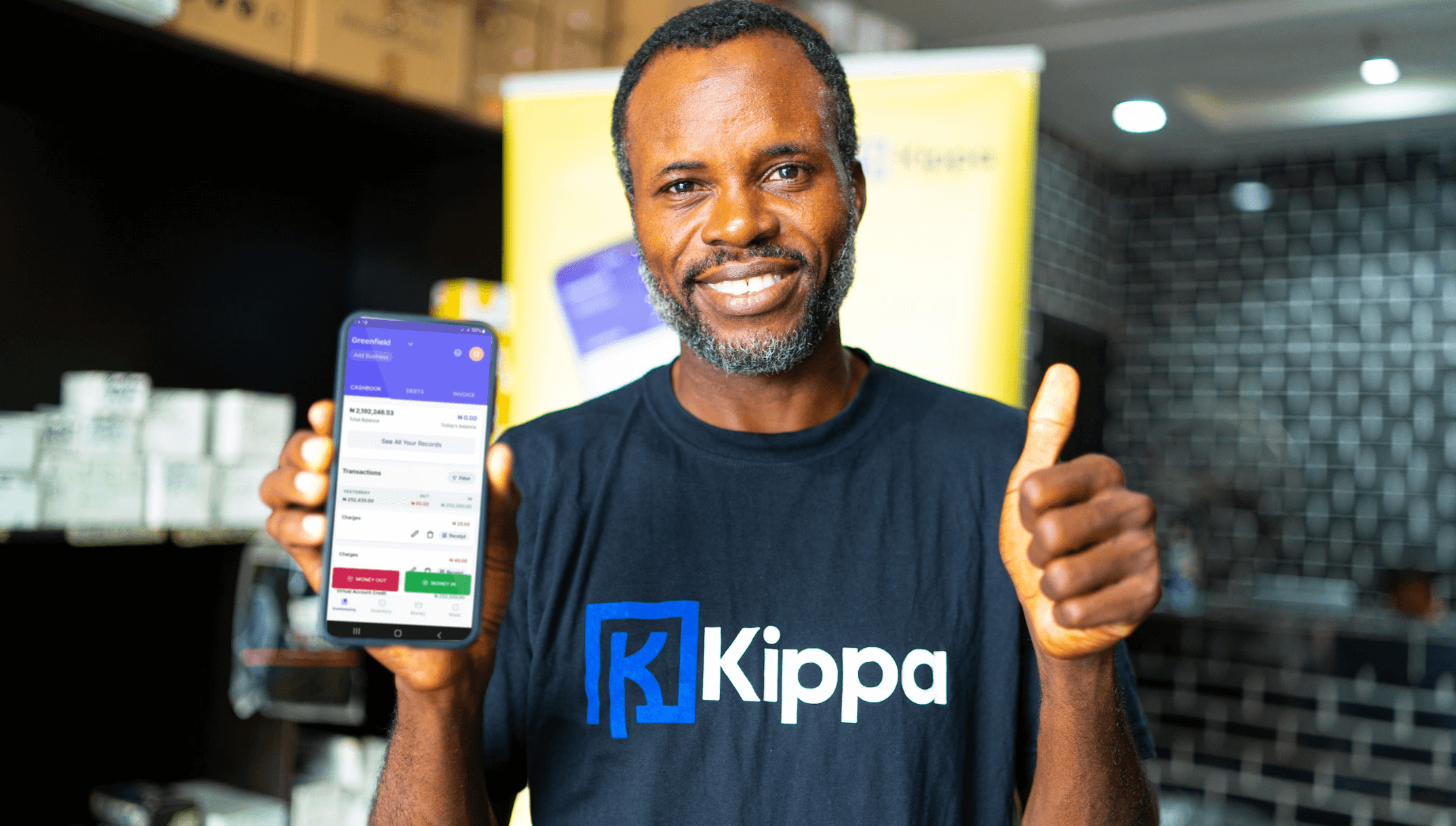

Launched in June 2021, Kippa started as a finance management app where small business owners can keep track of their daily income and expense transactions, create invoices and receipts, manage inventory and generally monitor how their businesses perform over time.

Last November, the company raised $3.2 million in pre-seed funding, led by Berlin-based VC Target Global. Other VCs that participated include Entrée Capital, Alter Global and Rally Cap Ventures. Babs Ogundeyi (Kuda CEO), Kyane Kassiri, Sriram Krishnan (an investor in Khatabook), Raffael Johnen (Auxmoney CEO) and other angel investors invested alongside.

The startup, which declared in November 2021 that it has over 130,000 active businesses who had processed $130 million, shared that it now has over 500,000 registered merchants within its network and has recorded an annualised transaction value of over $3 billion.

Over a call with TechCabal, Kippa’s CEO and co-founder Kennedy Ekezie described the acquisition of this license as a logical next step for the fintech startup.

“What this license does is that it allows us to truly empower all our customers with tools, and infrastructure to not just accept payments, but to start to offer financial services to their end customers,” Ekezie said. “It affords us the opportunity to implement integration with the national switches and allows us to provide business-to-business and platform and services to other fintechs.”

Is Kippa trying to be a Neobank?

Over the past two years, many African fintech startups such as Fairmoney, Eversend and Branch have evolved to become neobanks, so it is not far-fetched to think that Kippa’s acquisition of this license is a step to becoming a neobank.

But Ekezie doesn’t think Kippa is going that route, at least not yet.

“We definitely would not use the word neobank to describe what we’re trying to do,” Ekezie said. “What businesses want is not a new place to put their money, from my experience. Businesses want opportunities, tools, and finances to grow sustainably and in a manner that’s profitable. With that in mind, we’re trying to continue to provide them solutions to enable them to do that.”

Kippa serves merchants across Nigeria’s 36 states with the top five states where its merchants are present being Lagos, Ibadan, Abuja, Port Harcourt and Kano.

This year the company has also made a number of significant hires, including appointing former TeamApt and Opay marketing lead Osagie Alonge as its Director of Marketing.

The startup also hired former Chief Growth Officer at ITEX Integrated Services, Toyin Albert as head of its Payment Services, and former Deputy Managing Director of Nigeria Inter-Bank Settlement System (NIBSS) Niyi Ajao as its chairman of board of directors.

There are almost 50 million small businesses spread across Nigeria, according to the recent report by Enhancing Financial Innovation Access (EFInA). Kippa is one of many startups building tools and solutions for these small businesses. While they all appear to offer similar offerings, Ekezie shared that the startup’s software-first approach has been one of its differentiating factors in the space.

“We think that the winner in this segment is going to be the one that figures out, at the right nanometer scale, how to build for and serve these businesses in a way that is profitable over time. That’s what we’re trying to do,” Ekezie said.