IN PARTNERSHIP WITH

Happy pre-Friday 🎊

Have you always wanted to build apps and websites but can’t code?

Look, we’ve all seen the videos and tutorials of tech bros spending months and years learning coding languages so they can build all sorts of things.

But coding isn’t for everyone, yet that doesn’t mean you can’t build cool stuff.

In yesterday’s edition of Entering Tech, we explore no-code development, a career path that helps people build and create without writing a single line of code. We also speak to a 19-year-old no-code developer who’s earning $30/hour working for agencies abroad. Read Entering Tech #003 here.

CRYPTO MARKET

|

|

|

|---|---|---|

|

Bitcoin

|

$20,045 |

– 1.71% |

|

Ether

|

$1,603 |

– 0.94% |

|

BNB

|

$274 |

– 2.35% |

|

Solana

|

$33.10 |

– 2.06% |

|

Cardano

|

$0.46 |

– 1.00% |

|

|

Source: CoinMarketCap

|

|

* Data as of 06:00 AM WAT, September 15, 2022.

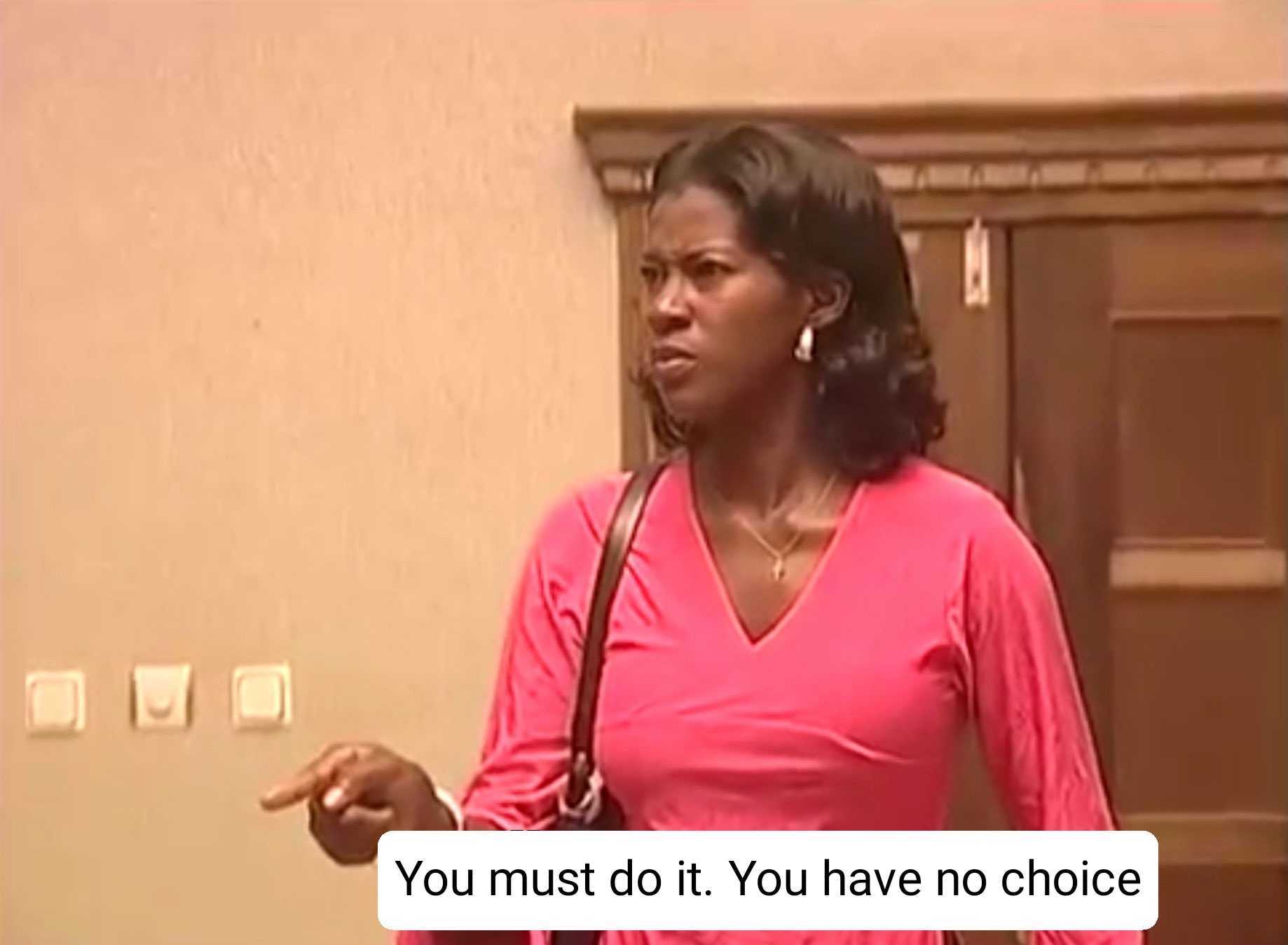

KENYA GIVES DIGITAL LENDERS ULTIMATUM

Kenya is tightening its grip on digital loan apps.

The Central Bank of Kenya (CBK) has given all digital lenders an ultimatum; they have until Saturday, September 17, 2022, to apply for operational licences.

What’s happening?

Last year, the Kenyan parliament approved the Central Bank of Kenya (Amendment) Bill which bestowed the Central Bank with the power to regulate digital lenders.

The approval subjects digital lenders to the Data Protection Act, which prevents them from violating users’ privacy through debt-shaming.

Earlier this March, the CBK published the Digital Credit Providers Regulations, 2022 which requires digital lenders to obtain licences from the CBK in order to operate in the country.

Now, the wait period is over and the CBK expects that all lenders should have submitted applications by Saturday.

In a legal alert document, Joseph Githaiga and Caroline Kipkulei of PwC’s Legal & Regulatory Compliance Advisory department shed more light on the situation: “Similar to other CBK regulated financial institutions, new digital credit providers seeking a licence are first required to submit their proposed names to the CBK for approval before proceeding to incorporate a company with the Registrar of Companies. Upon submission of a digital credit licence application with the CBK, the CBK may grant or reject the application within sixty (60) days from the date of receipt of the application.”

Zoom out: This year, Kenya has taken a tough stance in regulating its digital ecosystem. While some regulations like the Digital Credit Providers Regulations have received wide acclaim, others like its ICT Practitioners’ Bill have been widely criticised by the public and government officials.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

BRAZILIAN UNICORN COMES FOR AFRICAN FINTECH GIANTS

How big is the African fintech sky? We are about to find out as Brazilian unicorn EBANX is flying into the continent to capitalise on the continent’s growing digital economy.

The B in EBANX is for billion?

EBANX is a decade-old billion-dollar company that has processed about one billion payments in 15 countries for companies like Spotify and Uber. Last year, in October, it filed for an initial public offering (IPO) in the US. The economic downturn is slowing down its IPO process, but EBANX is not slowing down at all. It is gliding out of Latin America into Africa to launch in Kenya, Nigeria, and South Africa.

Been there, done that

João Del Valle, CEO and co-founder of EBANX, says that Nigeria’s ecosystem is currently playing at the level that Latin America was at when his company was born in 2012.

However, the company doesn’t see itself blazing any new trails in its first year in Africa. It will instead be a student and potential partner of strong players in Africa’s three biggest fintech markets—Kenya, Nigeria, and South Africa. It hopes to learn from M-Pesa’s ubiquity in Kenya, OZOW’s capabilities in electronic fund transfers in South Africa, and the use of USSD and bank transfers in Nigeria.

Why Africa?

Africa is still cash-based. There is a great opportunity to build new solutions that will take Africa’s payment space to new frontiers. EBANX said that this week it will announce products (old and new ones) that are posed to play a part in getting the continent to transition accordingly.

SAFARICOM AND NCPWS ARE HELPING DISABLED PERSONS GET JOBS

Disability shouldn’t take away one’s right to earn a living.

As a result, laws have been established to safeguard the employment rights of the 2.2% of Kenyans who live with a disability. The Persons with Disabilities Act No. 14 of 2003 is one such law.

According to that law, businesses must set aside at least 5% of their positions for people living with disabilities. Since 2020, Safaricom has collaborated with Kenya’s National Council of Persons with Disabilities (NCPWD) to run an online portal that matches disabled people to job opportunities. The portal is called the NCPWD Career Portal.

What have the results been so far?

The online portal is powered by the AI-powered hiring platform Fuzu and is the first of its kind in Africa. Currently, it has more than 5,000 job candidates and over 360 employers, including Safaricom, that have used the portal for its recruitment needs. We do not know how many jobs have been secured on the site, but Safaricom was recently nominated for a 2023 Zero Project award. The nomination lauds the telco’s commitment to diversity, equity, and inclusion as mirrored in the partnership with NCPWD.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

👉🏾 Learn more at paystack.com/storefront.

This is partner content.

ANOTHER E-COMMERCE MARKETPLACE LAUNCHES IN SOUTH AFRICA

According to MyBroadband, e-commerce platform Bidorbuy and order fulfilment platform uAfrica have joined forces to launch Bob Group—an all-in-one e-commerce marketplace in South Africa. Bob Group will offer a complete set of e-commerce services to merchants, including a marketplace, inventory management, order fulfilment, online payments, and courier software-as-a-service.

More about Bob Group

According to managing director of Bob Group Andy Higgins, the new company will have a decentralised logistics approach, allowing services to be priced more competitively and the marketplace to be more seller-friendly than their competitors, without compromising service levels.

The company will also ship orders directly from the seller to the buyer and will also only support third-party sales, eliminating the need to compete against its own marketplace sellers like is the case with marketplaces like Amazon.

Swimming with the sharks

Bob Group will be competing with incumbent e-commerce giants in South Africa like Takealot, Makro, and soon, Amazon.

Asked how the Bob Group plans to compete with these, Higgins stated that they would predominantly compete at a marketplace level but acknowledged that a well-established logistics network is crucial for success.

“By offering sellers better support, especially when it comes to logistics and more favourable fees, we believe these efficiencies will be passed on to shoppers,” Higgins said.

Big picture: South Africa’s e-commerce industry grew by an impressive 66% according to latest figures, and it seems like it is poised for fierce competition in the next few years as Bob Group enters the arena currently dominated by Takealot and Makro.

EVENT: NIGERIA FINTECH WEEK

The 6th edition of the Nigeria Fintech Week (NFW) is set to hold from October 24 to 28, 2022.

The theme for this year’s week-long event is “Navigating the Next Normal: Sustainable Impacts in Fintech, e-Government & Emerging Technologies”.

NFW is one of the largest gatherings of players in the fintech ecosystem in Nigeria as well as Africa, and this edition will hold in a hybrid format which offers you the opportunities to attend physically or be a part of the event online. You can register to attend the #NFW2022 here.

Start cashing out your bitcoin for naira today. With Cashout, you can own a bitcoin exchange and start receiving payments with bitcoin. Cashout makes it easy to exchange bitcoin for naira.

Get started today! Cash out with Cashout.

This is partner content.

IN OTHER NEWS FROM TECHCABAL

Grindstone partners with EnterpriseSG to bring Singaporean startups to South Africa.

After exiting Tanzania, Uber is struggling to remain in Kenya amidst commission wars.

OPPORTUNITIES

- The AYuTe Africa Challenge Nigeria 2022 is now open to early and growth-stage agritech businesses in Nigeria. Young Nigerians using technological innovation to address smallholder farmer challenges can apply to get up to $10,000 in prizes. Apply by September 16.

- The Ecobank Fintech Challenge 2022 is now open to Africa-focused fintechs addressing specific problems including financial inclusion, credit scoring, and customer experience. One winner will be awarded a grand prize of $50,000. Apply by September 16.

- Applications are now open for Meta’s AR/VR Africa Metathon. XR developers, programmers, UI/UX designers, artists, animators, storytellers, and professionals resident in Africa can sign up to get curated learning resources from XR experts who will provide mentorship, and facilitate masterclasses and workshops. Apply here.

What else is happening in tech?

- ChamsSwitch is providing seamless access to financial services for governments and businesses.

- Canal+ has increased its stake in MultiChoice.

- Why Nigeria rejected Telsa’s bid to mine raw lithium.

- Francophone Africa’s first unicorn is disrupting its mobile money market. But can it last?

- How Uganda became Africa’s digital transport hub.